January 1 to December 31, 2022

In accordance with the Dental Care Plan Board of Management (NJC part) Terms of Reference, the undersigned submit this annual report regarding the performance and the management of the Dental Care Plan (NJC Part) during the period of January 1 to December 31, 2022.

Chairperson of the Board of Management

Martin Chartier

Employer Side Members

Philippe Blanchette, Canada Revenue Agency

Hilary Flett, Health Canada

Jane Manuel, Treasury Board of Canada Secretariat

Bargaining Agent Side Members

Colby Briggs, Professional Institute of the Public Service of Canada

Paul Cameron, International Brotherhood of Electrical Workers

Joy Thomson, Canadian Merchant Service Guild

Mireille Vallière, Canadian Association of Professional Employees

General Statement

The Dental Care Plan Board of Management (NJC Part) (the Board) is pleased to present this report for the period of January 1 to December 31, 2022. The Public Service Dental Care Plan (PSDCP) completed 35 years of operation on March 1, 2022. The Plan is intended to cover reasonable and customary dental treatment necessary to prevent or correct dental disease or defect, provided the treatment is consistent with generally accepted dental practices. The Plan is private, and its cost is fully paid by the Treasury Board of Canada Secretariat (TBS), the Employer.

The Board is composed of management and union representatives. It is responsible for the overall administration of the Plan, balancing the overall needs of the members within the allocated funding, resolving members’ complaints regarding eligibility or claims disputes, monitoring the claims settlement performance of the Administrator, and recommending changes to the Plan. During 2022, the Board continued with their modified meeting format of virtual meetings. In total, the Board met 5 times, devoting its time to overseeing the administration and financial status of the Plan, resolving appeal cases, and recommending improvements to the Plan.

Administration

The Board noted that the Administrator had a claim turnaround time of 3.38 calendar days, which is 3.62 days less than the target turnaround time of 7 calendar days, and an improvement from 2021. The Board is pleased with claim turnaround time but remains concerned with the level of review, and auto-adjudication, on said claims. Regarding service level standards during 2022, Canada Life was just below their target level of 80%, answering 78.30% of calls within 60 seconds. Additionally, it was noted that while the abandon rate for calls on the dedicated line increased by 1.69% since 2021, first call resolution remained above the 93% target, at 94%.

As a part of the Board’s duties, it is responsible for the overall administration of the Plan and monitoring claims settlement performance of the Administrator. As noted in the 2021 Annual report, TBS indicated that an external claims audit of the Administrator would take place during 2022; however, this did not happen. Nonetheless, the Board remains interested and continues to wait for said audit to take place, in order to address the Board’s outstanding questions concerning past scaling reports for children.

The Administrator notified the Board of their improved Dependent Eligibility Verification Program (DEVP), which they have been developing since 2014. Although the current program is effective, the improvements being made to the program will increase its efficacy through a variety of program modifications, including the use of the Administrator’s new website, My Canada Life at Work. The new website will replace the Administrator’s current website, GroupNet, in 2023. My Canada Life at Work uses modern, industry-leading technology including enhanced security measures (two-step authentication), easier access to support (chat capabilities through the website), more in-depth claims history, a mobile friendly platform (to be released later in 2023), and faster access to adjudication information. At this time, 3.1 million Canadians are using the website and the Administrator has received positive feedback.

Regarding the COVID-19 temporary administrative measures for the PSDCP, they have continued to be applied throughout 2022, and were in effect until March 31, 2023.

Activities

Regarding Board membership during 2022, the Board welcomed a new Chairperson, Martin Chartier and noted the departure of Julie Laverty, from the Supreme Court of Canada. The Board dedicated time to resolving members’ complaints regarding eligibility and claims disputes. The Board reviewed 23 appeals; 7 were upheld (including 4 requests for coverage), 3 were upheld in part and 13 were denied.

During 2021, TBS introduced the Observer Program, which is an informal program whereby diverse senior-level public servants are selected to participate on pension and benefits boards to develop their knowledge and experience to become an Employer representative in the future. During 2022, the Board continued to have 2 observers attend meetings. The Board will continue participating in the Observer Program and will again welcome 2 new observers who will attend Board meetings in 2023.

The Board provided feedback to TBS regarding an appeal checklist for PSDCP appeals, which TBS intends to finalize and publish. This checklist, which will be similar to the checklist already available for the Pensioners’ Dental Services Plan (PDSP), is intended to help Plan members better understand the appeal process and how to submit an appeal to the correct Board of Management.

Throughout 2021, the Board engaged in discussions regarding the desire to enter into Plan negotiations during 2022. Although a mandate from the President of the Treasury Board to begin negotiations was not issued in 2022, the Board added “Plan negotiations” as a standing item for future meetings, to ensure they remain up to date on this initiative.

Training

When possible, the Board participates in conferences and learning sessions held by the International Foundation of Employee Benefit Plans (IFEBP) as a means to develop Board member expertise and to stay current with trends in the dental care field. The Board remains committed to investing in the development of its members. Fortunately, various Board members were able to attend two conferences in 2022: the Canadian Public Sector Pension and Benefits Conference and the 55th Annual Canadian Benefits Conference.

Plan Expenditures

The total cost of the Plan (NJC Part) since 2017 is as follows:

- 2017 - $121.4 M

- 2018 - $125.2 M

- 2019 - $137.0 M

- 2020 - $112.2 M

- 2021 - $153.8 M

- 2022 - $168.1 M

Plan costs increased in 2015, 2016, 2017, 2018 and 2019 by 1.6%, 2.8%, 1.7%, 3.1% and 9.4% respectively. In 2020, costs decreased by 18.1%. This drastic reduction was due to the closure of dental offices in Q2 due to the COVID-19 pandemic. Administration expenses decreased proportionately in relation to the number of claims processed and taxes decreased in relation to the value of paid claims and administration expenses. In 2021, costs increased by 37.1% over 2020 or 12.3% over 2019. In 2022, the costs increased by 9.3% over 2021, 49.8% over 2020 (keeping in mind the dental office closures in 2020) and 22.7% over 2019.

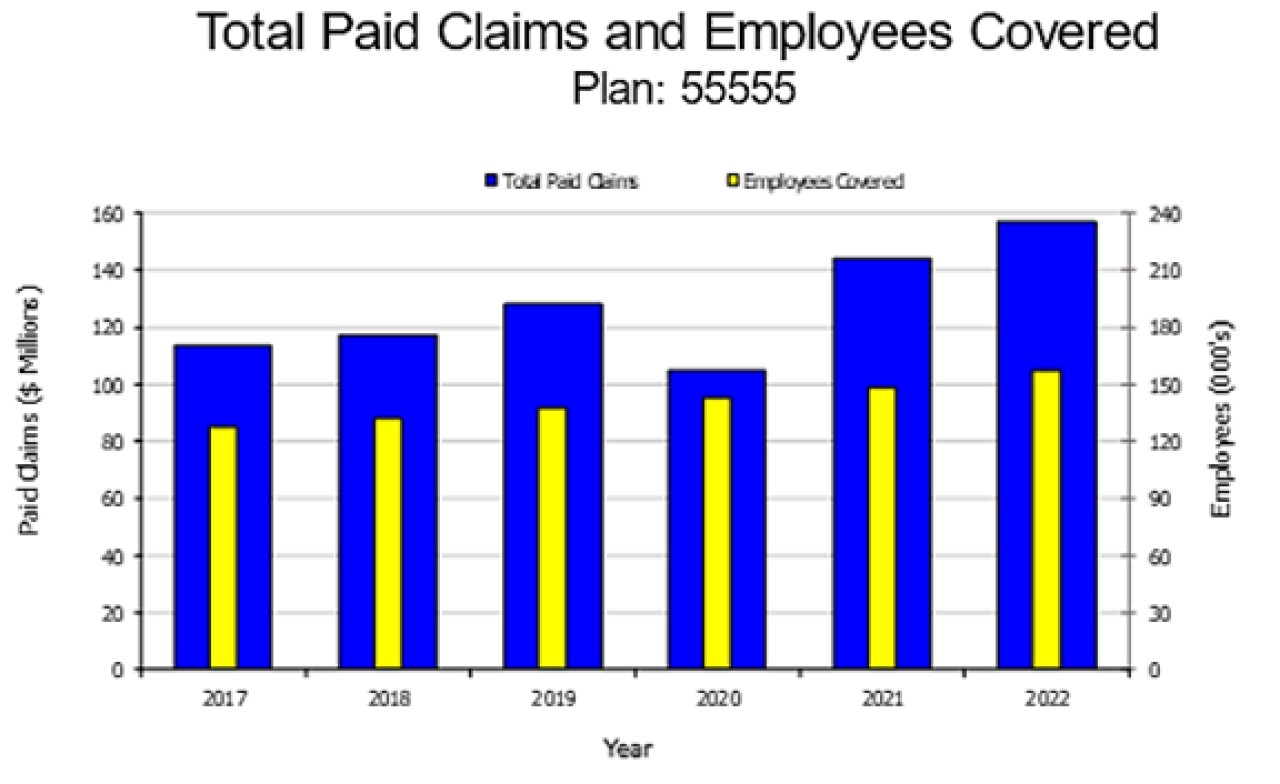

Paid Claims and Employees Covered (NJC Part)

The total cost of $168.1M for 2022 includes $157M or 93.4% for paid claims and $11.1M or 6.6% for expenses. The year-to-year changes are:

- 2017 - 1.7%

- 2018 - 3.1%

- 2019 - 9.4%

- 2020 - (18.1%)

- 2021 - 37.1%

- 2022 - 9.3%

The number of covered employees at the end of 2022 was 159,417, of which a total of 134,248 employees (84.2%) submitted at least one claim, either for themselves or an eligible dependant.

A total of 884,083 member claims were resolved, representing an increase of 8.2% over 2021 but 43.6% from 2020; the average cost per claim in 2022 increased by 0.7% to $177.68 from 2021 or increased by 4.2% from 2020. The average benefit per member in 2022 increased by 11%, to $985.37 from $961.78 (in 2021), which represents an increase of 2.5% or from $730.25 (in 2020) which represents an increase of 34.93%. Additionally, there has been a 10.5% increase in paid claims since 2019.

Out of these 884,083 member claims, 12% were submitted via paper, 79.5% were submitted by the provider and 8.5% were submitted online by the member. Overall, a total of 2,257,722 claims were handled, including dependant claims, representing an increase of 8.3% over 2021 and 40.9% from 2020.

Figure 1

For 2022, the total amount charged by dentists to Plan members was $308,323,499 compared to $157,084,083[1] in net benefits paid to employees, for a reimbursement ratio of 50.9% (see Table 1).

[1] Amount does not include the exchange portion of claims in US dollars.

|

Breakdown of Paid Claims |

|||||||

|---|---|---|---|---|---|---|---|

|

Year |

Routine |

% |

Major |

% |

Ortho Amount |

% |

Total Amount |

|

2017 |

92,526,067 |

81.6 |

10,281,966 |

9.1 |

10,545,054 |

9.3 |

113,353,087 |

|

2018 |

95,601,166 |

81.8 |

10,060,075 |

8.6 |

11,284,292 |

9.6 |

116,945,533 |

|

2019 |

104,120,814 |

81.3 |

11,474,634 |

9.0 |

12,467,706 |

9.7 |

128,063,154 |

|

2020 |

84,406,432 |

80.4 |

9,522,652 |

9.1 |

11,047,849 |

10.5 |

104,976,933 |

|

2021 |

115,629,048 |

80.2 |

13,104,366 |

9.1 |

15,429,241 |

10.7 |

144,162,655 |

|

2022 |

126,353,081 |

80.4 |

13,838,140 |

8.8 |

16,892,862 |

10.8 |

157,084,083 |

Variations between years 2017 and 2022, concerning paid claims by type of treatment, are as follows:

Table 2

|

Treatment |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|

|

Major Restorative |

6.37 |

5.98 |

5.81 |

5.81 |

5.78 |

5.34 |

|

Minor Restorative |

21.04 |

20.96 |

20.75 |

20.75 |

20.52 |

20.00 |

|

Oral Surgery |

4.77 |

4.84 |

5.23 |

5.65 |

5.91 |

5.68 |

|

Orthodontic |

9.30 |

9.65 |

9.74 |

10.52 |

10.70 |

10.75 |

|

Periodontic |

24.87 |

24.96 |

25.00 |

24.11 |

24.97 |

25.50 |

|

Preventive |

12.54 |

12.52 |

12.04 |

10.86 |

10.47 |

10.89 |

|

Adjunctive |

1.21 |

1.23 |

1.40 |

1.49 |

1.58 |

1.57 |

|

Reline Rebase |

0.02 |

0.02 |

0.02 |

0.02 |

0.02 |

0.02 |

|

Dentures |

0.58 |

0.52 |

1.66 |

1.53 |

1.62 |

1.61 |

|

Diagnostic |

13.63 |

13.79 |

13.50 |

13.93 |

13.59 |

13.92 |

|

Endodontic |

3.55 |

3.41 |

3.35 |

3.60 |

3.15 |

2.86 |

|

Fixed Bridges |

2.12 |

2.10 |

1.50 |

1.73 |

1.39 |

1.86 |

|

Total |

100 |

100 |

100 |

100 |

100 |

100 |

Table 2 shows that, while most percentages remained fairly stable from 2017 to 2022, we did see an increase in oral surgery and orthodontics. In view of the pandemic, there was a noticeable decrease in Preventive Services in 2020 which continued in 2021 and 2022 from 12.54% of total paid claims in 2017 to 10.89% in 2022.

In comparison, the percentage of total amount paid for Orthodontic Services rose to 10.75% in 2022 from 9.30% in 2017.

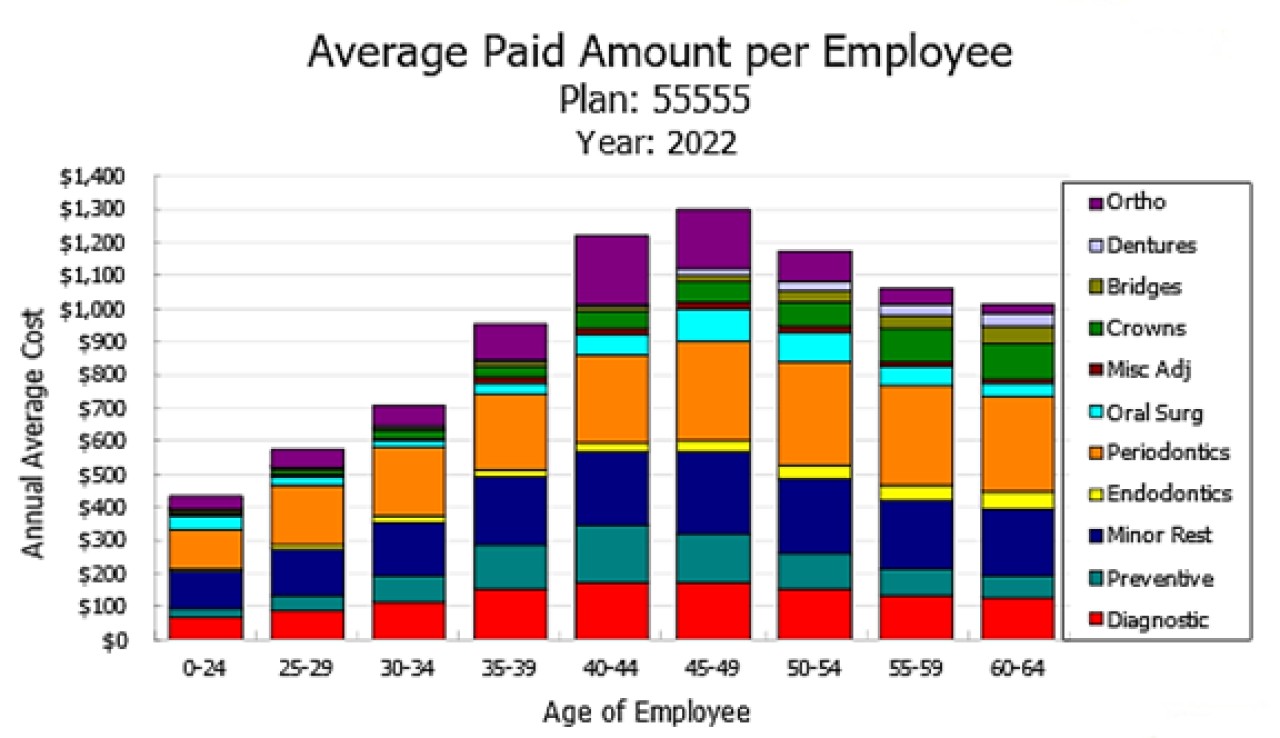

Figure 2 (below) represents the average amount paid by the Administrator to employees in 2022 in the various age groups. The age group from 45 to 49 continue to have the highest amount paid per employee. The average paid amount in 2022 increased for all age categories but even more significantly for the 35-39 age group there was an increase of 10% over 2021 (or 52.8% over 2020).

Figure 2

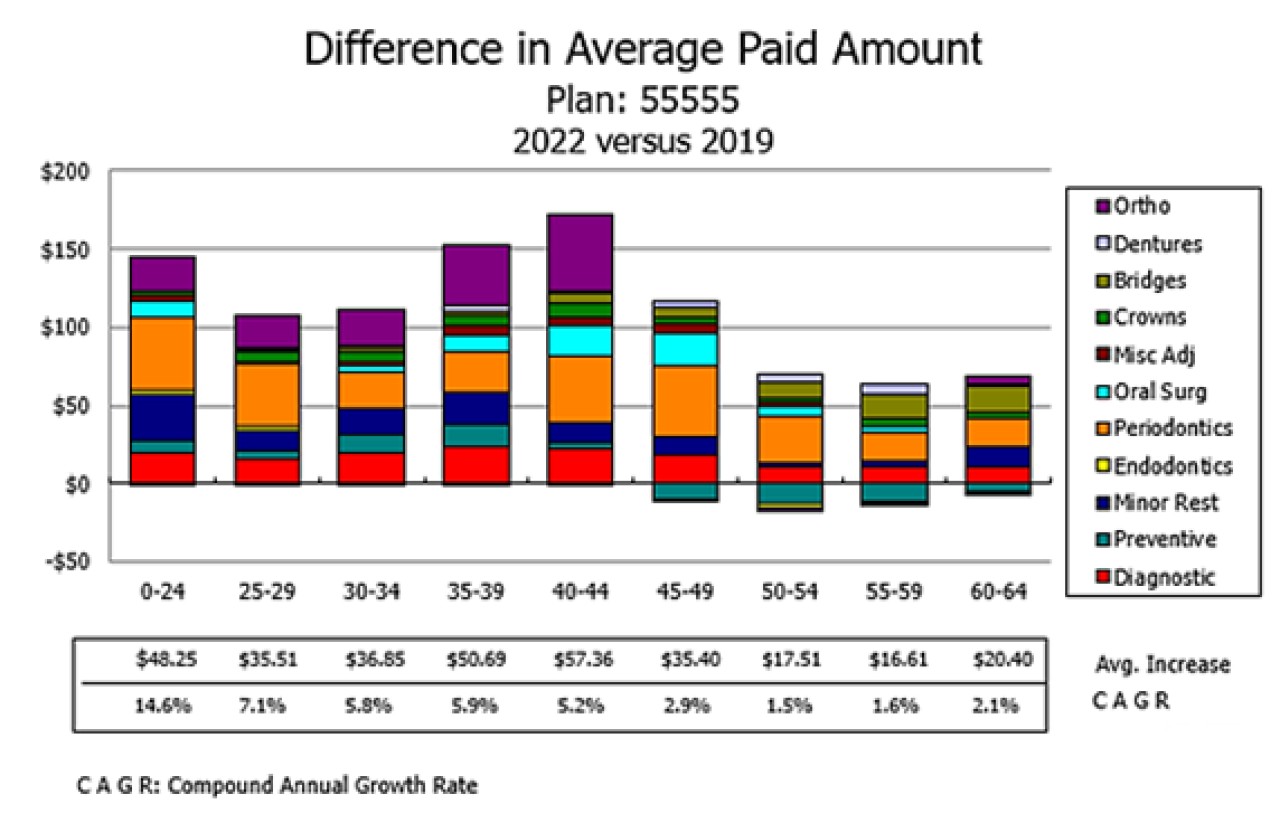

Figure 3 (below) shows that the average amount paid increased for all age categories from 2019 to 2022 but more noticeably for the 35-39 and 40-44 age group. The table also shows that the average amount increased for all services and all age categories except for some decreases in various age bands for Endodontics, Preventive and Ortho.

Figure 3

Overall, compared to 2019 the Plan showed a compound average cost increase per employee in all age bands except for Preventive which reduced for ages 45 and above, the majority of Endodontic services age 30 and above as well as some others in certain age bands. The increase in the average Plan cost per employee from 2019 to 2022 was mainly attributable to the increase in the average amount paid per Plan member for all other services.

Total costs for the Dental Care Plan (NJC Part) in 2022 increased by 9% over 2021 (49.6% over 2020) driven mostly by the increase in the average amount paid per employee of 2.5% (34.9% over 2020) combined with an increase in membership of 6.4% (10.9% over 2020). Furthermore, total costs in 2022 increased by 22.7% over 2019; driven by average amount paid per employee increase by 6% over 2019.

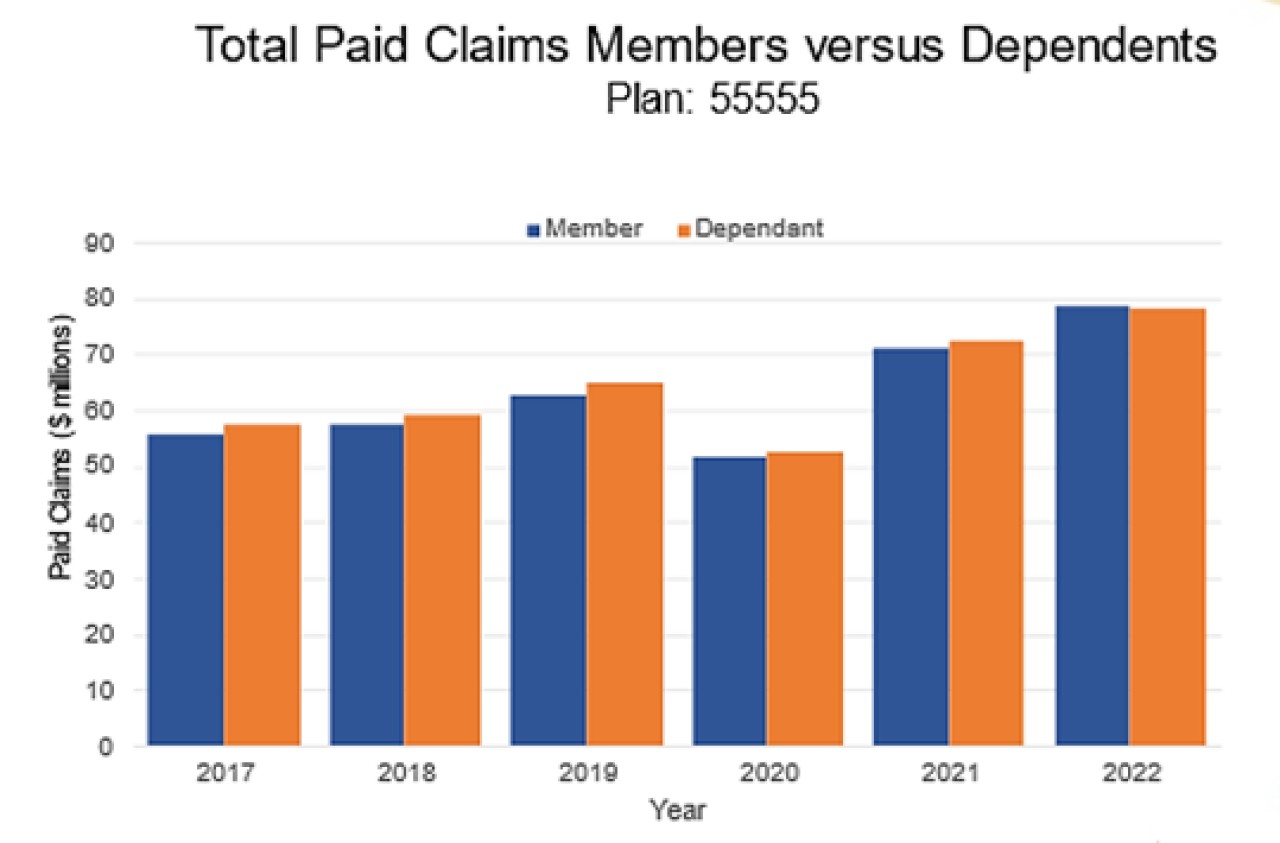

Figure 4

Figure 4 (above) shows increases year over year with dependent claims slightly higher than members each year, except for 2022 where dependent claims drop 1% lower than member claims. In 2021 & 2020 the table shows dependent claims paid were 1.7% higher than members, whereas in 2019 dependent claims 3.3% higher than members.

Service Level Performance Review

Throughout the year, the Board continuously monitors the performance of the Plan and the level of service provided to the Plan members. Currently, there are 76,839 (48.2%) NJC members registered for member portal access. Of those registered for member portal access, 57,860 NJC members (75.3%), have elected for direct deposit. In 2021, 84.3% of total claims resolved for the PSDCP were submitted electronically.

For 2022, the performance was as follows[2]:

Table 3

|

Targets |

Results |

|

|---|---|---|

|

Calls answered in 60 seconds or less |

|

|

|

Wait time for calls |

60 seconds or less |

78 seconds |

|

Claims turnaround time |

7 calendar days |

3.38 calendar days |

|

Abandon rate |

5% of total calls or less |

3.54% of total calls |

[2] The call centre performance is based on the results for the dedicated line only.

Table 4 (below) denotes the Plan’s operating expenses for 2022. Expenses have increased by 15% over 2021 with the majority of the increase as a result of claims settlement expense (27.3%).

Table 4

|

Public Service Dental Care Plan |

||||

|---|---|---|---|---|

| 2022 | 2021 | |||

| $ | % | $ | % | |

| Taxes | 6,838,068.67 | 61.8193 | 6,302,989.49 | 65.5191 |

| Claims Settlement Expense | 4,223,006.16 | 38.1780 | 3,316,791.08 | 34.4778 |

| Other | 300.00 | 0.0027 | 300.00 | 0.0031 |

| Total Expenses | 11,061,374.83 | 100 | 9,620,080.57 | 100 |

| Statistics shown have been provided by: |  |

Communication

As the Board received a variety of appeals regarding late claim submissions during 2022, the Board requested that TBS send a reminder to Plan members about the time limitations when submitting appeals. As noted in the Board’s 2021 Annual Report, the Board was engaged in ongoing discussions with TBS and the Administrator, Canada Life, regarding claims assessment guidelines used by the Administrator. As a result of the discussions, during this past year, the Administrator did share claims assessment guidelines during meetings, when requested by the Board.

Following the launch of the Compensation and Email Notification System, which is a bi-monthly email from TBS to subscribers (active employees and pensioners), Board members acknowledged content related to the Plan and anticipate it may result in better Plan awareness, as well as possibly fewer appeals, moving forward.

Conclusion

In closing, the Board wishes to take this opportunity to thank the Administrator, Canada Life, for their contribution to the administration of the Plan in the year 2022. As always, the Board is pleased to oversee and provide advice on the management of this important employee benefit.