The following guidance is published as a companion to the Travel Directive, to provide detailed instructions to convert foreign expenses to Canadian dollars (CAD)* when submitting travel claims.

If you have travelled outside Canada on government business and need to complete your travel claim, figuring out what you can claim in Canadian dollars is not as confusing as it may seem. As such, the Government Travel Committee, with the approval of the Executive Committee, has created this document for you!

First, let’s start with a few basic concepts:

- Currency exchange – the act of converting an amount from one currency to an equivalent amount in another currency, e.g. CAD$ to Euros €.

- Currency exchange itself does not result in an expense because you still have the equivalent amount in your pocket, although it is now in another currency. This is similar to going to a bank to convert $100 cash to $100 travellers cheques – you are changing the form of the currency but not the value;

- The currency exchange amounts are used in the conversion calculation to determine the Canadian equivalent of travel expenses incurred in foreign currency (e.g. meals and incidentals) but they are not entered on the travel claim as an actual expense.

- Currency exchange expense – an expense associated with currency exchange where you are out of pocket, such as service fees charged for converting or reconverting one currency to another, and loss on foreign exchange on reconversion.

- The service fees will appear as a separate item on the exchange receipt and are entered on the travel claim as an expense;

- These expenses are separate from the actual currency exchange described above.

- Currency exchange receipt – any document that shows the exchange rate for a transaction.

For example:- credit card statement showing travel expenses (e.g. hotel, car rental, meals)

- Individual Designated Travel Card statement showing cash advance

- withdrawal slip or bank statement for ATM transaction

- receipts from currency exchange at bank/hotel/kiosk

- It documents the exchange rate and amounts to be used in the conversion calculation (including the calculation of a weighted average when necessary) to determine the Canadian equivalent of travel expenses incurred in foreign currency.

- It may also serve as an expense receipt for currency exchange service fees (if any) to be entered on the claim.

Now that you understand these concepts, you are ready to complete your travel claim. Follow the instructions under scenario A, B, or C below, according to your situation:

- If you don’t have any currency exchange receipts:

Calculate the average Bank of Canada exchange rate (see Appendix A) and use it for each expense incurred in the foreign currency on your claim. - If the only foreign currency exchange receipt you are submitting is a credit card statement for receipt-based expenses only (e.g. hotel, car rental):

On your claim, enter each foreign receipt-based expense (e.g. hotel, car rental, gas) charged to your credit card using the documented exchange rate from your credit card statement.

Use the average Bank of Canada exchange rate (see Appendix A) for meal and incidental allowances and for foreign receipt-based expenses that were paid in cash. - If you have other foreign currency receipts (e.g. currency exchange at bank, ATM withdrawal, Individual Designated Travel Card statement showing cash advance in foreign currency):

On your claim, enter each foreign receipt-based expense (e.g. hotel, car rental, gas) charged to your credit card using the documented exchange rate from your credit card statement.

Enter any currency exchange fees charged to you as an expense on your claim; if the fees were paid in foreign currency, remember to use the exchange rate documented on the receipt.

When you returned, did you convert your remaining foreign currency (if any) back to Canadian dollars? If so, calculate the gain or loss on exchange (see Appendix B) and enter as a currency exchange expense on your claim.

Enter all foreign receipt-based expenses that were paid in cash (e.g. taxi, parking), and meal and incidental allowances. If your travel claim system requires you to enter an exchange rate for each foreign expense, you will need to use a temporary exchange rate (we recommend 1.0002). You will replace this temporary exchange rate later with the weighted average exchange rate. Review the draft claim to get the total for these expenses, which is needed in the next step. Don’t submit your claim yet.

Use one of the approved foreign exchange rate calculator tools (see Appendix C) to determine the weighted average exchange rate.

Replace the temporary rate from step (4) with the weighted average exchange rate from step (5) for all your meal and incidental allowances in foreign currency and for foreign expenses that were paid in cash. Assuming all other required information has been entered, you are now ready to submit your claim to your manager for approval.

If you would like to read more about the Foreign Currency Conversion Calculation Methodology approved by the National Joint Council, which forms the basis for the foreign exchange rate calculator tools, see Appendix D.

Appendix A – Determining the Average Bank of Canada Exchange Rate

To calculate the average Bank of Canada (BoC) rate, just add the exchange rates for the first and last day in the foreign country and divide by 2, as shown below.

- For first and last days in the foreign country during a weekend or statutory holiday, use the previous business day’s rate; e.g. Friday’s rate will be used when the first or last day in the country is on a weekend.

To calculate average BoC exchange rate:

Example: Departing Sunday February 12, 2017; Returning Family Day Monday February 20, 2017:

| Date | USD > CAD | CAD > USD |

(1.3084 + 1.3102) / 2 = 1.3093

|

|---|---|---|---|

| 2017-02-10 | 1.3084 | 0.7643 | |

| 2017-02-13 | 1.3082 | 0.7644 | |

| 2017-02-14 | 1.3070 | 0.7651 | |

| 2017-02-15 | 1.3088 | 0.7641 | |

| 2017-02-16 | 1.3055 | 0.7660 | |

| 2017-02-17 | 1.3102 | 0.7632 | |

| 2017-02-20 | Bank holiday | Bank holiday | |

| 2017-02-21 | 1.3148 | 0.7606 |

Figure 1 - Bank of Canada USD Exchange Rates Feb 10-21, 2017

To access the Bank of Canada rates:

Go to http://www.bankofcanada.ca/rates/exchange/daily-exchange-rates-lookup/

(For rates prior to 2017, go to http://www.bankofcanada.ca/rates/exchange/10-year-lookup/)

What if there is no Bank of Canada rate for the country you travelled to?

For those foreign countries where the Bank of Canada does not provide rates (e.g. Burma), you can use an alternate exchange rate source; however, the same principles apply: initial date entering the country and the final date exiting the country:

- OANDA.com: http://www.oanda.com/

- eXchangeRate.com: http://www.exchangerate.com/indication_rates.html

- XE-Universal Currency Converter: http://www.xe.com/ucc/

Note: Malaysia (Ringgit) has been removed from our calculator as the foreign exchange rate was removed from the Bank of Canada’s site in January 2020.

Appendix B – Calculating Gain / Loss on Foreign Exchange

If you did not use all your foreign currency on your trip and reconverted the remaining amount back to CAD, the exchange rate was probably different than the rate for the original exchange. Usually, you will suffer a loss on reconversion, which can be claimed as a currency exchange expense.

For example:

- You went to the bank to get $100 USD at a CAD->USD exchange rate of 0.8363, at a “cost” of $119.57 CAD. This part of the transaction is an exchange only, since you still have the equivalent of $119.57 CAD in your possession. The only expense at this point would be the service fees to convert the money.

- If you only use $50 USD on your trip and reconvert the remainder back to CAD upon your return at a USD->CAD exchange rate of 1.1594 (i.e. a CAD->USD rate of 0.8625), then you would experience an exchange loss, which is considered a currency exchange expense:

|

CAD |

CAD->USD |

USD |

|

|---|---|---|---|

|

original currency purchase (currency exchange) |

$119.57 |

0.8363 |

$100.00 |

|

less amount used |

$59.79 |

0.8363 |

$50.00 |

|

remaining currency |

$59.79 |

0.8363 |

$50.00 |

|

reconversion to CAD |

$57.97 |

0.8625 |

$50.00 |

|

exchange rate loss (currency exchange expense) |

($1.82) |

||

|

Enter the loss on exchange ($1.82) as a currency exchange expense on your claim. |

Note the different rate upon return to Canada (0.8625). | ||

If the exchange rates are reversed in the above scenario, then you would have an exchange rate gain. If the gain is related to a travel advance or a cash advance obtained with your Individual Designated Travel Card, then the exchange rate gain should be reported as a negative expense in your travel claim.

Appendix C – Foreign Exchange Rate Calculators

Two foreign exchange rate calculator tools have been created to help employees determine the weighted average exchange rate to be used on travel claims. If your department uses the Expense Management Tool (EMT), you can use the Foreign Exchange Rate Calculator available in EMT. If you do not use EMT, you can use the NJC Foreign Currency Exchange Rate Calculator. Both tools were designed in accordance with the Foreign Currency Conversion Calculation Methodology approved by the National Joint Council. For a detailed explanation of the methodology, see Appendix D.

- Before using either of the Foreign Exchange Rate Calculator tools, sort all your receipts and credit card statements in like-currency, and review your claim to get the total expenses in each foreign currency.

- Enter the information requested in the data entry fields.

- EMT users - Detailed instructions on the use of the EMT Foreign Exchange Rate Calculator are available on the Shared Travel Services portal.

- Non-EMT users - Detailed guidance on the use of the web-based Foreign Currency Exchange Rate Calculator is available here.

- Once you have completed the form:

- EMT users - Save the information as part of the Expense Report.

- Non-EMT users - Save the PDF form and attach it to your claim.

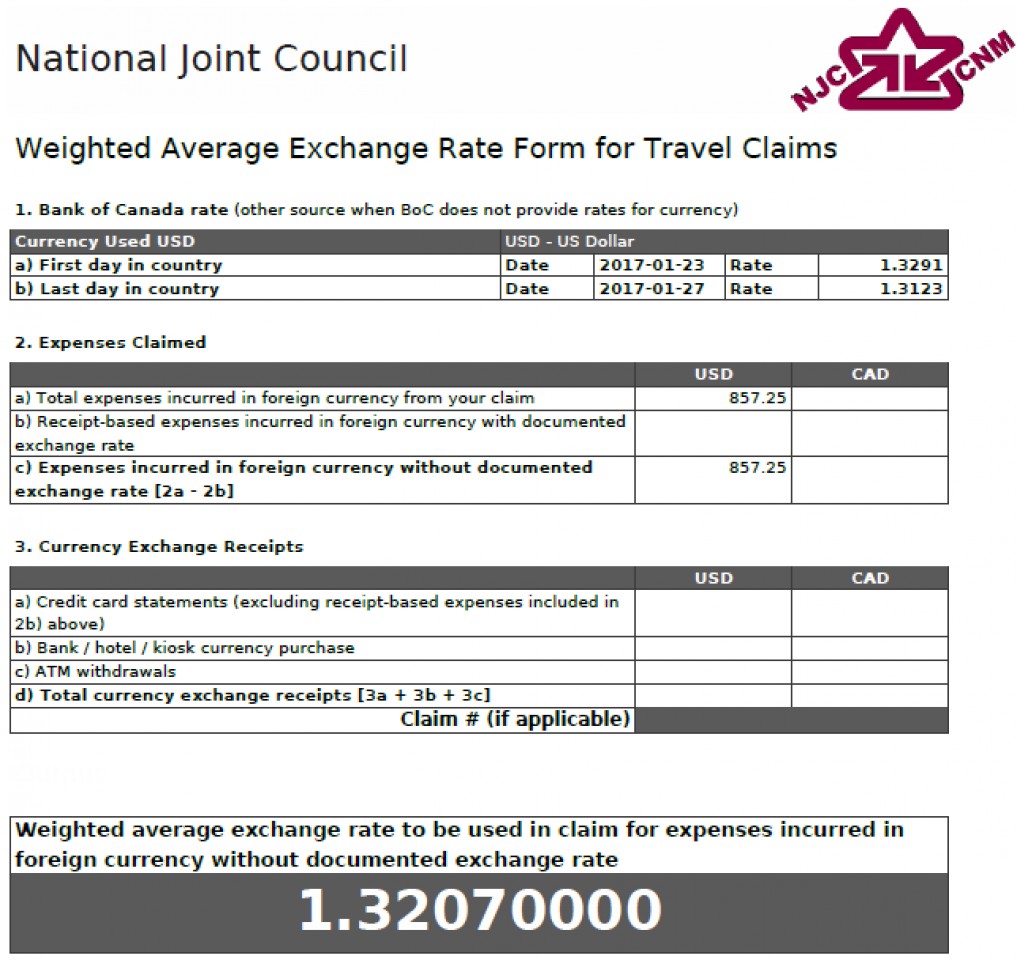

- The rate at the bottom of the form is the calculated weighted average exchange rate to use for your foreign meal and incidental allowances and for receipt-based expenses that do not have a documented exchange rate (e.g. taxi paid in cash).

- Complete a separate form for each foreign currency that was used on the trip.

EMT Foreign Exchange Rate Calculator:

In EMT, open the tool by clicking on the Foreign Exchange Rate Calculator link in the top right section of the Travel Requests & Expenses page:

Figure 2 - EMT Foreign Exchange Rate Calculator

NJC Foreign Currency Exchange Rate Calculator:

Open the web-based tool and follow the instructions as you navigate through the application to calculate the weighted average exchange rate to be used for all your expenses without a direct exchange rate. Download and save the PDF form shown below, which you will attach to your travel claim.

Figure 3 - NJC Foreign Currency Exchange Rate Form

Appendix D – Foreign Currency Conversion Calculation Methodology

The National Joint Council has approved the following methodology for determining the reimbursement amount in Canadian dollars (CAD)* for expenses incurred in a foreign currency. All currency exchange receipts will be considered in the calculation. Before converting expenses to CAD, the traveller must first partially complete the travel claim to determine the total expenses in the foreign currency:

- For each allowable receipt-based expense incurred in foreign currency that has a documented exchange rate, use the documented exchange rate to convert the expense to CAD. For example, for accommodations or car rental expenses that were charged to a credit card, use the exchange rate that appears on the credit card statement for that expense.

- Total all other allowable expenses incurred in the foreign currency that do not have a documented exchange rate (e.g. meal and incidental allowances, receipt-based expenses paid in cash).

- Total all remaining foreign currency exchange receipts for the currency (e.g. cash advance on the Individual Designated Travel Card, currency exchange at bank), excluding amounts already converted in (1).

- Determine the weighted average exchange rate to be used when converting the expenses from (2) to CAD according to the applicable scenario (a) or (b) below. A weighted average exchange rate factors in the relative size of each exchange receipt, giving greater importance (weight) to the exchange rate for a large exchange receipt than the exchange rate for a smaller exchange receipt. The weighted average exchange rate is calculated by dividing the total amount in CAD by the total amount in the foreign currency for all currency exchange receipts.

- (3) ≥ (2): If the total value of remaining foreign currency exchange receipts from (3) is equal to or exceeds the total expenses without documented exchange rates from (2), the weighted average of the remaining foreign currency exchange receipts must be used to convert to CAD. (Refer to Example 1 – Total value of foreign currency exchange receipts is higher than the expenses.)

- (3) < (2): If the total value of the remaining foreign currency exchange receipts from (3) is lower than the total expenses without documented exchange rate from (2), use a three step calculation to determine the weighted average exchange rate to be used to convert to CAD. (Refer to Example 2 – Total value of foreign currency exchange receipts is lower than the expenses.)

- the total of all other currency exchange receipts (e.g. cash advance on your Individual Designated Travel Card, currency exchange at bank) is used to convert the equivalent amount of expenses from (2) above; and.

- For the remaining expenses from (2) above, apply the average bank exchange rates to convert directly from the foreign currency to CAD. This is an average of two bank exchange rates:

- The bank exchange rate for the initial date entering the country; and

- The bank exchange rate for the final date exiting the country.

- Calculate the weighted average exchange rate based on the actual exchange receipts from (i) and the average Bank of Canada exchange rate (ii).

- Finalize the claim by applying the weighted average exchange rate calculated in (4) to each expense without a documented exchange rate.

Example 1 – Total value of foreign currency exchange receipts is higher than the allowable expenses

A person travelled to Thailand. Based on the NJC Travel Directive provisions, the allowable expenses in Thai Bahts are 20,000 as entered on the travel expense claim.

- Of the total 20,000 expenses, 10,000 were paid using the IDTC for receipt-based expenses (hotel, car rental, gas) and converted on the credit card statement to $350 CAD, so the documented exchange rate shown on the IDTC statement for each of these expenses shall be entered on the claim.

- This leaves a total of 10,000 expenses in Thai Bahts for which there is no documented exchange rate.

- During travel status, the person made 3 additional currency exchange transactions totalling 500.00 CAD converted to 14,000 Bahts.

The three currency exchange receipts show the following transactions:

Currency Exchange Receipt #

Thai Bahts

Canadian Dollars (CAD)

#1 credit card cash advance (statement)

6,000

210.00

#2 ABM cash withdrawal

4,000

140.00

#3 ABM cash withdrawal

4,000

150.00

Total

14,000

500.00

- Since the currency exchange receipts of 14,000 Bahts from (3) exceed the 10,000 Bahts expenses without documented exchange rate from (2), the weighted average exchange rate from the currency exchange receipts shall be used for the conversion.

500.00 (CAD) / 14,000 (Thai Bahts) = 0.03571429 - The weighted average exchange rate is then applied to the expenses without documented exchange rate when finalizing the claim:

10,000 Bahts x 0.03571429 = 357.14 CAD

The allowable travel claim expenses of 20,000 Bahts are equivalent to 707.14 CAD ($350.00 + $357.14).

Example 2 – Total value of foreign currency exchange receipts is lower than the total allowable expenses

A person travelled to Thailand. Based on the NJC Travel Directive provisions, the allowable expenses in Thai Bahts are 20,000 as entered on the travel expense claim.

- Of the total 20,000 expenses in Thai Bahts, 6,000 were paid using the IDTC for receipt-based expenses (hotel, car rental, gas) and converted on the credit card statement to $210.00 CAD, so the documented exchange rate shown on the IDTC statement for each of these expenses shall be entered on the claim.

- This leaves a total of 14,000 expenses in Thai Bahts for which there is no documented exchange rate.

- During travel status, the person made 3 additional currency exchange transactions totalling 355.00 CAD converted to 10,000 Bahts.

The three currency exchange receipts show the following transactions:

Currency Exchange Receipt #

Thai Bahts

Canadian Dollars (CAD)

#1 credit card cash advance (statement)

4,000

140.00

#2 traveller's cheques

3,000

105.00

#3 cash exchange

3,000

110.00

Total

10,000

355.00

- Since the currency exchange receipts of 10,000 Bahts from (3) is lower than the 14,000 Bahts expenses without documented exchange rate from (2), a three-step calculation must be done to determine the weighted average exchange rate to be used for the conversion:

- Apply the actual foreign currency exchange rates to an equivalent amount of expenses incurred in the foreign currency that do not have a documented exchange rate (i.e.10,000 Bahts expenses converts to 355.00 CAD).

- For the balance of the allowable expenses without a documented exchange rate (14,000 Bahts – 10,000 Bahts = 4,000 Bahts), the average bank exchange rate must be used.

- On the initial date the person entered Thailand, the Bank of Canada rate was: 0.03427000.

- On the final date the person exited Thailand, the Bank of Canada rate was: 0.03392000.

Average Bank Exchange Rate calculation is:

(0. 03427000+ 0. 03392000) / 2 = 0.03409500.

Therefore, the average bank exchange rate of 0.03409500 is used for the 4,000 Bahts not covered by exchange receipts:

4,000 Bahts x 0. 03409500= 136.38 CAD.

- Using the three-step method, a weighted average exchange rate is then calculated using the amount supported by exchange receipts (i) and the amount converted using the average Bank of Canada exchange rate (ii):

10,000 Bahts (exchange receipts)

355.00 CAD

4,000 Bahts (Bank of Canada average exchange rate)

136.38 CAD

14,000 Bahts expenses without documented exchange rate

491.38 CAD

491.38 (CAD) / 14,000 (Thai Bahts) = 0.03509857

- The weighted average exchange rate of 0.03509857 is then applied to each expense without a documented exchange rate when finalizing the claim.

Accordingly, the total allowable expenses of 20,000 Bahts (travel expense claim amount) are equivalent to 701.38 CAD ($210.00 + $491.38).

Two foreign exchange rate calculator tools (see Appendix C) were designed in compliance with the prescribed methodology to further simplify the process for employees submitting travel claims.

* For employees posted to locations outside Canada, the currency conversion may be to the local or other currency rather than Canadian dollars.