Reimbursement for Business Use of Personal Vehicles

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1 Fuel Price Update Synopsis

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the Annual evaluation of per-kilometre Reimbursement Rates for government employees that are required to use their personal vehicles while performing government business. Furthermore, the periodic impact of varying fuel prices was to be evaluated quarterly by producing three additional Fuel Price Updates per year. The present document represents the Update for May 2023 (for publication on July 1st, 2023).

The latest Annual study established Reimbursement Rates for each Canadian Province and Territory after performing a comprehensive analysis of all vehicle operating expenses. These rates were presented in the Reimbursement for Business Use of Personal Vehicles Report, dated November 2022 (for publication on January 1st, 2023). A subsequent Fuel Update was produced for February 2023 (for publication on April 1st, 2023).

The present Update reflects the impact of current fuel prices on the Travel and Commuting Rates’ recommendations made in the Annual Report with a focus on average pump prices of gasoline by Province and Territory. The prices were averaged for each Province or Territory for the three months prior to the release of the current Update (the months of March, April and May 2023). All prices are given in dollars per litre.

This Update also presents the latest recommended rates of reimbursement for consideration by the Treasury Board Secretariat in dollars per kilometre. Federal and provincial sales taxes were also researched to determine if there were any recent changes that could have had an immediate impact on the total costs of vehicle ownership and operation.

For the period March - May 2023 fuel expenses represent 22.8% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 12.8 cents per kilometre. The present Update identified a slight increase in average gasoline prices across Canada, which had a minor impact on Reimbursement Rates. As a result, both Reimbursement Rates for the ten Provinces either stayed constant or increased slightly relative to the previous Fuel Update (February 2023 for publication on April 1st, 2023) by between 0.5 cents and 1.0 cents. For the Territories, both rates increased by 0.5 cents, with the exception of the Travel Rate for Nunavut, which remained constant.

2 Fuel Prices

2.1 Energy Market Context

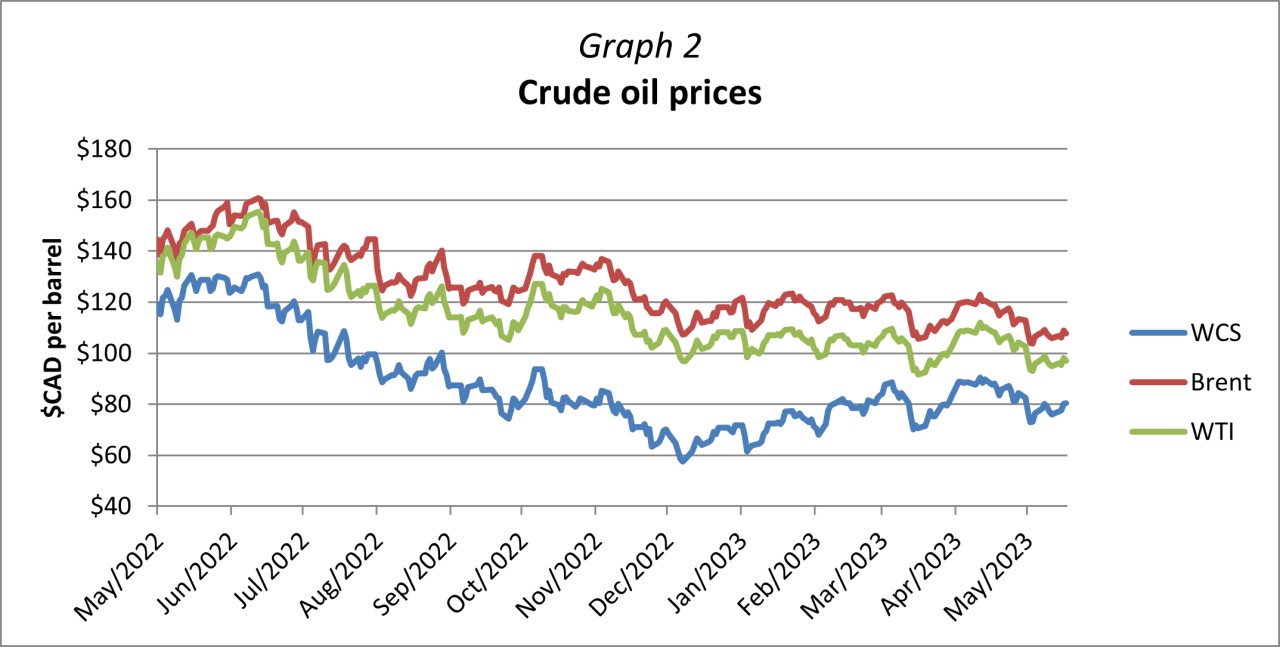

Over the past three months, global crude oil prices have gone through a decline in March, followed by an increase that peaked in mid-April, just to slide back down in May. The price levels seen in March and May have been the lowest in 15 months. The overall decline in oil prices has been driven by concerns over the weakening of the global economy, while the temporary increase in April was mostly due to an unexpected production cut announced by the OPEC+ coalition. Volatility in the global crude market remains high with regular fluctuations in excess of 5% per week. As a result, over the past three months, the West Texas Intermediate (WTI) fluctuated between $67 USD per barrel and just over $83 USD per barrel, while the Brent ranged from just about $72 USD per barrel to over $87 USD per barrel. As of May 19th, 2023, the WTI stood at $71.55 USD per barrel and the Brent was at $75.58 USD per barrel.

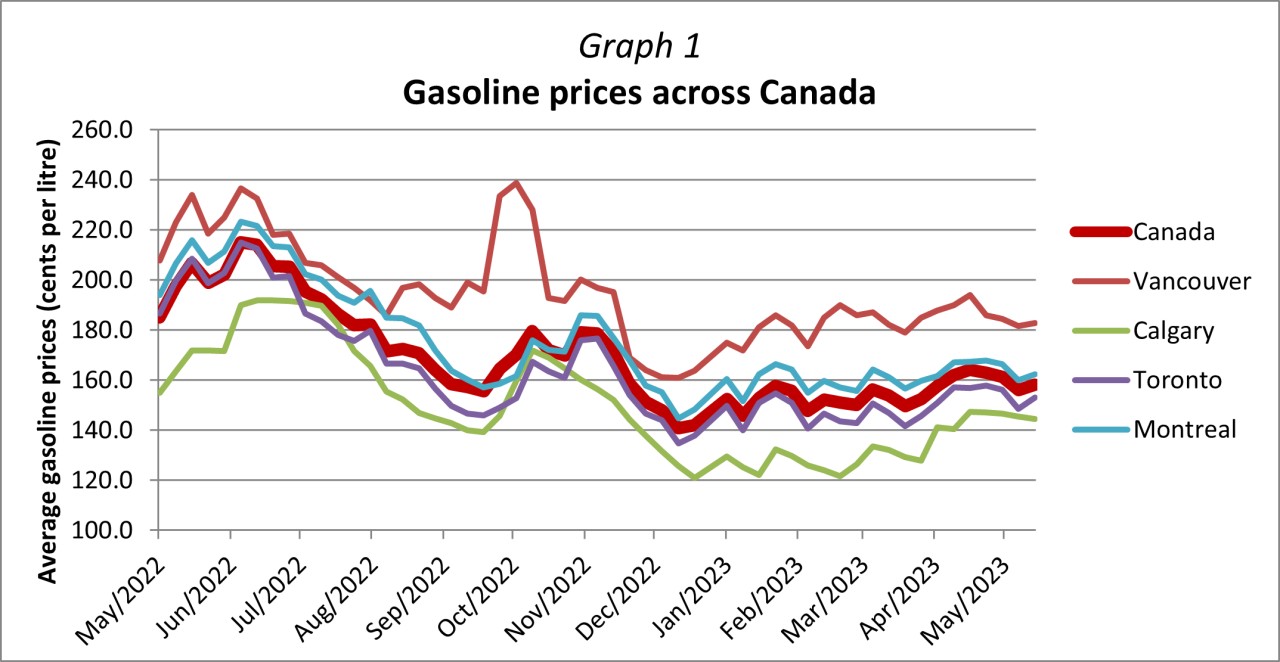

Gasoline prices have largely followed crude oil, rising in March and early April, and then exhibiting a slight decline in May. Nevertheless, due to strong demand and a tight product supply, these fluctuations have been less pronounced. The Canadian average price for gasoline in the three-month period increased by 3.2%, averaging $1.568 per litre. From a yearly perspective, however, the price of gas has declined by 11.2% as compared to the same three-month period last year when it averaged $1.766 per litre.

2.1.1 Global Crude Oil Demand

According to the World Economic Outlook (WEO) published in April 2023 by the International Monetary Fund (IMF), the global economy grew by 3.4% in 2022 and is projected to grow at a slower pace of 2.8% in 2023. The outlook for this year has seen a downward revision of 0.1 percentage points as compared to the WEO Update from January 2023. Notably, this is a significantly lower global growth rate than the average annual rate of 3.7% seen between the years 2010 and 2019.

The IMF notes that current global economic risks are high, with uncertainty on the rise, particularly as a result of the turmoil in the financial sector. In March 2023 the global market was significantly rattled when a large U.S. bank – The Silicon Valley Bank – serving tech start-ups in Silicon Valley declared bankruptcy after incurring large losses. It was the second-biggest bank failure in U.S. history after Washington Mutual’s collapse during the height of the 2008 financial crisis. Just a few days later, in Europe, UBS reached a deal to take over its rival – Credit Suisse – a large Swiss bank that had been struggling in the past several years. The effects of these events were felt across the entire banking sector: the combined market value of JPMorgan Chase, Bank of America, Wells Fargo and Citigroup was reduced by $52 billion in the coming weeks. These events brought on uncertainty and fear that a further economic decline could be inevitable. While the situation in the financial system appears to have normalized, the uncertainty remains significantly elevated, negatively affecting the economic outlook.

The IMF projects that the global headline inflation (the price increase for products and services including food and energy) is set to decline from 8.7% in 2022 to 7.0% in 2023 due to lower commodity prices. However, the underlying (core) inflation that does not consider the price of food and energy directly is likely to decline more slowly. The IMF notes that in most countries the return to target inflation rates is unlikely before 2025.

To combat inflation, central banks around the world have been aggressively increasing their interest rates. Higher interest rates make it more expensive to borrow money to buy a home, expand a business or take on any other debt. By increasing those borrowing costs, demand weakens, and prices begin to cool off. For example, the Federal Reserve’s latest increase in the key interest rate by 0.25 percentage points in early May 2023, marks the 10th hike in 14 months, with the rates now standing between 5.0% and 5.25%, up from near zero in March 2022, which is the highest level since 2007. The interest rate hikes in the U.S. have sharply increased borrowing costs leading to a slowdown in different sectors, such as housing, as well as playing a role in the banking sector failures. Nevertheless, the interest rate increases have led to a reduction in inflation rates. In March 2023, US inflation was at 5%, the lowest level in nearly two years, but still much higher than the target rate of 2%. Similarly, the European Central Bank also recently raised key rates by 0.25 percentage points, with the borrowing rate now standing at 3.75%. While some banks are indicating a likely slowdown of interest rate hikes, others are not, and thus the uncertainty over future borrowing costs and their impact on the economies remains high. The Bank of Canada hasn’t increased their interest rates since January 2023.

As a result, the rate of economic growth in advanced economies is projected to decline sharply from 2.7% in 2022 to 1.3% in 2023, with 90% of economies projected to see a decline as compared to last year. After a 3.5% growth in 2022, the Euro Area growth projection is now estimated at 0.8% for 2023. Projections for next year have seen slight downward adjustments and are now estimated at 1.4%. The U.S. economy remains strong and thus has seen improvements in the growth projections by 0.1-0.2 percentage points, now at 1.6% for this year and 1.1% for 2024. The U.S. labour market remains very strong, with the unemployment rate at a historical low.

According to the Monetary Policy Review published by the Bank of Canada in April 2023, the demand in Canada still exceeds supply. The labour market remains tight and is above the maximum sustainable employment level. This continues to exhibit an upward pressure on prices, resulting in high inflation. Household spending as well as the growth in business investment are being restrained by the rising borrowing costs, while exports are slowing due to weaker foreign demand. As a result, the Bank projects that while the economy adjusts to the higher interest rates and inflation returns to the 2% target, the growth will remain slow at 1.4% this year (up from 1.0% in the January 2023 MPR) and an additional 1.3% in 2024 (down from 1.8% projection three months prior), before reaching 2.5% in 2025. For comparison, the IMF projections for 2023 and 2024 remain at 1.5% for both years.

The outlook for emerging markets and developing economies remains stronger than for advanced economies but varies widely across regions. The IMF projection has been reduced slightly for 2023 for this group, now at 3.9% (down from 4.0% in the January WEO Update). China’s growth rates remain at 5.2% for 2023 and 4.5% for 2024. The reopening of China’s economy, the second-largest in the world, after the COVID-19 outbreak late last year has had significant spillovers globally. China is the destination for about a quarter of all exports in Asia and between 5% and 10% from other regions. Lifting of the restrictions and improved mobility are also easing the global supply challenges. At the same time, weak manufacturing growth figures in early May refuelled concerns that the world’s largest petroleum importer may be struggling. Despite the ongoing and new sanctions imposed by numerous countries, Russia’s economy is expected to expand by 0.7% (an improvement of 0.4 percentage points over the WEO Update from January 2023), while the 2024 projection stands at 1.3%, a significant reduction from the 2.1% projected in the WEO Update in January 2023.

While the demand for crude oil in developed nations has been lower than previously projected due to warmer weather and sluggish industrial activity, robust gains in China and other non-OECD countries have been providing a strong offset. As a result, the global demand for oil is expected to increase significantly this year. The International Energy Agency’s (IEA) Oil Market Report from May 2023 forecasts a record high demand of 102.0 million barrels per day (mb/d) in 2023, with about 90% of the 2.2 mb/d growth coming from non-OECD countries, including China, that is making up more than half of the global increase. Similarly, OPEC estimates that in 2022 the global demand for crude oil averaged 99.6 mb/d and estimates that this year the demand will further increase by 2.3 mb/d, averaging 101.9 mb/d, nearly the same estimate as the one from IEA. In contrast, the U.S. Energy Information Agency (EIA) estimates, while improved, remain more modest, and are projected at 101.0 mb/d in 2023 – an improvement of 0.5 mb/d as compared to the U.S. EIA’s Short-Term Energy Outlook (STEO) report from February 2023.

The OPEC reference basket price (calculated as a weighted average of prices of crude oil produced by OPEC countries) averaged $84.13 USD per barrel in April 2023, 3.1% higher than in January 2023, but 20.4% lower than a year ago.

2.1.2 Global Crude Oil Supply

Similar to the previous Fuel Update (February 2023, for publication on April 1st, 2023), the supply side has had a modest effect on energy markets as concerns over the health of the global economy have taken the limelight. Nevertheless, a few events have had a sizable impact on global oil prices, namely the surprise production cuts by the OPEC+ alliance as well as disruptions caused by wildfires in Canada.

On April 2nd, 2023, the OPEC+ alliance (a group of 23 oil-exporting countries producing about 40% of the global crude oil supply) announced further output cuts of around 1.16 million barrels per day (mb/d). Combined with the previous output cuts of 2.0 mb/d implemented in November 2022, as well as Russia’s 0.5 mb/d cuts in March 2023, the OPEC+ alliance’s total volume restriction stands at 3.66 mb/d, equal to about 3.7% of global demand. Nonetheless, not all OPEC+ members committed to new cuts (e.g. Russia has agreed to extend the previously established cuts of 0.5 mb/d), while other countries have already been pumping below the agreed levels due to a lack of production capacity, for example Nigeria and Angola. This latest output cut came as a surprise to the market, which was expecting that the previous level of production cuts would be maintained until the end of the year. As a result, this had the immediate impact of pushing the oil prices up following the announcement, as well as a few weeks after.

According to the International Energy Agency (IEA) data, Russian oil exports in March 2023 soared to the highest level since April 2020, returning to levels last seen before Russia invaded Ukraine. Russian oil shipments rose by 0.6 mb/d to 8.1 mb/d in March 2023. After Russia invaded Ukraine, European Union countries stopped importing all Russian oil transported by sea and countries such as the U.S. and the United Kingdom stopped buying it altogether. Russia is now exporting more crude to India and China, which did not join the Western sanctions against Moscow. Similarly, Russia has also been diverting its supplies to other nations like Brazil, Morocco, South Korea, and Singapore.

Additionally, widespread wildfires in Alberta have caused a significant disruption of oil supply. As of May 19th, a total of 93 wildfires were burning in the province with 26 of those being “out-of-control”. According to estimates, the equivalent of anywhere between 240,000 to 300,000 barrels of oil and gas production per day has been shut off due to the fires. This includes sites owned by Chevron, Paramount Resources, Crescent Point Energy, and Kiwetinohk Energy, where production has been halted and staff evacuated. Furthermore, according to the consultancy firm Rystad Energy, it is estimated that “nearly 2.7 mb/d of Alberta oil sands production in May is at risk in very high or extreme wildfire danger rating zones”. As a result, the wildfires are weighing on oil inventory levels at a critical hub in Edmonton. According to the industry data provider Ursa Space Systems, the oil inventory at this hub was at 18.1 million barrels as of May 13th, a significant reduction from 19.7 million barrels at the start of May 2023.

Other, less significant production interruptions have come from the reduced output in Iraq’s northern Kurdish region following the shutdown of the Iraq-Turkey export pipeline since end of March, as well as worker protests in Nigeria and maintenance-related production reductions in Brazil.

On the other hand, U.S. oil production is continuing to recover after the pandemic, with the latest EIA Short-Term Energy Outlook (STEO) report published by the U.S. Energy Information Administration (EIA) indicating steady growth. The estimates remain the same as three months ago – U.S. production is estimated to have averaged 11.9 mb/d last year and the forecast for this year stands at 12.5 mb/d.

As noted by the International Energy Agency (IEA), the oil market balance between demand and supply has been quite tight, with a potential for a substantial supply deficit in the second half of 2023. The IEA estimates that the additional cuts by OPEC+ will push world oil supply down, potentially causing a shortage in the market as demand continues to soar. For the year, according to the IEA estimates, the global oil production growth is expected to be 1.2 mb/d by non-OPEC+ countries, led by the U.S. and Brazil. Similarly, the OPEC reports that the non-OPEC 2023 supply is projected to grow by 1.4 mb/d. The U.S. EIA estimates that global crude oil production will reach 101.3 mb/d this year, an increase of 1.4% over the last year. It must be noted that, in general, although oil fundamentals point to declining inventories and generally tight supply, the market has been much more focused on the demand side of the equation. If the concerns materialize and the economy slows and the demand for oil subsequently falls, the low inventories and supply deficits will resolve on their own.

2.2 Gasoline Prices Across Canada

While the oil supply so far has been sufficient, the supply and inventories of gasoline and other products in the North American market have been getting low, declining since the beginning of March. This has been mostly driven by surging exports as well as a busier than usual refinery maintenance season. As reported by the U.S. EIA in May 2023, inventory draws in April left the U.S. gasoline inventories 3% below their five-year (2018–2022) minimum and contributed to rising retail gasoline prices.

As described in the Fuel Update from August 2022 (for publication on October 1st, 2022), due to high crack spreads (differences between the price of crude oil and the prices of refined products), leading to high profits last year, many companies delayed their planned refinery maintenance. As crack spreads have reduced, although still remaining above historic averages, refineries are catching up with the delayed closures, resulting in reduced product supplies. On the other hand, it is expected that by the end of the year the U.S. will be adding about 0.43 million barrels per day (mb/d) of new refining capacity, which should aid in easing the tightness in the gasoline market, thus allowing for prices to adjust downwards.

Recently, gasoline markets have witnessed a particular situation where, despite the deteriorating fundamental factors in global and local economies, the demand for gasoline for vehicles as well as jet fuel has remained strong, mostly due to the pent-up demand for travel after the pandemic. In addition, the switch to the more refined (thus more expensive) summer-grade gasoline has added support to higher gas prices. In consequence, prices for gasoline across Canada have been moderately increasing. The three-month average price increases ranged from 0.8% to 1.6% in the Eastern provinces, to 3.4% in Alberta and 6.2% in British Columbia. The territories have seen an increase of between 1.0% and 3.3%.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across Canada, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. The present Update calculated the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate Technologies Limited (previously Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the Annual Report, when determining average gasoline prices per Province or Territory, we have used weighted averages according to population in order to better conform to reality. In this manner, larger metropolitan centers account for a greater portion of the total average price compared to smaller municipalities.

The following is a table with average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, for the period March - May 2023:

|

Province/Territory |

Current fuel price |

April 1st, 2023 Fuel Update fuel price |

Price |

|

Alberta |

$1.353 | $1.309 | $0.044 |

|

British Columbia |

$1.825 | $1.719 | $0.106 |

|

Manitoba |

$1.578 | $1.539 | $0.039 |

|

New Brunswick |

$1.613 | $1.589 | $0.024 |

|

Newfoundland and Labrador |

$1.682 | $1.661 | $0.021 |

|

Northwest Territories |

$1.641 | $1.621 | $0.020 |

|

Nova Scotia |

$1.541 | $1.529 | $0.012 |

|

Nunavut |

$1.456 | $1.410 | $0.046 |

|

Ontario |

$1.502 | $1.471 | $0.031 |

|

Prince Edward Island |

$1.631 | $1.608 | $0.023 |

|

Quebec |

$1.623 | $1.597 | $0.026 |

|

Saskatchewan |

$1.550 | $1.473 | $0.077 |

|

Yukon |

$1.760 | $1.742 | $0.018 |

Fuel price data was extracted for a period of three months (February 13th to May 19th, 2023) in order to reflect current gasoline price trends. Subsequent reports will focus on three-month periods following the period covered in the present study. Average gasoline prices per litre and per Province or Territory were found to vary between $1.353 in Alberta to $1.825 in British Columbia, with a Canadian average of $1.568, an increase of 4.8 cents from the previous Fuel Update (February 2023 for publication on April 1st, 2023).

Gas prices in Nunavut are typically set for a full calendar year and rarely exhibit any changes throughout the year. However, the Government of Canada has announced that they are eliminating the Government of Nunavut carbon tax rebate for fuel, which resulted in an additional increase in the retail price for each fuel type. Thus, on April 1st, 2023, a new price update was issued to reflect this change, which brought the average price up by 4.6 cents for the current report. This, however, only had a slight effect on the Reimbursement Rates, and now gasoline prices in Nunavut are more in line with the rest of Canada.

For illustration purposes, Graph 1 displays gasoline prices for the larger metropolitan areas for a one-year period (May 2022 - May 2023).

Also for illustration purposes, Graph 2 displays crude oil prices for three benchmarks – WTI (West Texas Intermediate), Brent and WCS (Western Canada Select) for a one-year period (May 2022 - May 2023).

* Note that the crude oil prices vary depending on the trading location and the source of data. Graph data source: Kalibrate Technologies Limited (previously Kent Marketing).

2.3 Sales Taxes

For the current Update, research was performed to see if there were any relevant changes to Federal and Provincial sales taxes that could have an immediate impact on the Reimbursement Rates. As of the date of this Update, no changes were observed in sales taxes anywhere in Canada as compared to the previous Annual Report. Moreover, no changes are foreseen at this time for the immediate future.

3 Impact of Fuel Prices on Reimbursement Rates

3.1 Fuel Consumption

In calculating the fuel costs contribution to the total vehicle operating costs, the methodology employed in the Annual Report was strictly adhered to. Fuel consumption for every vehicle model in the study was thus combined with average prices per Province or Territory to determine the fuel portion of operating costs, based on an average of 20,000 kilometres per year.

3.2 Updated Reimbursement Rates

For comparison, the following table provides updated Travel and Commuting Rates, as well as rates previously calculated for the November 2022 Annual Report (for publication on January 1st, 2023) and the February 2023 Fuel Update (for publication on April 1st, 2023):

Current Fuel Update Reimbursement Schedule (in dollars per kilometre)

|

Travel Rate |

Commuting Rate |

|||||

|

Province/Territory |

Current Fuel Update |

April 1st, 2023 Fuel Update |

Jan 1st 2023 Annual Report |

Current Fuel Update |

April 1st, 2023 Fuel Update |

Jan 1st 2023 Annual Report |

|

Alberta |

$0.525 |

$0.520 |

$0.540 |

$0.215 |

$0.210 |

$0.230 |

|

British Columbia |

$0.550 |

$0.545 |

$0.565 |

$0.265 |

$0.255 |

$0.280 |

|

Manitoba |

$0.540 |

$0.540 |

$0.555 |

$0.240 |

$0.235 |

$0.255 |

|

New Brunswick |

$0.570 |

$0.570 |

$0.575 |

$0.245 |

$0.245 |

$0.250 |

|

Newfoundland and Labrador |

$0.585 |

$0.585 |

$0.595 |

$0.250 |

$0.250 |

$0.260 |

|

Northwest Territories |

$0.700 |

$0.700 |

$0.715 |

$0.325 |

$0.320 |

$0.340 |

|

Nova Scotia |

$0.570 |

$0.570 |

$0.580 |

$0.240 |

$0.240 |

$0.250 |

|

Nunavut |

$0.670 |

$0.665 |

$0.640 |

$0.300 |

$0.295 |

$0.270 |

|

Ontario |

$0.580 |

$0.580 |

$0.590 |

$0.235 |

$0.230 |

$0.240 |

|

Prince Edward Island |

$0.555 |

$0.550 |

$0.565 |

$0.245 |

$0.245 |

$0.255 |

|

Quebec |

$0.565 |

$0.565 |

$0.575 |

$0.255 |

$0.250 |

$0.260 |

|

Saskatchewan |

$0.525 |

$0.520 |

$0.530 |

$0.235 |

$0.230 |

$0.245 |

|

Yukon |

$0.695 |

$0.690 |

$0.710 |

$0.340 |

$0.335 |

$0.355 |

Note: All figures were rounded up to the nearest half-cent.

The impact of gasoline prices on the Reimbursement Rates was relatively minor for the present Fuel Update. In comparison with the February 2023 Fuel Update (for publication on April 1st, 2023), the Reimbursement Rates either stayed constant or increased by a maximum of 1.0 cent per kilometre for the Provinces. Similarly, for the Territories, the Rates have either remained constant or increased by a maximum of 0.5 cents per kilometre. Canadian weighted averages have stayed constant for the Travel Rate and increased by 0.5 cents for the Commuting Rate and are now at 56.0 cents per kilometre for the Travel Rate and 24.0 cents per kilometre for the Commuting Rate, respectively.

Fuel contributes on average 12.8 cents per kilometre to total operating costs, ranging from 11.1 cents in Alberta to 20.9 cents in the Yukon. The socio-economic factors affecting the global energy market are hard to forecast and it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the subsequent Fuel Update.