Reimbursement for Business Use of Personal Vehicles

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1 Fuel Price Update Synopsis

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the annual evaluation of per-kilometre Reimbursement Rates for government employees who are required to use their personal vehicles while performing government business. Furthermore, the periodic impact of varying fuel prices is to be evaluated quarterly by producing three additional Fuel Price Updates per year. The present document represents the Update for February 2024.

The latest annual study established Reimbursement Rates for each Canadian Province and Territory after performing a comprehensive analysis of all vehicle operating expenses. These rates were presented in the Reimbursement for Business Use of Personal Vehicles Report, dated November 2023 (for publication on January 1st, 2024).

The present Update reflects the impact of current fuel prices on the Travel and Commuting Rates’ recommendations made in the Annual Report with a focus on average pump prices of gasoline by Province and Territory. The prices were averaged for each Province or Territory for the three months prior to the release of the current Update (the months of December 2023, January 2024 and February 2024). All prices are given in dollars per litre.

This Update also presents the latest recommended rates of reimbursement for consideration by the Treasury Board Secretariat in dollars per kilometre. The recommendations for Reimbursement Rates are given for:

- Travel Rates (travellers authorized and reimbursed to use their personal vehicles on government business travel), also referred to as “Kilometric Rates” in the National Joint Council Travel Directive (Appendix B), and

- Commuting Rates (employees reimbursed their variable expenses to use their personal vehicles to commute to their designated remote worksites), also referred to as “Lower Kilometric Rates” in the National Joint Council Commuting Assistance Directive (Appendix A).

Federal and Provincial sales taxes were also researched to determine if there were any recent changes that could have had an immediate impact on the total costs of vehicle ownership and operation.

For the period December 2023 - February 2024, fuel expenses represent 20.7% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 11.7 cents per kilometre. The present Update identified moderate decreases in average gasoline prices across Canada, which had a slight downward impact on Reimbursement Rates everywhere except in Nunavut. As a result, the Reimbursement Rates for the ten Provinces decreased by a maximum of 2.0 cents relative to the previous Annual Report (November 2023, for publication on January 1st, 2024). For the Territories, while the rates for the Yukon and the Northwest Territories decreased in tandem with the Provinces, Nunavut saw an increase of 1.0 cent for the Travel Rate and 1.5 cents for the Commuting Rate (see Section 2.2 - Gasoline prices across Canada for details).

2 Fuel Prices

2.1 Energy Market Context

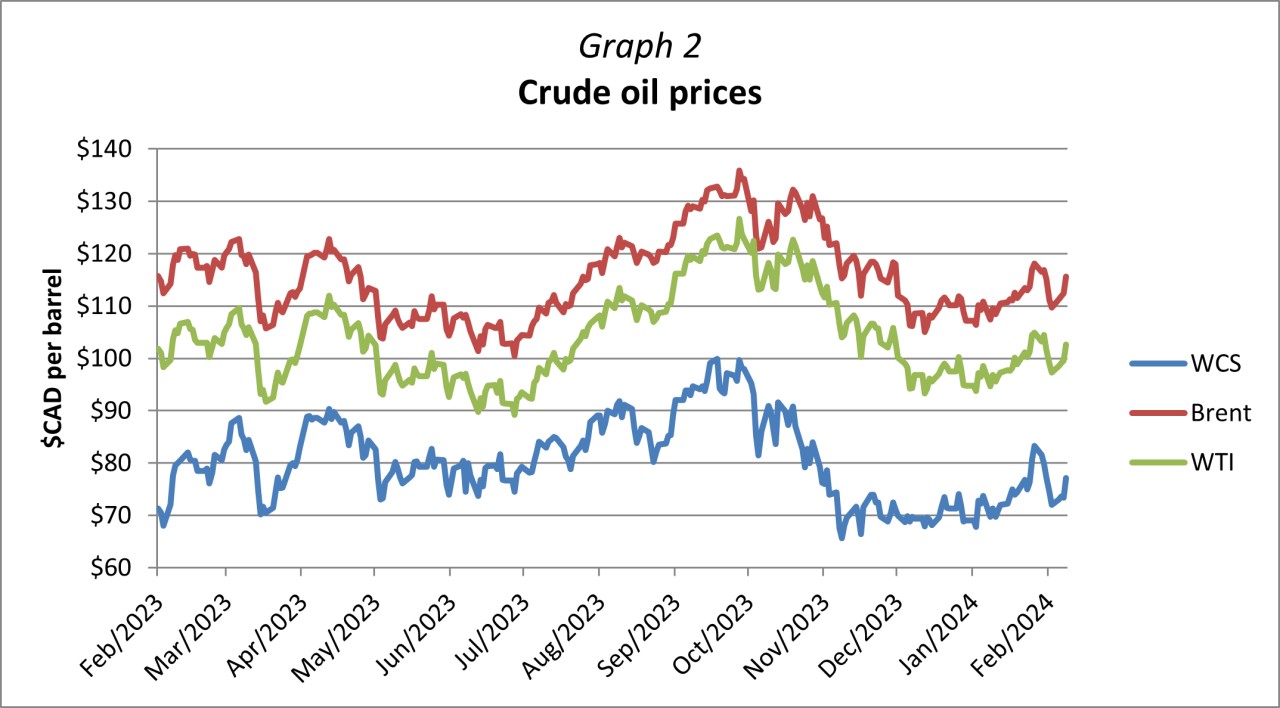

In the last three-month period, varied and often conflicting factors have been affecting the energy markets which resulted in considerable price volatility. After the crude oil rally in summer and early fall when prices approached $100 USD per barrel followed by a rapid decline, prices continued to recede in November and December. The period’s lowest price was recorded on December 11th, 2023, when the West Texas Intermediate (WTI) was just over $68 USD per barrel and the Brent was at $73 USD per barrel. Since then, prices have been volatile but generally on a slight upward trajectory. As of February 16th, 2024, the WTI stood at just over $79 USD per barrel and the Brent was at $83.5 USD per barrel.

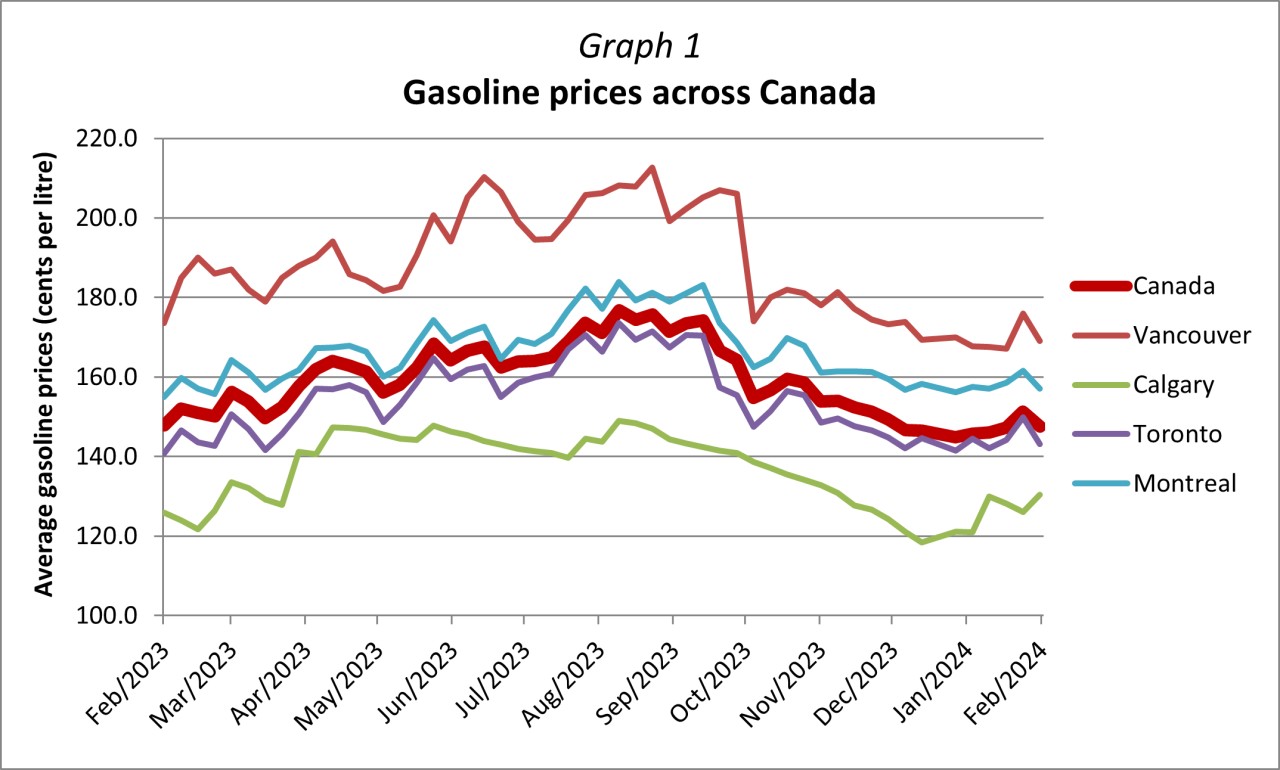

Gasoline prices followed crude oil, declining in November and December, followed by a slight increase since the beginning of the year. On average, the price of gasoline in Canada over the past three-month period was $1.488 per litre as compared to $1.646 per litre in the previous three-month period, a decrease of 9.6%. From a yearly perspective, the price has been 2.1% lower than last year, when it averaged $1.520 per litre.

2.1.1 Global Crude Oil Demand

According to the International Monetary Fund’s (IMF) latest Update of the World Economic Outlook (WEO) published in January 2024, the “global economic recovery from the COVID-19 pandemic, Russia’s invasion of Ukraine, and the cost-of-living crisis is proving surprisingly resilient”. Global inflation has been declining from its 2022 peak faster than expected, with a limited toll on employment activity. This indicates that the tightening carried out by central banks, combined with favourable supply-side developments, has been successful in keeping inflation expectations anchored. However, high-interest rates designed to help fight inflation combined with the withdrawal of fiscal support are expected to weigh on growth in 2024. As central banks have raised policy interest rates, credit availability has become significantly tighter, meaning high mortgage costs for consumers and challenges for firms refinancing their debt, resulting in weak business and residential investment.

Despite these challenges, the economic outlook has improved since the WEO was published in October 2023 and the IMF projects that the global economy will expand by 3.1% this year (the same rate as in 2023), 0.2 percentage points higher than previously projected. This was due to stronger economic resiliency in the United States (U.S.) and several large Emerging Markets and Developing Economies, including China. The IMF projects a similar growth rate in 2025, averaging 3.2%. Albeit stronger than previously expected, the growth rate remains below the recent historic average of 3.8% for the period between 2000 and 2019. Notably, for the first time in several years, the IMF analysis indicates that the risks to global growth are broadly balanced with roughly equal chances of better or worse economic results than the current projections.

The economic expansion in Advanced Economies is expected to decline from 1.6% in 2023 to 1.5% in 2024 before increasing to 1.8% in 2025. Similar to the previous report, the United States (U.S.) economy has been stronger than expected while the Euro Area has been presenting weaker-than-expected economic results. The second half of 2023 in the United States (U.S.) showed a strong economic performance, but the latest data is indicating some slowing down in 2024. According to the IMF estimates, U.S. economic expansion is to steadily decline from 2.5% last year to 2.1% this year and 1.7% in 2025, due to the lagged effects of tighter monetary policy (rising of the interest rates), gradual fiscal tightening and expected softening in labour markets. Similarly, Goldman Sachs Investment Research (GIR) revised their first-quarter expectations downwards on account of U.S. industrial production, as well as retail sales, falling below expectations in January 2024. While industrial production witnessed a marginal decline of 0.1%, manufacturing production experienced a sharper contraction of 0.5%.

The Euro Area has seen a notably subdued growth rate, estimated at 0.5% in 2023, reflecting the relatively high exposure to the war in Ukraine, lingering effects of high energy prices, and weak consumer sentiment. The IMF expects that household consumption will recover as the effects of the high energy prices subside and inflation falls, thus supporting real income growth. As a result, the growth is projected to gradually increase to 0.9% this year and 1.7% in 2025.

The outlook for the Canadian economy has seen some downward adjustments and projections for future growth remain mixed. On one hand, the IMF estimates that the growth of Canada’s gross domestic product (GDP) was 1.1% in 2023 and is projected to increase to 1.4% in 2024, with both figures seeing a downward revision of 0.2 percentage points from the previous WEO report published in October 2023. The projection for 2025 stands at 2.3%. On the other hand, the Bank of Canada estimates that the growth was 1.0% in 2023, with 2024 seeing a further slowdown with a growth rate of 0.8%, before a significant recovery of 2.4% in 2025. As reported by the Bank, the Canadian economy largely stalled in the second half of 2023 and has continued to remain close to zero in the first quarter of 2024. This has been mainly due to past increases in interest rates that continue to weigh on household spending and business investment along with slowing foreign demand that has restrained exports. The Consumer Price Index (CPI) inflation continued to decline, reaching 3.3% in the last quarter of 2023. However, the Bank also noted that inflation remains above the target of 2%, with particularly significant strength in housing and food prices.

The growth in Emerging Markets and Developing Economies, as reported by the IMF, has seen some improvement and is now anticipated to be 4.1% in 2024 and 4.2% in 2025. The slight upward adjustment of 0.1 percentage points for both years reflects the enhanced outlook regarding the Chinese economy thanks to the easing of their monetary policy and a pledge by China’s central bank to provide sufficient liquidity to facilitate government bond issuance to support economic recovery in the country. The world’s fifth-largest economy, India, remains strong and is projected to grow by 6.5% in 2024 as well as in 2025. In addition, Russia’s GDP growth projection saw a noteworthy upward adjustment of 1.5 percentage points for 2024 and is now estimated at 2.6%, due to carryover from stronger-than-expected growth in 2023 on account of high military spending as well as private consumption.

Although economic growth has seen adjustments in both directions, demand for crude oil has reached record levels. The average oil demand globally exceeded 100 million barrels per day (mb/d) for the first time in 2023. Oil and Petroleum Exporting Countries (OPEC) estimate that demand averaged 102.2 mb/d, while the U.S. Energy Information Administration’s (EIA) estimate is more conservative at 101.0 mb/d. Looking forward, the demand projections by OPEC stand at 104.4 mb/d for this year, an increase of 2.2% over last year. The U.S. EIA projects a 1.4% increase to 102.4 mb/d in 2024.

2.1.2 Global Crude Oil Supply

On the supply side, contradicting factors have been affecting the market. As these factors ebb and flow, energy prices have followed suit. On one hand, further production cuts by the OPEC+ coalition, the continued geopolitical unease in the Middle East and the resulting conflict in the Red Sea that severely affected transportation channels, alongside severe winter storms in North America applied upward pressure on oil prices. On the other hand, rising production in the U.S. as well as Canada and other countries have been applying opposite forces to the global crude prices, pushing them downward.

Actions by the OPEC+ coalition remain an important driving force for the developments in the crude oil market. In the Fall of 2023, the OPEC+ coalition’s output totalled about 43.0 mb/d, reflecting production cuts of about 5.0 mb/d as compared to their combined capacity. In late November, seven OPEC countries, including Saudi Arabia announced additional voluntary production cuts of approximately 0.9 mb/d for the first quarter of 2024 as Saudi Arabia and Russia extended their previous 1.3 mb/d cuts through the same time period. In addition, Brazil made an announcement to join the coalition in a non-binding move starting in January 2024. It has been reported, however, that OPEC+ coalition compliance with the production cuts has not been uniform, with some member states (e.g. Iraq and the United Arab Emirates) exceeding their production quotas and countering the effects of the ongoing cuts by Saudi Arabia and other OPEC+ members aimed at supporting the oil market.

Geopolitical conflicts also continued to cast uncertainty in the energy markets. Ukraine launched drone attacks on oil refineries in southern Russia resulting in supply disruptions and refinery fires. In the Middle East, ceasefire negotiations between Israel and Hamas have been unsuccessful and have led to an expansion of the conflict into the Red Sea, which is a significant global energy transportation channel. The Suez Canal which connects the Red Sea and the Mediterranean is used by roughly one-third of global seaborne oil cargo. The Iran-aligned Houthi group had been attacking international oil tankers since the beginning of the escalation in Gaza. In December, the United States began a multinational operation aimed at safeguarding commerce in the Red Sea with the U.S. and U.K. launching airstrikes on Houthi targets in Yemen. Despite their attempts, the attacks on ships have continued and many shipping companies continue to divert vessels around Africa due to ongoing risks. Redirecting ships around the southern tip of Africa is estimated to add 10-14 days and cost up to $1 million USD extra in fuel for every round trip between Asia and Northern Europe. Trade disruptions like these directly increase costs as well as raise uncertainty, which also adds a premium to global oil prices.

Global crude oil markets have been largely in balance, with demand equaling supply. However, based on current projections, oversupply is possible in the near future, which could lead to a decline in oil prices. The U.S. Energy Information Administration’s (EIA) projection for 2024 stands at 102.4 mb/d for demand and 102.3 mb/d for supply, meaning that supply is slightly lagging behind demand. However, in 2025, supply is expected to increase more rapidly than demand, resulting in a possible oversupply of 0.5 mb/d. The International Energy Agency’s (IEA) projections are similar, albeit more bullish, with supply already expected to outpace demand this year. The world oil supply is forecast to increase by 1.5 mb/d to a new high of 103.5 mb/d in 2024, fuelled by the record-setting output from the U.S., Brazil, Guyana and Canada. OPEC+ supply is expected to broadly hold steady.

United States (U.S.) oil production, as reported by the Energy Information Administration (EIA) in the Short-term Economic Outlook (STEO) published in February 2024, reached an all-time high in December 2023 of more than 13.3 mb/d, coinciding with the Red Sea shipping issues, providing balancing effects to crude prices. The production receded to 12.6 mb/d in January due to the shut-ins related to cold weather. For the year, the U.S. crude oil production averaged 12.9 mb/d in 2023 and is projected to grow to 13.1 mb/d in 2024 and 13.5 mb/d in 2025.

Similarly, Canada is on track to significantly increase its crude oil production by as much as 10% from 4.8 mb/d to about 5.3 mb/d by the end of 2024. However, this increase is largely dependent on the opening of the Trans Mountain pipeline expansion, which should triple the transport capacity from Alberta to the Pacific Coast to nearly 0.9 mb/d. Uncertainty as to the exact opening date of the pipeline has increased due to the project facing prolonged technical issues, resulting in delays.

Severe winter weather in North America affected both the oil production as well as refining activity in January. According to the research company IIR Energy, it was estimated that about 1.5 mb/d of the U.S. refining capacity was offline in mid-January 2024, including many refineries on the Gulf Coast. In addition, the largest refinery in the Midwest located in Whiting, Indiana had an unplanned outage on February 1st, 2024. The refinery, with a capacity of 0.4 mb/d, remained offline for over two weeks providing further tightness in the gasoline market. These events reduced the industry's ability to meet demand both domestically as well as internationally and led to price increases at the pump in late January, which continued well into February.

2.2 Gasoline Prices Across Canada

Thanks to declining crude oil prices as well as the switch to the less expensive winter-grade fuel, the average gas prices at the pump over the last three-month period declined across Canada, with the only exception being Nunavut, where a government-established price review resulted in the average price for gasoline to increase by 7%. Gasoline prices in the rest of Canada declined from 4% in Northwest Territories to as much as 18% in Manitoba. All other provinces, as well as the Yukon, saw price declines in the range of 8% to 13%.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across Canada, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. The present Update calculated the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate (previously Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the Annual Report, when determining average gasoline prices per Province or Territory, we have used weighted averages according to population in order to better conform to reality. In this manner, metropolitan population centers account for a greater portion of the total average price compared to smaller towns.

The following is a table with average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, for the period December 2023 - February 2024:

|

Province/Territory |

Current fuel price |

January 1st, 2024, Annual Report fuel price |

Price difference |

|

Alberta |

$1.250 |

$1.405 |

-$0.155 |

|

British Columbia |

$1.688 |

$1.902 |

-$0.214 |

|

Manitoba |

$1.317 |

$1.597 |

-$0.280 |

|

New Brunswick |

$1.561 |

$1.754 |

-$0.193 |

|

Newfoundland and Labrador |

$1.643 |

$1.817 |

-$0.174 |

|

Northwest Territories |

$1.617 |

$1.678 |

-$0.061 |

|

Nova Scotia |

$1.568 |

$1.746 |

-$0.178 |

|

Nunavut |

$1.636 |

$1.535 |

$0.101 |

|

Ontario |

$1.448 |

$1.590 |

-$0.142 |

|

Prince Edward Island |

$1.587 |

$1.750 |

-$0.163 |

|

Quebec |

$1.591 |

$1.726 |

-$0.135 |

|

Saskatchewan |

$1.361 |

$1.560 |

-$0.199 |

|

Yukon |

$1.773 |

$1.924 |

-$0.151 |

Fuel price data was extracted for a period of three months (November 13th, 2023, to February 9th, 2024) in order to reflect current gasoline price trends. Subsequent reports will focus on three-month periods following the period covered in the present study. Average gasoline prices per litre and per Province or Territory were found to vary between $1.250 in Alberta to $1.773 in the Yukon, with a Canadian average of $1.488, a decrease of 15.8 cents from the previous Annual Report (November 2023, for publication on January 1st, 2024).

Gas prices in Nunavut used to be set for a full calendar year and rarely exhibit any significant changes. However, after maintaining average gas prices at around $1.20 per litre in 2022, the Government of Nunavut started price increases at the end of the year, implementing a 20 cents per litre hike, effective December 4th, 2022. This increase was followed by subsequent increases on April 1st, 2023, October 1st, 2023, and the latest on January 4th, 2024. Nunavut is thus gradually bringing its gasoline prices more in line with the rest of Canada, while also accounting for the updates of the federally-imposed carbon tax and recovering the cost of purchasing and resupplying of fuel for the upcoming year. This effectively increases the average gas in Nunavut prices by 7%, in contrast with the rest of Canada, which saw decreases between 4% and 18% as compared to the previous Annual Report (November 2023, for publication on January 1st, 2024).

For illustration purposes, Graph 1 displays gasoline prices for the main metropolitan areas for a one-year period (February 2023 - February 2024).

Also for illustration purposes, Graph 2 displays crude oil prices for three benchmarks – WTI (West Texas Intermediate), Brent and WCS (Western Canadian Select) for a one-year period (February 2023 - February 2024).

2.3 Sales Taxes

For the current Update, research was performed to see if there were any relevant changes to Federal and Provincial sales taxes that could have an immediate impact on the Reimbursement Rates. As of the date of this Update, no changes were observed in sales taxes anywhere in Canada as compared to the previous Annual Report. Moreover, no changes are foreseen at this time for the immediate future.

3 Impact of Fuel Prices on Reimbursement Rates

3.1 Fuel Consumption

In calculating the fuel costs contribution to the total vehicle operating costs, the methodology employed in the Annual Report was strictly adhered to. Fuel consumption for every vehicle model in the study was thus combined with average prices per Province or Territory to determine the fuel portion of operating costs, based on an average of 20,000 kilometres per year.

3.2 Updated Reimbursement Rates

For comparison, the following table provides updated Travel (Kilometric) and Commuting (Lower Kilometric) Rates, as well as rates previously calculated for the Annual Report (November 2023, for publication on January 1st, 2024):

Current Reimbursement Schedule (in dollars per kilometre)

|

Travel Rate |

Commuting Rate |

|||

|

Province/Territory |

Current Fuel Update |

Jan 1st 2024 Annual Report |

Current Fuel Update |

Jan 1st 2024 Annual Report |

|

Alberta |

$0.525 |

$0.535 |

$0.210 |

$0.220 |

|

British Columbia |

$0.565 |

$0.580 |

$0.255 |

$0.275 |

|

Manitoba |

$0.540 |

$0.560 |

$0.220 |

$0.240 |

|

New Brunswick |

$0.575 |

$0.590 |

$0.240 |

$0.260 |

|

Newfoundland and Labrador |

$0.595 |

$0.605 |

$0.250 |

$0.265 |

|

Northwest Territories |

$0.700 |

$0.705 |

$0.320 |

$0.330 |

|

Nova Scotia |

$0.580 |

$0.595 |

$0.245 |

$0.255 |

|

Nunavut |

$0.690 |

$0.680 |

$0.325 |

$0.310 |

|

Ontario |

$0.590 |

$0.605 |

$0.230 |

$0.245 |

|

Prince Edward Island |

$0.565 |

$0.575 |

$0.245 |

$0.255 |

|

Quebec |

$0.570 |

$0.580 |

$0.255 |

$0.265 |

|

Saskatchewan |

$0.535 |

$0.550 |

$0.225 |

$0.240 |

|

Yukon |

$0.700 |

$0.720 |

$0.340 |

$0.355 |

Note: All figures were rounded up to the nearest half-cent.

The impact of gasoline prices on the Reimbursement Rates was moderate for the present Fuel Update. In comparison with the Annual Report (November 2023, for publication on January 1st, 2024), the Travel (Kilometric) and Commuting (Lower Kilometric) Rates have decreased between 1.0 cent to 2.0 cents per kilometre for the Provinces. For the Territories, the Reimbursement Rates varied between a decrease of 2.0 cents per kilometre for the Travel Rate in the Yukon, to an increase of 1.5 cents for the Commuting Rate in Nunavut.

Overall, Canadian weighted averages decreased by 1.0 cent per kilometre for the Travel Rate and by 1.5 cents for the Commuting Rate, compared to the last Annual Report (November 2023, for publication on January 1st, 2024). They are now at 57.0 cents per kilometre and 23.5 cents per kilometre, respectively.

Fuel contributes on average 11.7 cents per kilometre to total operating costs, ranging from 9.9 cents in Alberta, to 20.4 cents in the Yukon. Given the complexity of socio-economic factors affecting the global energy market, it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the next Fuel Update.