Open the web-based tool and follow the instructions as you navigate through the application to calculate the weighted average exchange rate to be used for all your expenses without a direct exchange rate.

Figure 1 - NJC Foreign Currency Exchange Rate Calculator

- Before completing the ‘Foreign Currency Exchange Rate Calculator’, sort all your receipts and credit card statements in like-currency, and review your claim to get the total expenses in each foreign currency.

- Enter the information requested in the data entry fields.

- Each data entry field contains an explanation of what should be entered – just click in the field (see Appendix A).

- Once you have completed the form as instructed, save the PDF form to attach to your claim.

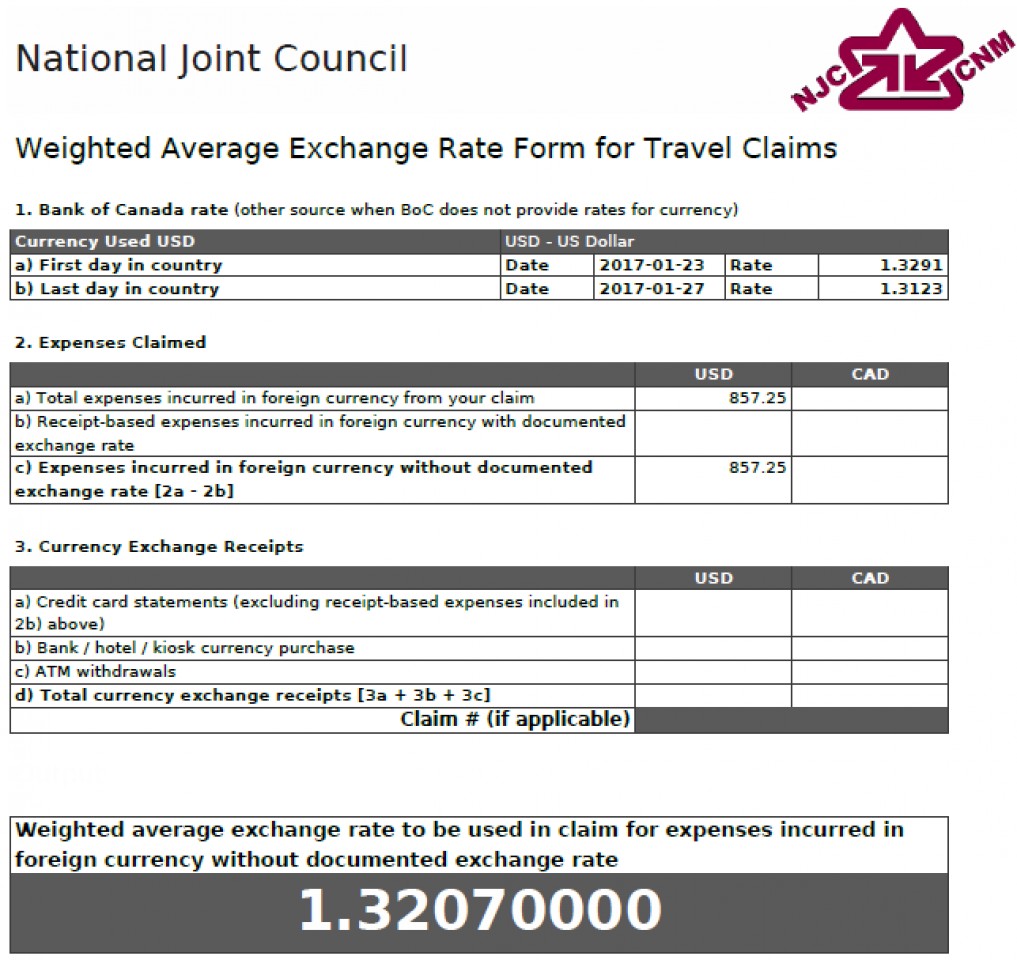

Figure 2 - NJC Weighted Average Exchange Rate Form

- The rate provided at the bottom of the form is the calculated weighted average exchange rate to use for your foreign meal and incidental allowances and for receipt-based expenses that do not have a documented exchange rate (e.g. taxi paid in cash).

- Complete a separate form for each foreign currency that was used on the trip.

Refer to Appendix B for examples showing the use of the ‘Foreign Currency Exchange Rate Calculator’.

Converting Foreign Travel Expenses To Canadian Dollars*

Appendix A – Foreign Currency Exchange Rate Calculator – Data Entry Fields

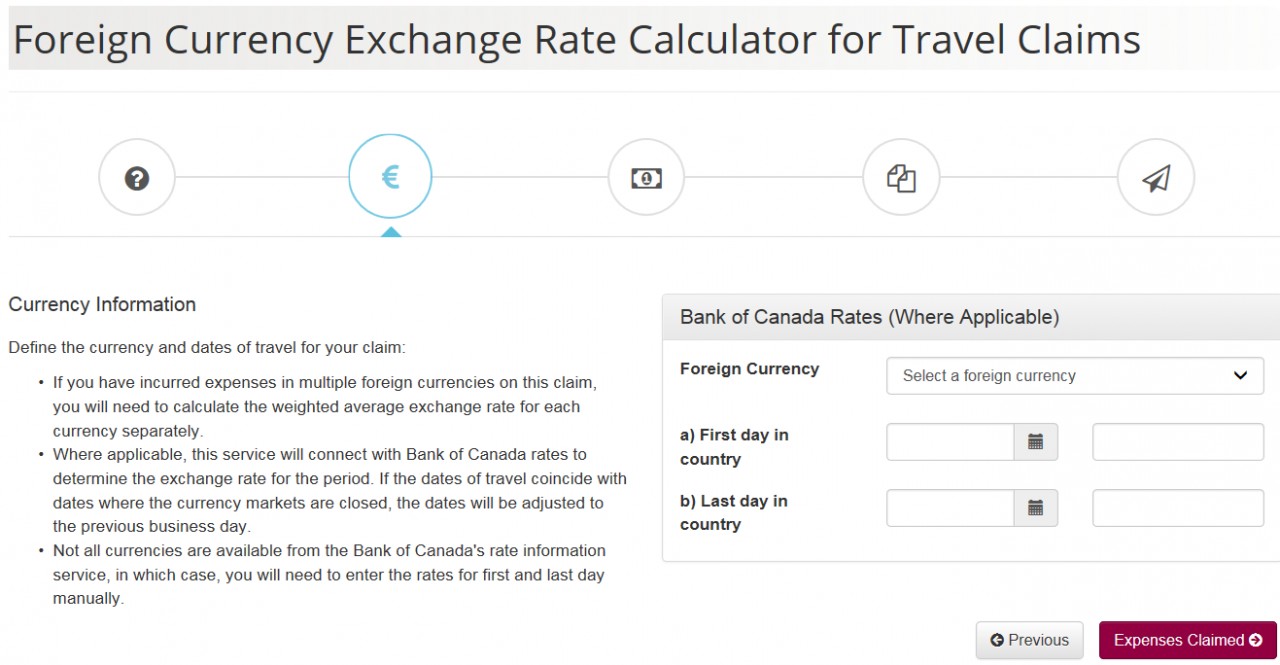

Currency Information

Figure 3 - NJC Foreign Currency Exchange Rate Calculator - Currency Information

|

Foreign Currency |

Select the foreign currency from the drop-down list |

|

|---|---|---|

|

a) First day in country |

Enter the date for the first day in the country (use the format YYYY-MM-DD) |

The Bank of Canada noon rate for the first day in the country will populate automatically. |

|

For currencies not listed by the Bank of Canada, enter the noon rate from another source. |

||

|

b) Last day in country |

Enter the date for the last day in the country (use the format YYYY-MM-DD) |

The Bank of Canada noon rate for the last day in the country will populate automatically. |

|

For currencies not listed by the Bank of Canada, enter the noon rate from another source. |

||

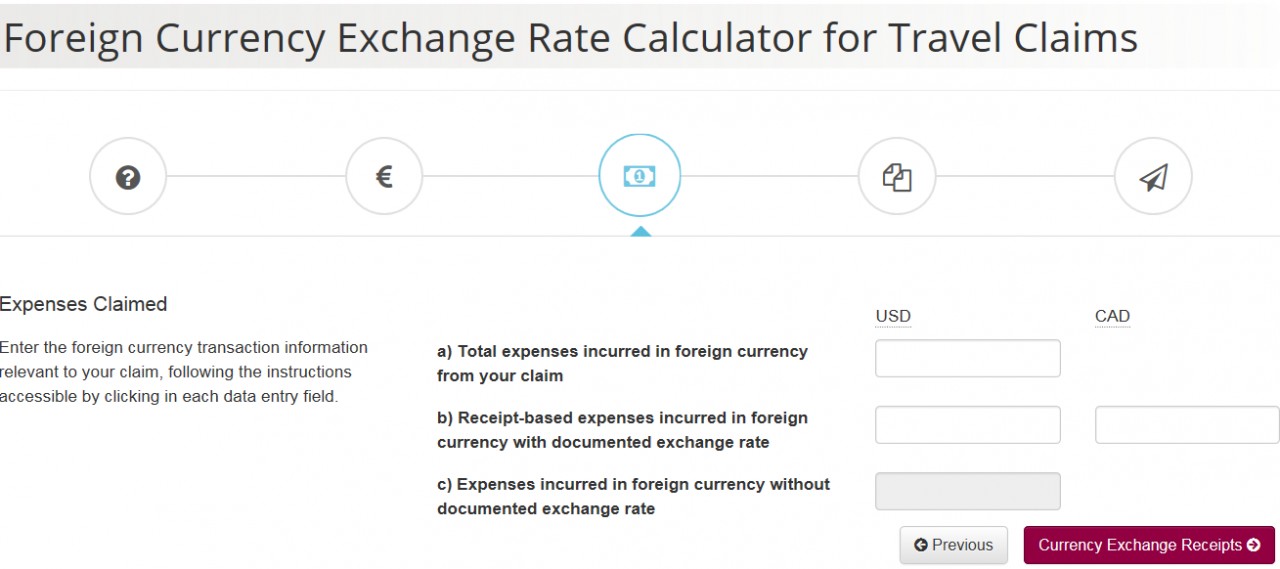

Expenses Claimed

Figure 4 - NJC Foreign Currency Exchange Rate Calculator - Expenses Claimed

|

|

Foreign Currency |

CAD |

|---|---|---|

|

a) Total expenses incurred in foreign currency from your claim |

Enter the total expenses incurred in the foreign currency. You will get this amount from your claim. |

|

|

b) Receipt-based expenses incurred in foreign currency with documented exchange rate |

Enter the foreign currency total for receipt-based foreign currency expenses with a documented exchange rate (e.g. accommodation expenses on your credit card statement). |

Enter the total Canadian amount for receipt-based foreign currency expenses with a documented exchange rate (e.g. accommodation expenses on your credit card statement). |

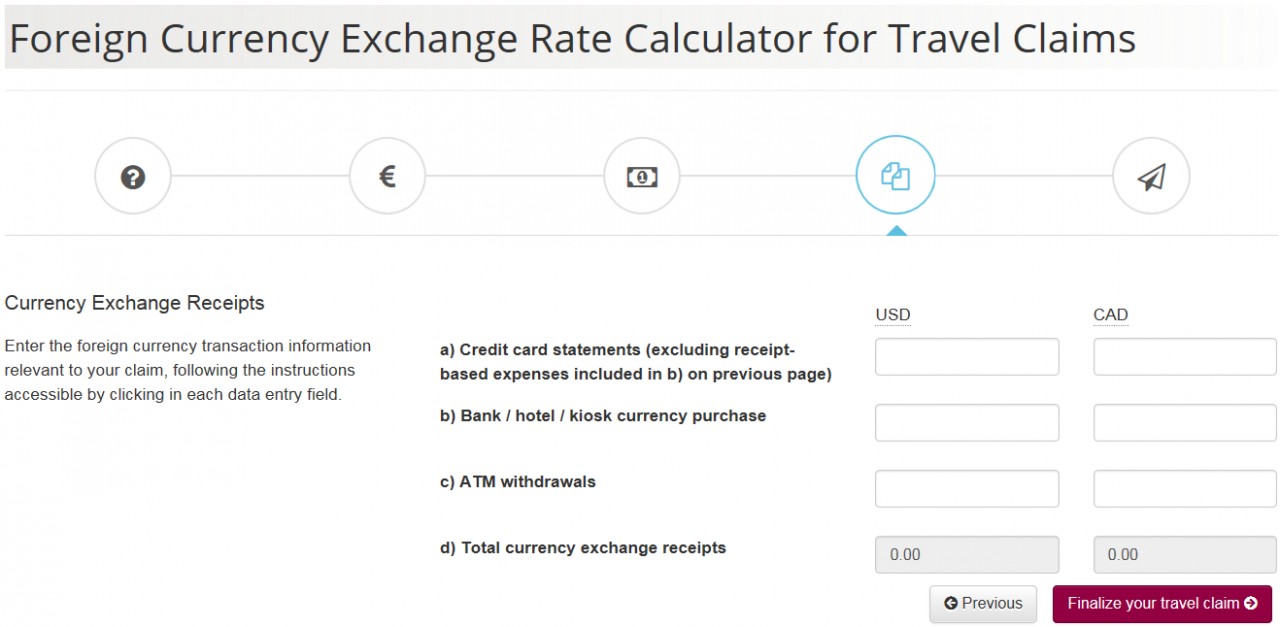

Currency Exchange Receipts

Figure 5 - NJC Foreign Currency Exchange Rate Calculator - Currency Exchange Receipts

|

|

Foreign Currency |

CAD |

|---|---|---|

|

a) Credit card statements (excluding receipt-based expenses included in b) on previous page) |

Enter the foreign currency total for foreign currency transactions on your credit card statement, (e.g. cash advances, other charges excluding personal purchases and receipt-based expenses entered on your claim). You can also include meals and incidental purchases from your credit card, as these count as currency exchange receipts for the purposes of determining a weighted average exchange rate, even though you will be paid an allowance as per Appendix C or D of the Travel Directive. |

Enter the total Canadian amount for foreign currency transactions on your credit card statement, (e.g. cash advances, other charges excluding personal purchases and receipt-based expenses entered on your claim). You can also include meals and incidental purchases from your credit card, as these count as currency exchange receipts for the purposes of determining a weighted average exchange rate, even though you will be paid an allowance as per Appendix C or D of the Travel Directive. |

|

b) Bank / hotel / kiosk currency purchase |

Enter the total amount of foreign currency purchased at banks, hotels or currency exchange kiosks. |

Enter the total Canadian amount of foreign currency purchased at banks, hotels or currency exchange kiosks. |

|

c) ATM withdrawals |

Enter the total amount of foreign currency withdrawn at ATMs. |

Enter the total Canadian amount of foreign currency withdrawn at ATMs. |

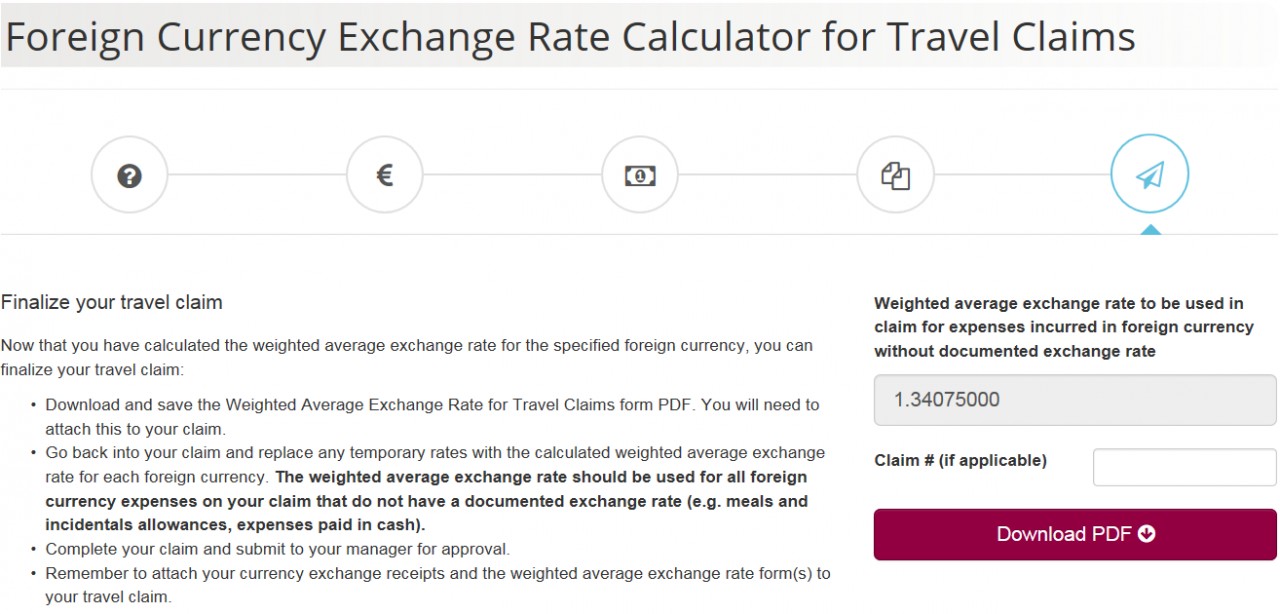

Finalize your travel claim

Figure 6 - NJC Foreign Currency Exchange Rate Calculator - Finalize Your Claim

|

Claim # (if applicable) |

Enter the claim # assigned by the system to your claim (if applicable) |

|---|

Appendix B – Foreign Currency Exchange Rate Calculator - Scenarios

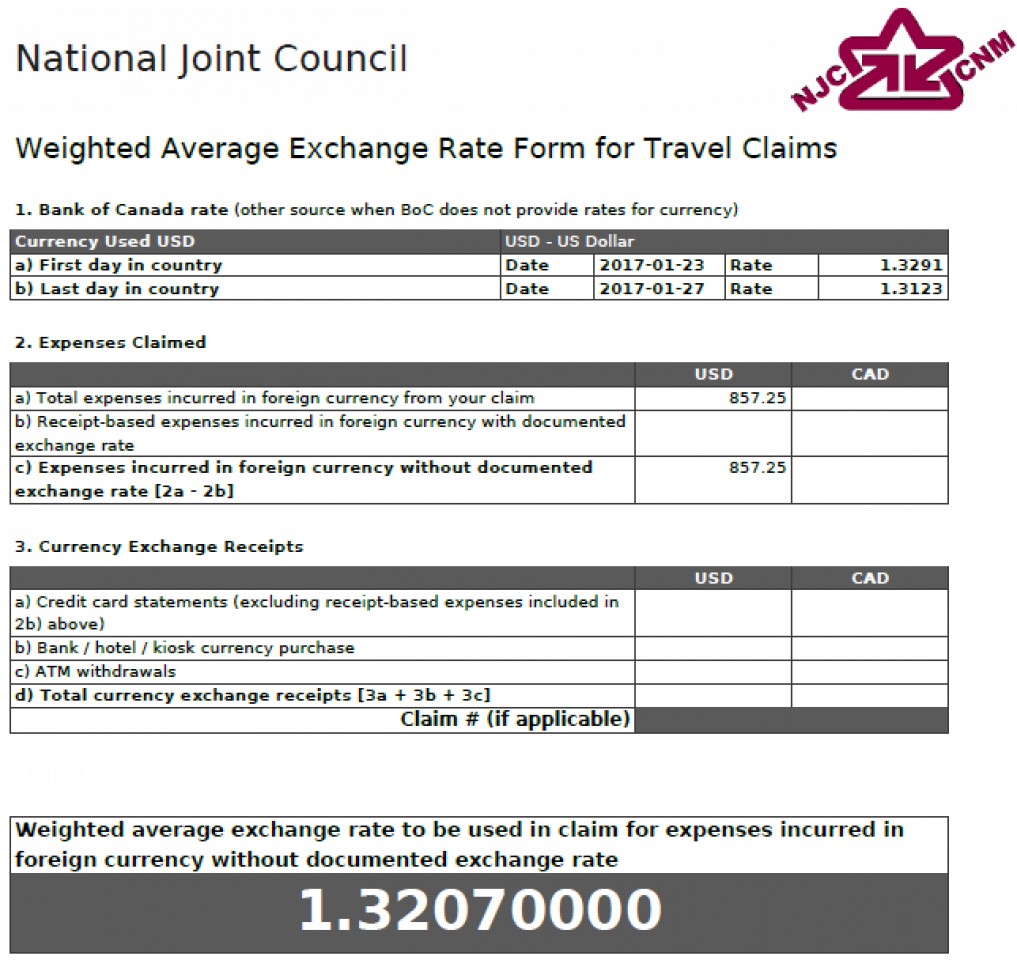

Example 1: Scenario A – No Currency Exchange Receipts

Trip to Minneapolis, USA Jan. 23-27, 2017

Total of foreign expenses $857.25 (USD) is converted to Canadian using only the average Bank of Canada noon rate – no bank receipts or credit card statements used.

Figure 7 - Example 1: NJC Weighted Average Exchange Rate Form

| Date | USD > CAD | CAD > USD | (1.3291 + 1.3123) / 2 = 1.3207 |

|---|---|---|---|

| 2017-01-23 | 1.3291 | 0.7524 | |

| 2017-01-24 | 1.3174 | 0.7591 | |

| 2017-01-25 | 1.3088 | 0.7641 | |

| 2017-01-26 | 1.3103 | 0.7632 | |

| 2017-01-27 | 1.3123 | 0.7620 |

Figure 8 – Example 1: Bank of Canada Exchange Rates - Jan 23-27, 2017

On your claim:

- Enter the average exchange rate highlighted at the bottom of the form (1.3207) as the exchange rate for each expense incurred in USD.

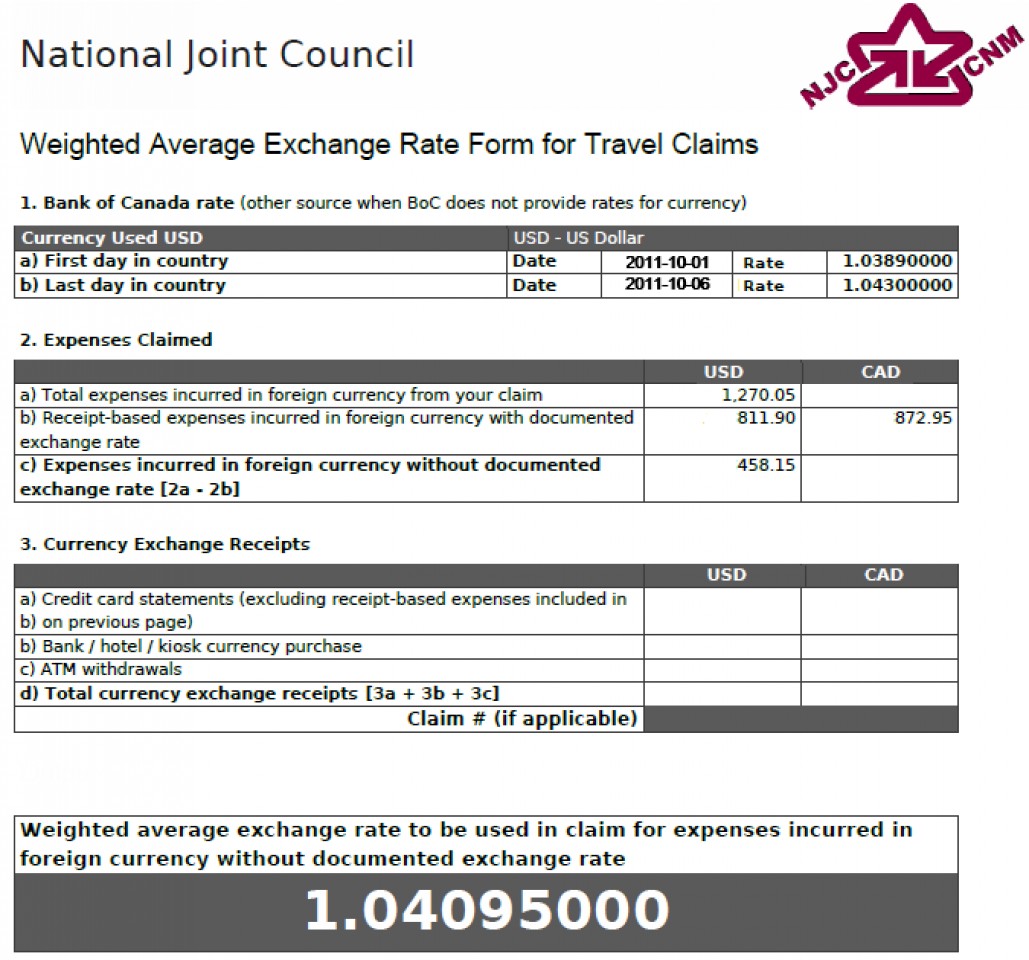

Example 2: Scenario B – Credit Card Statement for Reimbursable Receipt-Based Expenses Only

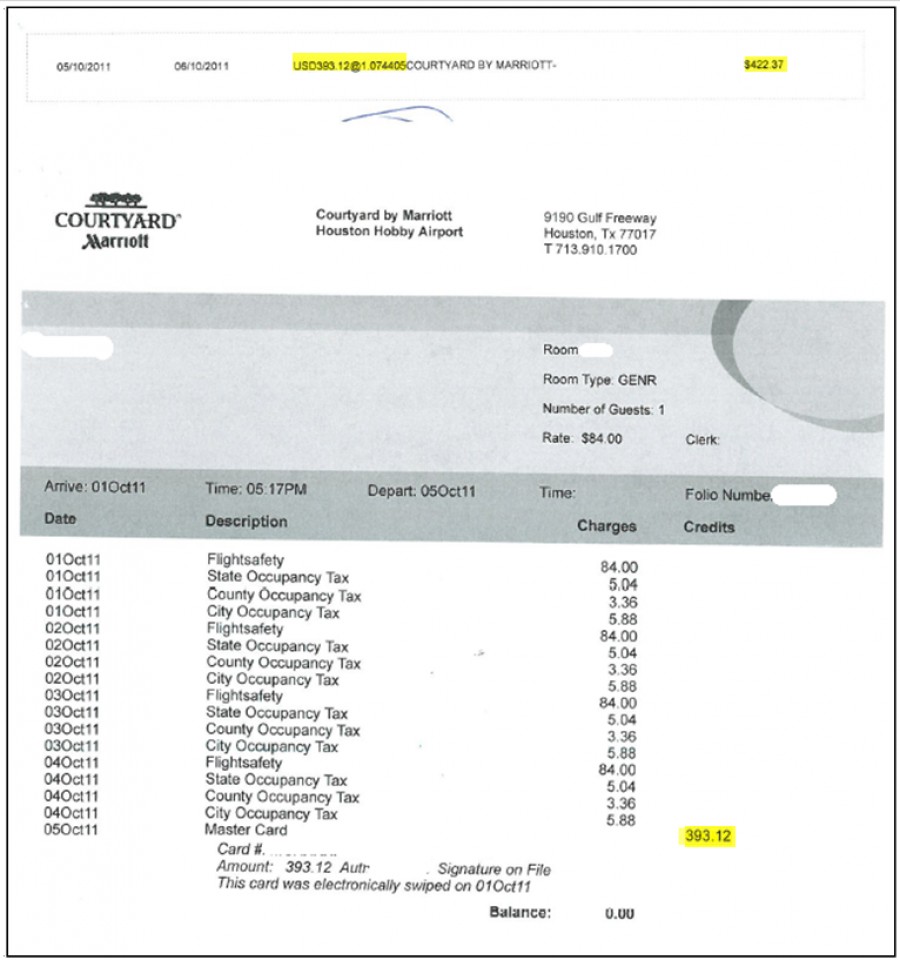

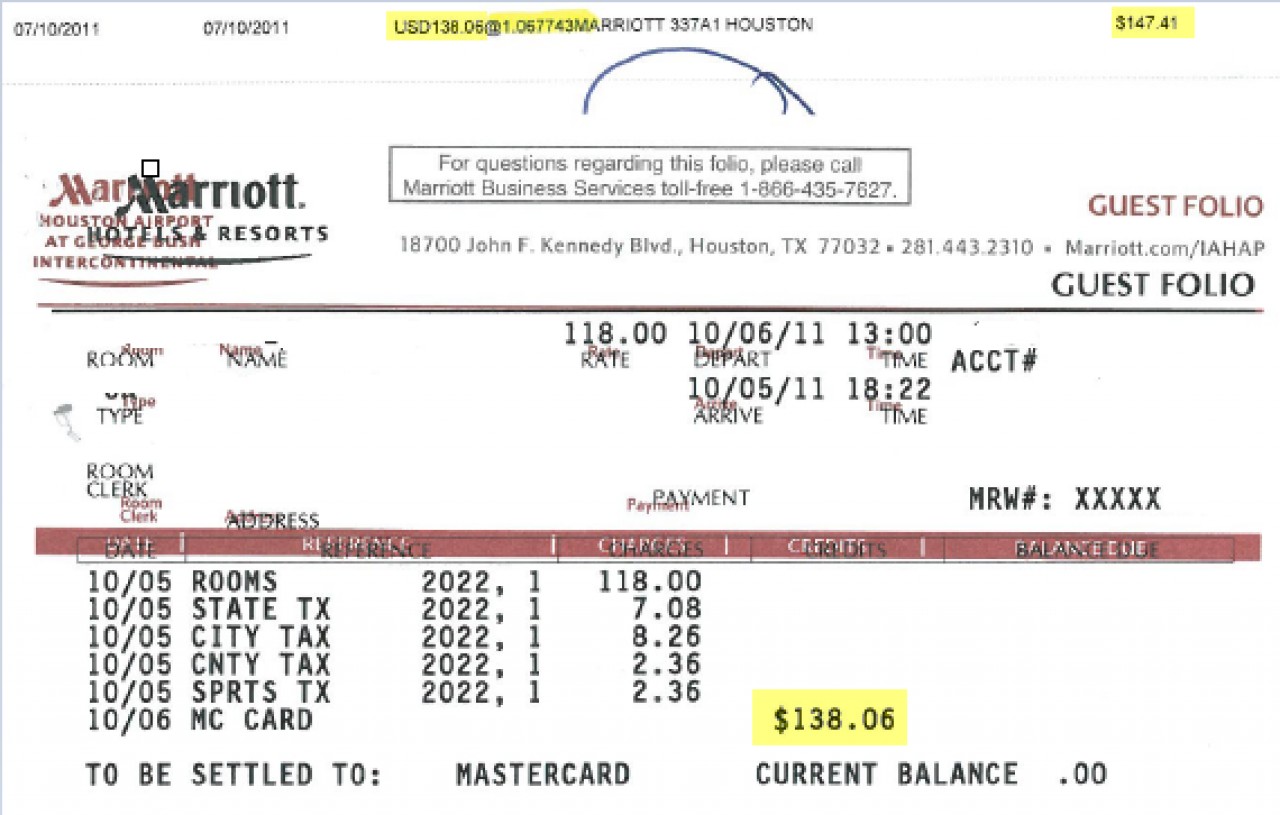

Trip to Houston, USA Oct. 1-6, 2011

Exchange rates from credit card statement used for receipt-based foreign expenses ($811.90). Average Bank of Canada rate (1.04095) used for remainder of expenses:

Figure 9 - Example 2: NJC Weighted Average Exchange Rate Form

Figure 10 – Example 2: Hotel Receipt with Credit Card Exchange Rate

Figure 11 – Example 2: Hotel Receipt with Credit Card Exchange Rate

Figure 12 - Example 2: Gas Receipt and Credit Card Exchange Rate

Figure 13 - Example 2: Car Rental Receipt and Credit Card Exchange Rate

| Date | 1 USD > CAD | 1 CAD > USD | Notice there are no weekend rates (Oct 1-2, 2011) |

|---|---|---|---|

| 2011-09-30 | 1.0389 | 0.9626 | |

| 2011-10-03 | 1.0440 | 0.9579 | |

| 2011-10-04 | 1.0604 | 0.9430 | |

| 2011-10-05 | 1.0449 | 0.9570 | |

| 2011-10-06 | 1.0430 | 0.9588 |

Figure 14 – Example 2: Bank of Canada USD Exchange Rates -

Sep 30 – Oct 6, 2011

On your claim:

- enter the actual exchange rate from the credit card statement for the receipt-based expenses incurred in USD (1.074405 for first hotel, 1.067743 for second hotel, 1.08035 for car rental, 1.074405 for gas)

- enter the weighted average exchange rate highlighted at the bottom of the form (1.04095) as the exchange rate for all other expenses incurred in USD.

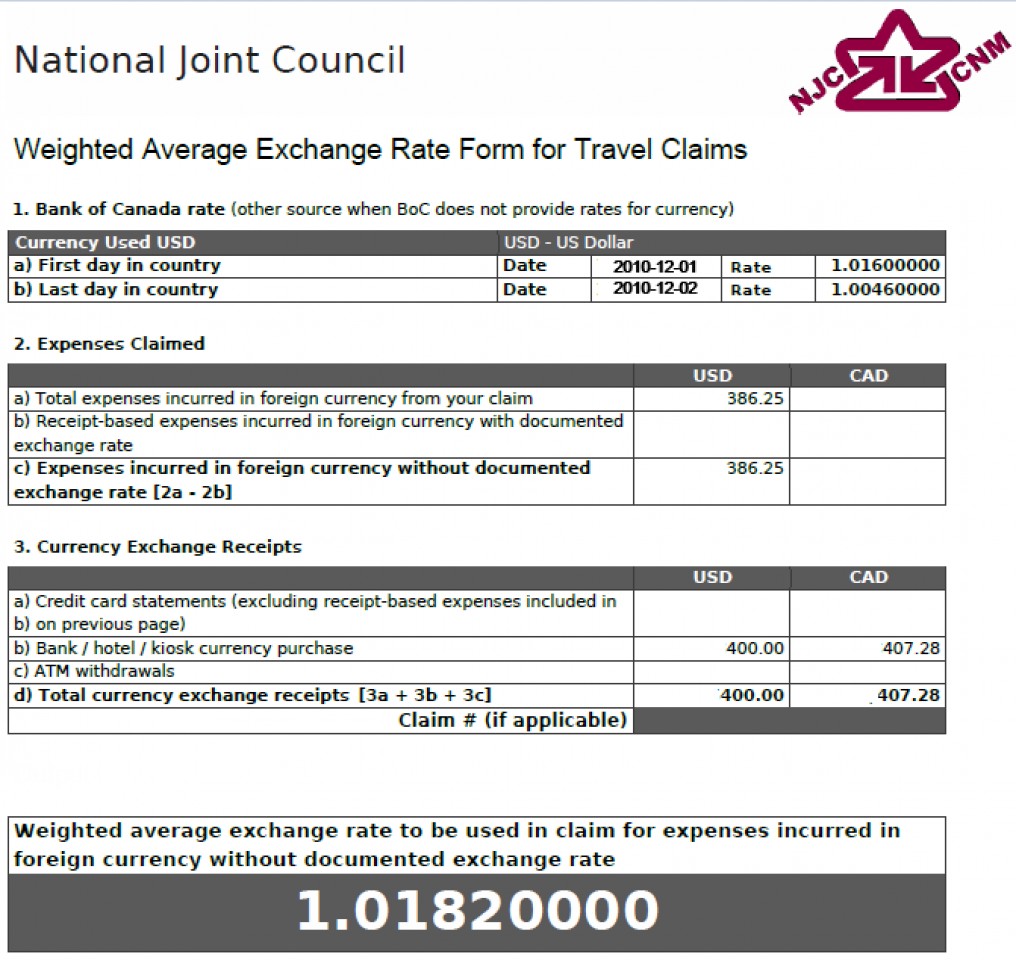

Example 3: Scenario C – Bank Currency Exchange Receipt Only

Trip to Montana, USA Dec. 1-2, 2010

Total amount of foreign currency withdrawn from bank ($400) is higher than allowable foreign expenses ($385.25); therefore, average Bank of Canada rates are excluded from the calculation. Credit card statement not used / supplied:

Figure 15 - Example 3: NJC Weighted Average Exchange Rate Form

| Date | 1 USD > CAD | 1 CAD > USD | In this scenario, the Bank of Canada rates are not used in the calculation as the currency exchanged is greater than the total foreign expenses. |

|---|---|---|---|

| 2010-12-01 | 1.0160 | 0.9843 | |

| 2010-12-02 | 1.0046 | 0.9954 |

Figure 16 – Example 3 Bank of Canada USD Exchange Rates - Dec 1-2, 2010

On your claim:

- Enter the weighted average exchange rate highlighted at the bottom of the pdf form (1.01820) as the exchange rate for each expense incurred in USD.

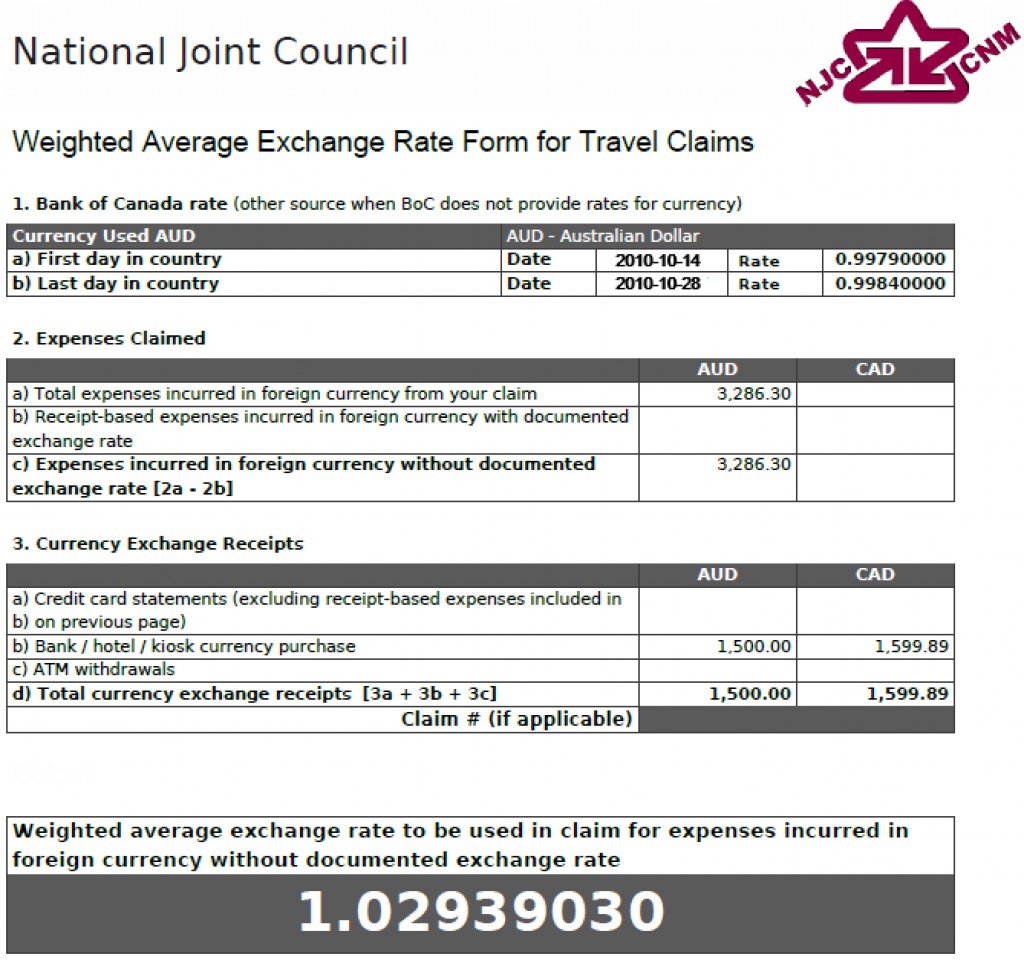

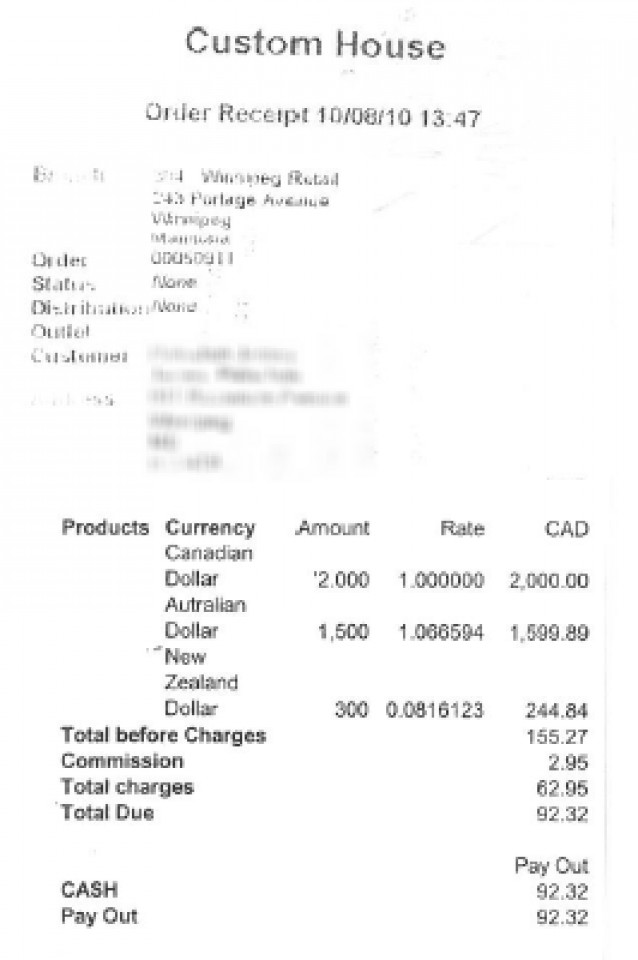

Example 4: Scenario C – Bank Currency Exchange Receipt Only

Trip to Australia Oct. 14-28, 2010

Total amount of foreign currency withdrawn from bank ($1,500) is lower than allowable foreign expenses ($3,286.30). Therefore, the weighted average exchange rate (1.02939030) is based on exchange rate from bank receipt (1.066594) and average Bank of Canada rates (0.99815). Credit card statement not used / supplied.

Figure 17 - Example 4: NJC Weighted Average Exchange Rate Form

Figure 18 - Example 4: Currency Exchange Receipt

| Date | 1 AUD > CAD | 1 CAD > AUD |

|---|---|---|

| 2010-10-14 | 0.9979 | 1.0021 |

| 2010-10-15 | 0.9989 | 1.0011 |

| 2010-10-18 | 1.0064 | 0.9936 |

| 2010-10-19 | 1.0049 | 0.9951 |

| 2010-10-20 | 1.0088 | 0.9913 |

| 2010-10-21 | 1.0063 | 0.9937 |

| 2010-10-22 | 1.0040 | 0.9960 |

| 2010-10-25 | 1.0129 | 0.9873 |

| 2010-10-26 | 1.0081 | 0.9920 |

| 2010-10-27 | 1.0009 | 0.9991 |

| 2010-10-28 | 0.9984 | 1.0016 |

Figure 19 – Example 4: Bank of Canada AUD Exchange Rates - Oct 14-28, 2010

On your claim:

- enter the weighted average exchange rate highlighted at the bottom of the form (1.0293903) as the exchange rate for each expense incurred in AUD.

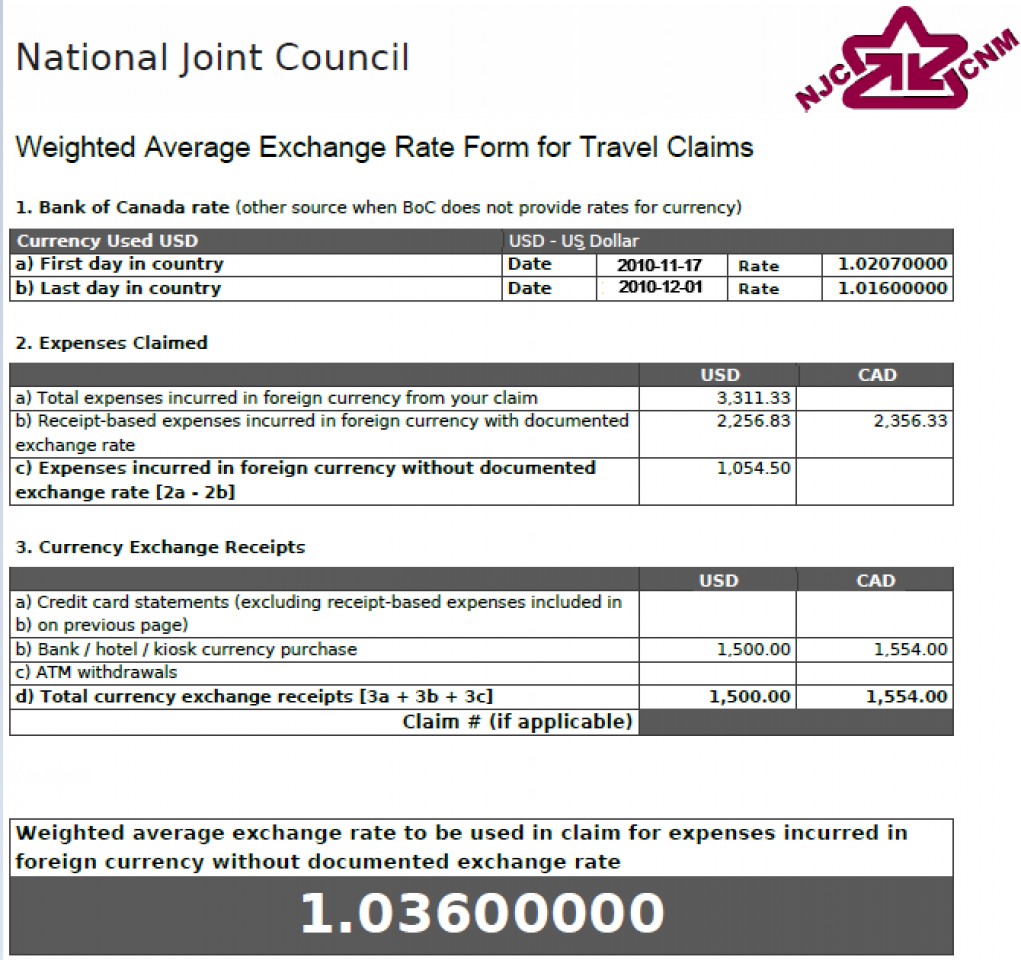

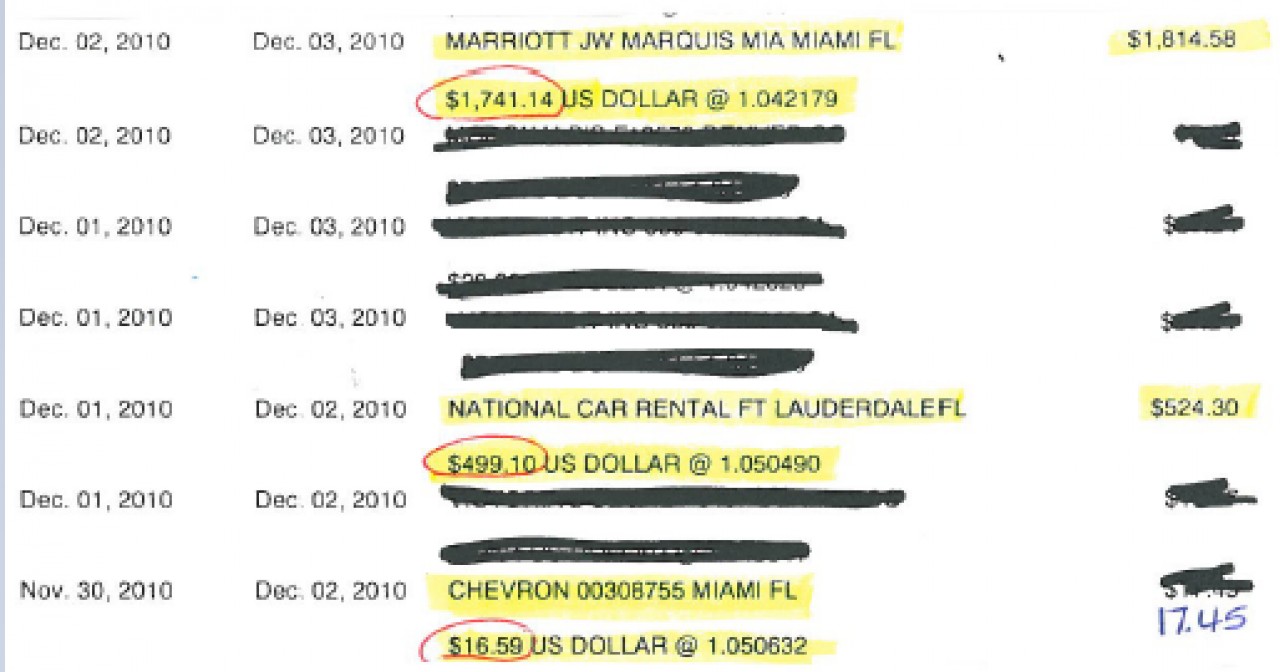

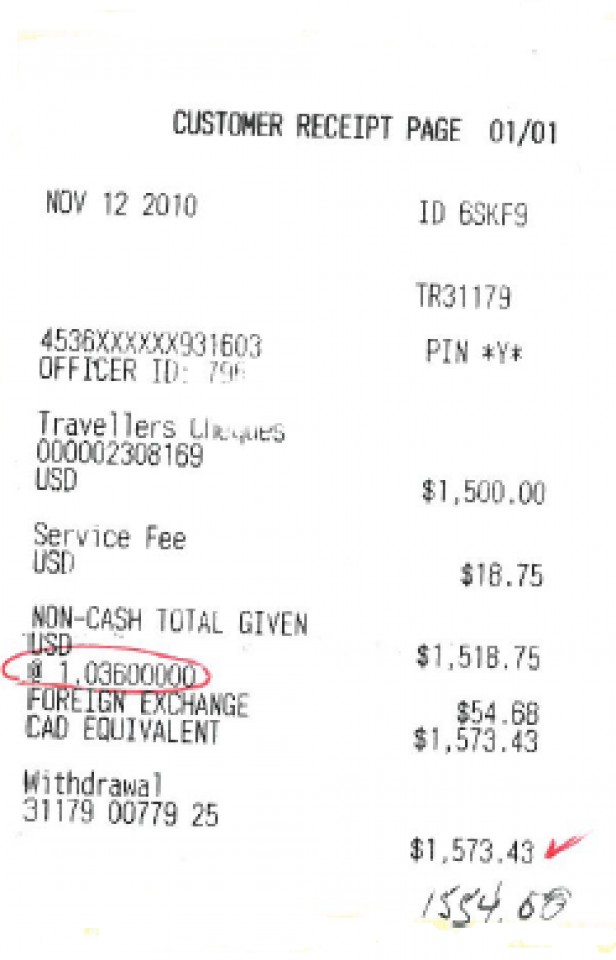

Example 5: Scenario C – Credit Card Statement and Bank Currency Exchange Receipt

Trip to Miami, USA Nov. 17 - Dec. 1, 2010

Total foreign currency exchange receipts from bank ($1,500) are higher than allowable foreign expenses without documented exchange rate ($1,054.50); therefore, Bank of Canada rates are excluded from the calculation.

Figure 20 - Example 5: NJC Weighted Average Exchange Rate Form

Figure 21 - Example 5: Exchange Rates from Credit Card

Figure 22 - Example 5: Currency Exchange Receipt

| Date | 1 USD > CAD | 1 CAD > USD |

|---|---|---|

| 2010-11-18 | 1.0174 | 0.9829 |

| 2010-11-19 | 1.0208 | 0.9796 |

| 2010-11-22 | 1.0187 | 0.9816 |

| 2010-11-23 | 1.0245 | 0.9761 |

| 2010-11-24 | 1.0108 | 0.9893 |

| 2010-11-25 | 1.0083 | 0.9918 |

| 2010-11-26 | 1.0191 | 0.9813 |

| 2010-11-29 | 1.0227 | 0.9778 |

| 2010-11-30 | 1.0264 | 0.9743 |

| 2010-12-01 | 1.0160 | 0.9843 |

Figure 23 – Example 5: Bank of Canada USD Exchange Rates -

Nov 17 - Dec 1, 2010

On your claim:

- enter the actual exchange rate from the credit card statement for the receipt-based expenses incurred in USD (1.042179 for hotel, 1.050490 for car rental, 1.050632 for gas)

- enter the weighted average exchange rate highlighted at the bottom of the form (1.036) as the exchange rate for all other expenses incurred in USD

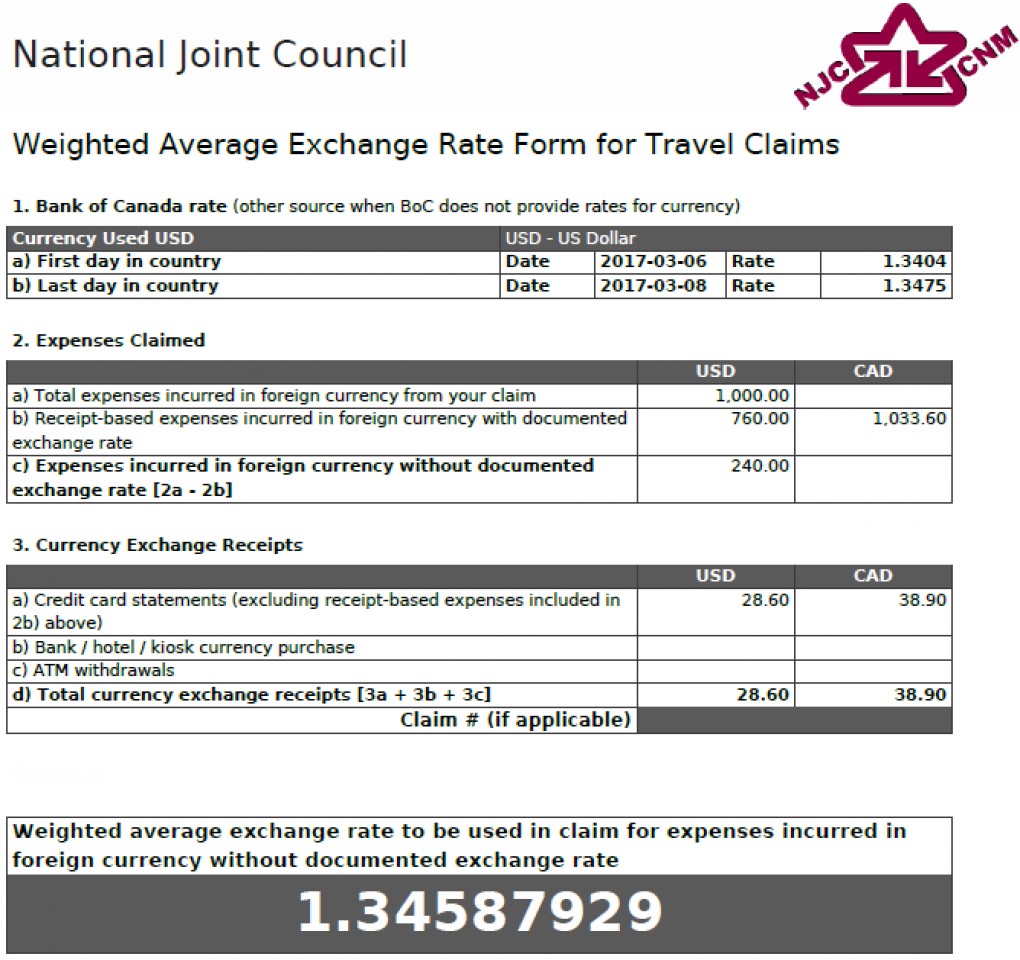

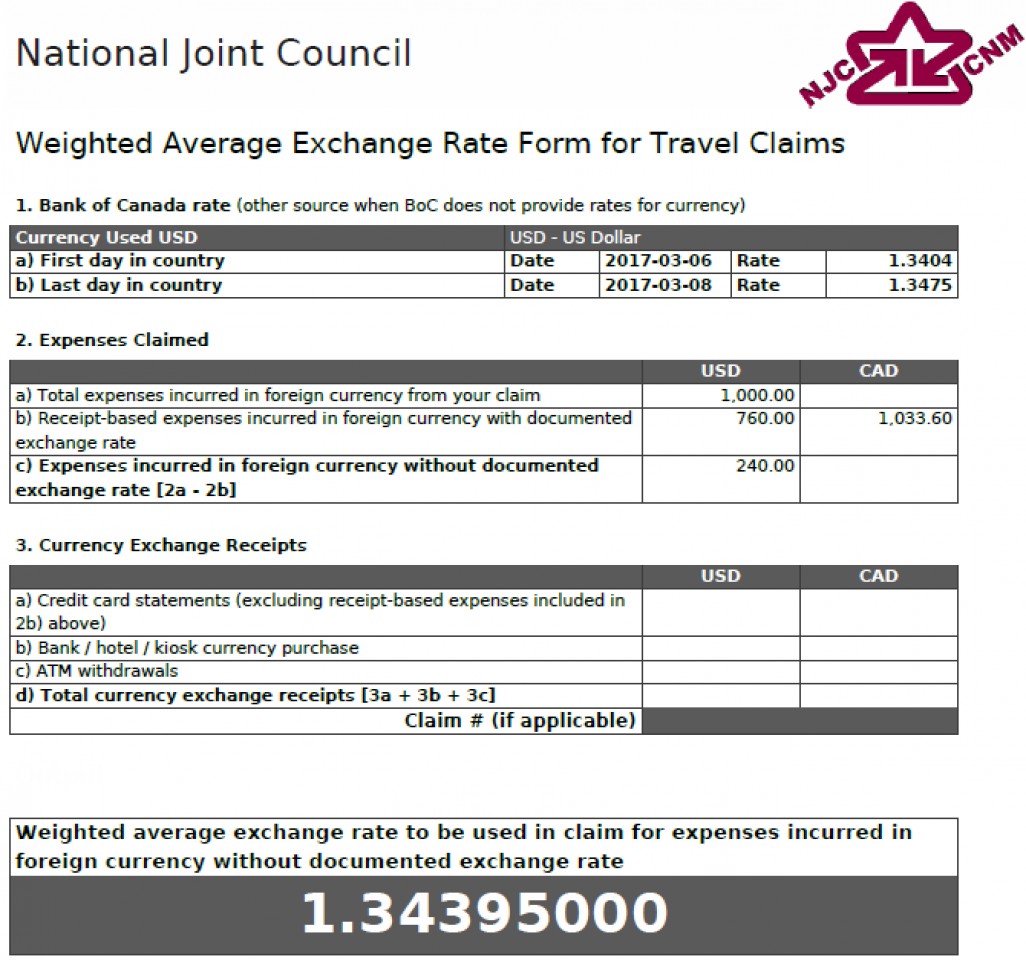

Example 6: Scenario C – Credit Card Statement Including Purchased Meals

Meals and incidental expenses: Although meals and incidentals are reimbursed based on the allowance rates in Appendices C and D of the Travel Directive, the associated exchange rate on your credit card statement can be used in the calculation of the weighted average exchange rate to be applied to your meal and incidental allowances and reimbursable receipt-based expenses paid in cash.

In this example, a meal was purchased for $28.60 USD. This amount is included in line 3a (with 1.36 exchange rate) but excluded from line 2b, since it is covered by the meal allowance and is not a reimbursable receipt-based expense. This in turn, raises the average rate from 1.34395 to 1.34587929 as shown below:

With Meal(s):

Figure 24 - Example 6: Weighted Average Exchange Rate Form -

With Meal on Credit Card

Without Meal(s):

Figure 25 - Example 6: Weighted Average Exchange Rate Form -

Without Meal on Credit Card