Reimbursement for Business Use of Personal Vehicles

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1 Fuel Price Update Synopsis

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the annual evaluation of per-kilometre Reimbursement Rates for government employees who are required to use their personal vehicles while performing government business. Furthermore, the periodic impact of varying fuel prices is to be evaluated quarterly by producing three additional Fuel Price Updates per year. The present document represents the Update for May 2024 (for publication on July 1st, 2024).

The latest annual study established Reimbursement Rates for each Canadian Province and Territory after performing a comprehensive analysis of all vehicle operating expenses. These rates were presented in the Reimbursement for Business Use of Personal Vehicles Report, dated November 2023 (for publication on January 1st, 2024). A subsequent Fuel Update was produced for February 2024 (for publication on April 1st, 2024).

The present Update reflects the impact of current fuel prices on the Travel and Commuting Rates’ recommendations made in the Annual Report with a focus on average pump prices of gasoline by Province and Territory. The prices were averaged for each Province or Territory for the three months prior to the release of the current Update (the months of March, April and May 2024). All prices are given in dollars per litre.

This Update also presents the latest recommended rates of reimbursement for consideration by the Treasury Board Secretariat in dollars per kilometre. The recommendations for Reimbursement Rates are given for:

- Travel Rates (travellers authorized and reimbursed to use their personal vehicles on government business travel), also referred to as “Kilometric Rates” in the National Joint Council Travel Directive (Appendix B), and

- Commuting Rates (employees reimbursed their variable expenses to use their personal vehicles to commute to their designated remote worksites), also referred to as “Lower Kilometric Rates” in the National Joint Council Commuting Assistance Directive (Appendix A).

Federal and Provincial sales taxes were also researched to determine if there were any recent changes that could have had an immediate impact on the total costs of vehicle ownership and operation.

For the period March - May 2024, fuel expenses represent 22.5% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 13.0 cents per kilometre. The present Update identified moderate increases in average gasoline prices across Canada, which had a slight upward impact on Reimbursement Rates everywhere except in the Northwest Territories and, for the Commuting Rate, also in Manitoba, where they remained constant. As a result, the Reimbursement Rates for the ten Provinces increased by a maximum of 2.0 cents relative to the previous Fuel Update (February 2024, for publication on April 1st, 2024). For the Territories, while the rates for the Yukon and Nunavut also increased slightly, the rates for the Northwest Territories remained constant (see Section 2.2 - Gasoline prices across Canada for details).

2 Fuel Prices

2.1 Energy Market Context

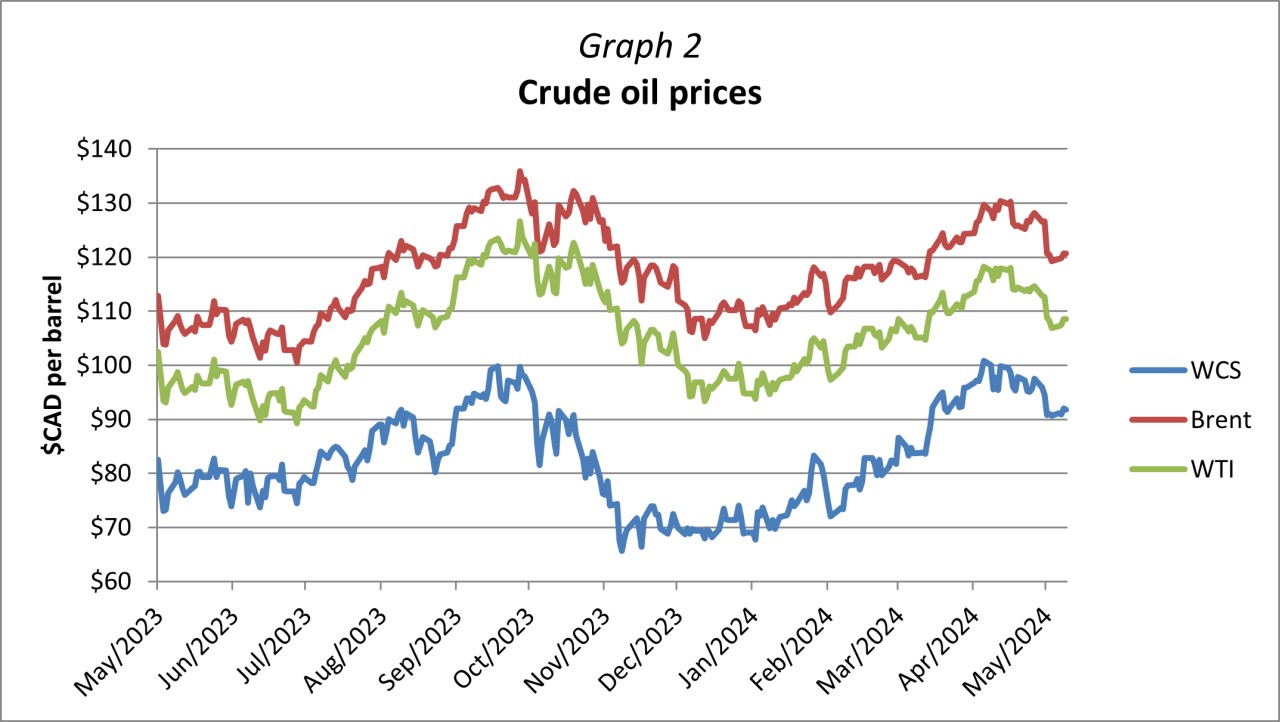

Global crude oil prices rallied in the first part of the year driven by a tight supply and continued geopolitical instabilities, finishing the quarter with an increase of approximately 16% from the beginning of the year. The three-month highest price was recorded on April 5th, 2024, when West Texas Intermediate (WTI) closed at $86.9 USD per barrel and Brent stood at $91.2 USD per barrel. Prices eased in April and May on the account of steadily high interest rates and concerns over the health of the global economy. As of May 17th, 2024, WTI stood at just over $80.0 USD per barrel and Brent was at nearly $84.0 USD per barrel.

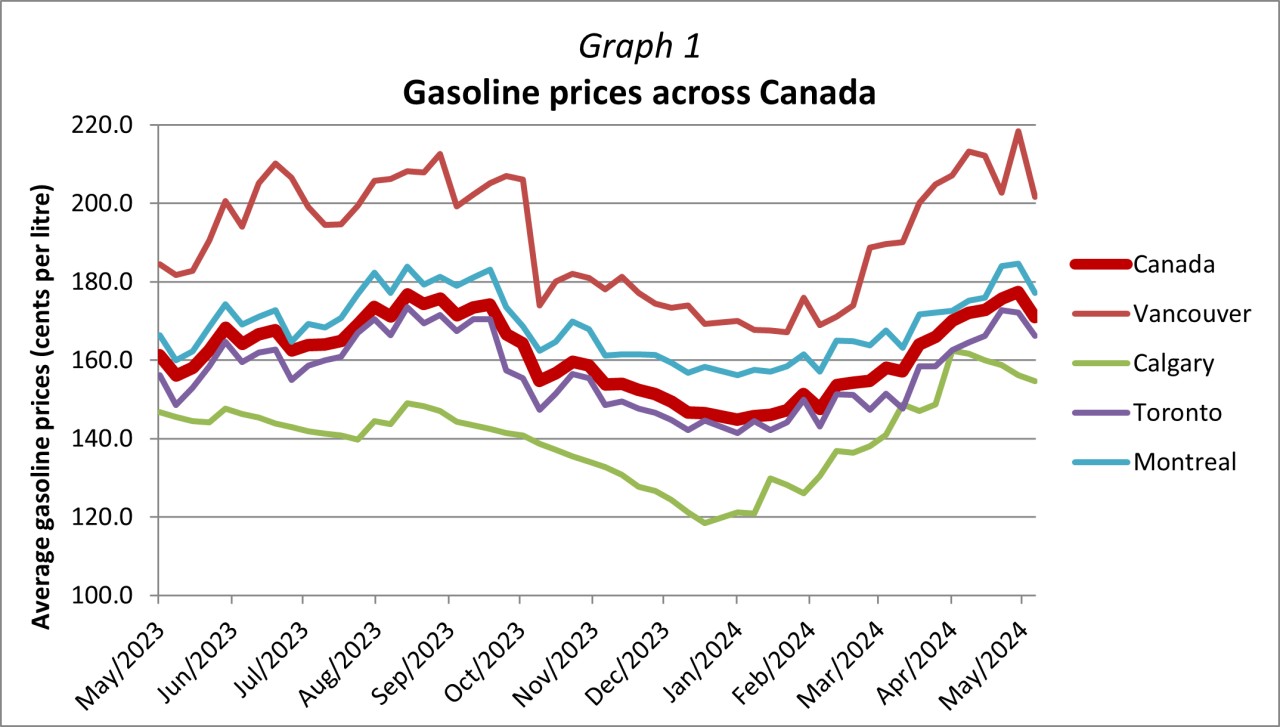

Gasoline prices followed crude oil quite closely with a delay of about two weeks. The daily average price for gasoline in Canada peaked on April 18th, 2024, at $1.806, an increase of 15.0% above the late February price of $1.571. On average, the price of gasoline in Canada over the past three-month period was $1.657 per litre as compared to $1.488 per litre in the previous three-month period, an increase of 11.4%. From a yearly perspective, the price was 5.7% higher than last year, when it averaged $1.568 per litre.

2.1.1 Global Crude Oil Demand

According to the International Monetary Fund’s (IMF) World Economic Outlook (WEO) published in April 2024, the global economy remains remarkably resilient, and the overall economic outlook has continued to improve. The IMF projects that the global economy will expand by 3.2% in 2024 as well as in 2025, at the same rate as in 2023. The prospects of easing of the tight monetary policy have been providing strong support to the market leading to equity market valuations soaring and capital flows improving, particularly in many of the emerging market economies. Nevertheless, the pace of economic growth remains below the historical average due a number of factors, including the high borrowing costs and withdrawal of fiscal support that followed the pandemic, as well as the effects of the pandemic itself and the ongoing war in Ukraine.

The outlook of the economic expansion in Advanced Economies has improved by 0.3 basis points, mainly driven by a significant 0.6 basis points increase in the United States and a moderate 0.1 to 0.4 basis points downward adjustment in other countries like Germany, France and Italy. The IMF estimates the Advanced Economies as a group will grow by 1.9% this year and by 1.7% the next year.

The resiliency of the United States (U.S.) market has been noteworthy. The country has already exceeded its pre-pandemic growth trend. In addition to continuously strong factors, including consumer spending and the labour market, manufacturing has picked up after an extended slump that began in mid-2022. This uptick in manufacturing is signalling a positive outlook for petroleum consumption in the upcoming months. While the strength of the U.S. economy is a major driver for global growth it also implies a strong demand that has been supporting sustained inflation. As a result, the U.S. Federal Reserve has been keeping the interest rates steady, somewhat moderating the positive market sentiments. In May, however, an expectation of a rate decrease in the near future, drove the equity markets up with the Dow Jones Industrial Average surpassing the 40,000 mark for the first time in history, indicating growing optimism in the market.

In the Euro Zone, the growth rate has improved to 0.8% after a moderate 0.4% last year. The delayed effects of tight monetary policy as well as past energy costs weigh in heavily on the future outlook. High wage growth and services inflation could lead to an extended period of inflation levels above current targets. Nevertheless, the IMF notes there is evidence that the European market might be overheating as companies have been holding onto labour in anticipation of a return in demand that might not materialize.

According to the Bank of Canada, the outlook for the Canadian economy has seen some significant improvements as compared to the Monetary Policy Report (MPR) from January 2024. The Bank now projects that the Canadian economy will grow by 1.5% this year, nearly twice as much as the 0.8% projection from three months prior. This adjustment reflects the increased supply of workers through strong population growth, as well as a recovery in household spending supported by wage growth. For comparison, the IMF estimates that Canada’s economic expansion will stand at 1.8% in 2024 and 2.3% in 2025. The Consumer Price Index (CPI) inflation was 2.8% in February and the high prices of gasoline this spring are expected to keep the CPI inflation close to 3.0% well into the second quarter of 2024. The Bank projects that inflation will fall below 2.5% by the end of the year and should reach the Bank’s target of 2.0% in 2025.

The growth in Emerging Markets and Developing Economies, as reported by the IMF, has seen no change and remains at 4.3% in 2024 and 4.1% in 2025. The Chinese economy has seen a fluctuating outlook that presently appears to be pointing downwards. The IMF estimates that China will grow their economy by 4.6% this year, a significant decline from a 5.2% growth rate last year. The downturn in the real estate sector remains persistent and is not expected to see a quick recovery until extensive reforms address the root cause. At the same time, internal demand remains depressed and trade tensions between the U.S. and China are expected to apply downward pressure on China’s economic development, thus having a negative ripple effect on its trading partners.

Inflation remains one of the most significant risks to the global economy. While global inflation has been declining, in large part thanks to the decrease in energy prices, the IMF points to a recent increase in headline and core inflation. Whether those effects will be short-lived remains to be seen. Overall, the inflation of goods has been stabilizing while prices for services remain significantly elevated supported by an overall strength in the job market.

While the present economic outlook appears to be solid, the effects on the demand for oil are unclear, with forecasts varying significantly, largely due to the changing expectations regarding future interest rate reductions. According to the Monthly Oil Market Report from May 2024, OPEC remains optimistic, expecting a 2.3 million barrels per day (mb/d) growth in global demand for crude oil this year, averaging 104.5 mb/d. At the same time, the International Energy Agency (IEA) in its Monthly Oil Report from May 2024 has revised its forecast downwards to an increase of 1.1 mb/d in 2024, citing lower-than-expected crude consumption in OECD countries, as well as a slump in global factory activity.

2.1.2 Global Crude Oil Supply

Reaching a balance between demand and supply in the crude oil markets is a complex and ongoing process. The year begun with expectations of a possible oversupply, however as of May 2024, the International Energy Agency’s (IEA) projections indicate a likely supply shortage later in the year driven by the OPEC+ production cut extensions, which could result in rising oil prices. The IEA projects that the OPEC+ production will fall by 0.8 million barrels per day (mb/d) while the non-OPEC+ output, including from the U.S. and Canada, will rise by 1.4 mb/d this year.

The U.S. Energy Information Administration’s (EIA) projection for 2024, albeit adjusted upward, remains balanced, with demand at 102.8 mb/d (up from 102.4 mb/d three months prior) and matched by supply at 102.8 mb/d (up from 102.3 mb/d in the February 2024 report). This is an increase of 1.0 mb/d in supply over last year’s average of 101.8 mb/d. Similar to the demand, the IEA forecast for supply has seen a significant downward adjustment, now being in line with the EIA’s projection. The IEA projects that global oil supply will increase by 0.6 mb/d this year to 102.7 mb/d, a record production value but a significant reduction of 0.8 mb/d as compared to the IEA report from three months prior. The IEA projects that the non-OPEC+ output will rise by 1.4 mb/d, while OPEC+ production will fall by 0.8 mb/d, assuming that voluntary cuts are maintained.

Geopolitics continue to play an important role in crude markets. On the one hand, the ongoing war in Ukraine and drone attacks by Ukraine on Russian refineries heightened concerns about supply shortages in March, leading to an increase in both fuel and crude oil prices. The continued instability in the Middle East has been adding a risk premium to oil prices, pushing them upwards.

Crude oil inventories were quite low in the winter months, standing in March at approximately 1.0% under the five-year average for this period, adding to the tightness in the market and pushing prices up. However, between mid-March and the end of April, crude oil inventories rose steadily, contributing to a downward price trend in spring.

Actions by the OPEC+ coalition remain an important driving force for the developments in the oil market. The OPEC+ has been extending the existing production cuts continuing to provide support to the market prices as the demand for oil fluctuates.

The U.S. is shaping up to be a critical player in the oil market as it establishes its pivotal role as the world’s marginal supplier. Recent data suggests that the sharp decline in oil production due to winter storms in January coincided with the oil price rally in the first quarter of the year. Alaska’s oil production and the strategic capacity of the Trans-Alaska Pipeline System have come into focus recently, with expectations of increased output contributing to the overall market dynamics. The state is currently channeling approximately 0.5 mb/d of oil through their pipeline system which has a capacity of more than 2.0 mb/d. Recently, the state of Alaska announced intentions to increase oil production by an additional 0.2 ‑ 0.3 mb/d, carving out another avenue where the U.S. is likely to expand its production. As reported by the U.S. Energy Information Administration (EIA) in the Short-term Economic Outlook (STEO) published in May 2024, the overall U.S. crude oil production is projected to average 13.2 mb/d in 2024 and 13.7 mb/d in 2025, revised up by 0.1 and 0.2 mb/d respectively as compared to the EIA report from February 2024.

A significant milestone was reached in the Canadian oil industry in May 2024. After numerous delays, the Trans Mountain Pipeline began its operations. The 980 kilometres of pipeline parallel to the original pipeline is nearly tripling the transportation capacity from 0.3 mb/d to close to 0.9 mb/d. As a result, Canada’s ability to export crude oil to international markets, particularly to Asia and the U.S., is increasing significantly. Previously, the transportation infrastructure was not keeping up with the pace of increasing production volumes. This resulted in transportation bottlenecks which led to Canadian crude being sold at significantly discounted rates. The opening of the Trans Mountain Pipeline is expected to resolve this issue, generating higher revenues and leading to increased tax and royalty incomes for the federal and provincial governments. This important update to the transportation infrastructure is also expected to aid Canada’s oilsands industry’s output to grow by 0.5 mb/d in the next five years. The spread between West Texas Intermediate (WTI) and Western Canadian Select (WCS), Canada’s crude oil benchmark, has already been narrowing from about $30 per barrel in the fall of 2023 to the $16-$20 range in April and May 2024.

2.2 Gasoline Prices Across Canada

The market for gasoline in Canada is tightly linked to the U.S. market as the two countries largely share their infrastructure. As reported by the U.S. Energy Information Administration, the weekly demand for gasoline in mid-April averaged 8.4 million barrels per day (mb/d), the lowest weekly average level since 2014. In a four-week perspective, the supply of gasoline in the U.S. averaged 8.6 mb/d, a decrease of 3.6% from the same period last year, reaching levels not seen since the onset of the COVID‑19 lockdowns. Such weak demand has led to the easing of gasoline prices at the pump.

There was a tightness in the supply of gasoline on the West Coast in March, resulting in a significant drop in inventories (by as much as 1 million barrels). In addition, the Parkland Refinery in Burnaby, British Columbia, had reduced operations for 13 weeks from January through the end of March. Moreover, several other refineries on the West Coast had commenced scheduled maintenance work at that time, thus adding additional pressure on gas prices and resulting in a price surge in the Western provinces. As a consequence, the three-month average price for gasoline increased the most in Alberta and British Columbia, where the average price rose by 18.5% and 14.8% respectively. Prices across the rest of Canada increased between 2.4% in the Yukon and 11.3% in Saskatchewan. A slight decline of 1.3% was recorded in the Northwest Territories. Overall, the average gasoline price across Canada increased by 11.4% as compared to the previous three-month period.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across Canada, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. The present Update calculated the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate (previously Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the Annual Report, when determining average gasoline prices per Province or Territory, we have used weighted averages according to population in order to better conform to reality. In this manner, metropolitan population centers account for a greater portion of the total average price compared to smaller towns.

The following is a table with average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, for the period March - May 2024:

|

Province/Territory |

Current fuel price |

April 1st, 2024, Fuel Update Report fuel price |

Price difference |

|

Alberta |

$1.481 |

$1.250 |

$0.231 |

|

British Columbia |

$1.938 |

$1.688 |

$0.250 |

|

Manitoba |

$1.366 |

$1.317 |

$0.049 |

|

New Brunswick |

$1.698 |

$1.561 |

$0.137 |

|

Newfoundland and Labrador |

$1.805 |

$1.643 |

$0.162 |

|

Northwest Territories |

$1.596 |

$1.617 |

-$0.021 |

|

Nova Scotia |

$1.712 |

$1.568 |

$0.144 |

|

Nunavut |

$1.740 |

$1.636 |

$0.104 |

|

Ontario |

$1.593 |

$1.448 |

$0.145 |

|

Prince Edward Island |

$1.701 |

$1.587 |

$0.114 |

|

Quebec |

$1.712 |

$1.591 |

$0.121 |

|

Saskatchewan |

$1.515 |

$1.361 |

$0.154 |

|

Yukon |

$1.815 |

$1.773 |

$0.042 |

Fuel price data was extracted for a period of three months (February 12th to May 10th, 2024) in order to reflect current gasoline price trends. Subsequent reports will focus on three-month periods following the period covered in the present study. Average gasoline prices per litre and per Province or Territory were found to vary between $1.366 in Manitoba to $1.938 in British Columbia, with a Canadian average of $1.657, an increase of 16.9 cents from the previous Fuel Update (February 2024, for publication on April 1st, 2024).

After years of setting its own discounted gasoline prices, Nunavut started to gradually bring its gasoline prices in line with the rest of Canada at the end of 2022, while also accounting for the updates of the federally-imposed carbon tax and recovering the cost of purchasing and resupplying of fuel for the upcoming year. The Government of Nunavut published its latest price update on April 1st, 2024, which marked an increase in gasoline prices of 3.3 cents for all locations except Iqaluit.

For illustration purposes, Graph 1 displays gasoline prices for the main metropolitan areas for a one-year period (May 2023 - May 2024).

Also for illustration purposes, Graph 2 displays crude oil prices for three benchmarks – WTI (West Texas Intermediate), Brent and WCS (Western Canadian Select) for a one-year period (May 2023 - May 2024).

2.3 Sales Taxes

For the current Update, research was performed to see if there were any relevant changes to Federal and Provincial sales taxes that could have an immediate impact on the Reimbursement Rates. As of the date of this Update, no changes were observed in sales taxes anywhere in Canada as compared to the previous Fuel Update. Moreover, no changes are foreseen at this time for the immediate future.

3 Impact of Fuel Prices on Reimbursement Rates

3.1 Fuel Consumption

In calculating the fuel costs contribution to the total vehicle operating costs, the methodology employed in the Annual Report was strictly adhered to. Fuel consumption for every vehicle model in the study was thus combined with average prices per Province or Territory to determine the fuel portion of operating costs, based on an average of 20,000 kilometres per year.

3.2 Updated Reimbursement Rates

For comparison, the following table provides updated Travel (Kilometric) and Commuting (Lower Kilometric) Rates, as well as rates previously calculated for the Annual Report (November 2023, for publication on January 1st, 2024) and the February 2024 Fuel Update (for publication on April 1st, 2024):

Current Reimbursement Schedule (in dollars per kilometre)

|

Travel Rate |

Commuting Rate |

|||||

|

Province/Territory |

Current Fuel Update |

April 1st 2024 Fuel Update |

Jan 1st 2024 Annual Report |

Current Fuel Update |

April 1st 2024 Fuel Update |

Jan 1st 2024 Annual Report |

|

Alberta |

$0.540 |

$0.525 |

$0.535 |

$0.225 |

$0.210 |

$0.220 |

|

British Columbia |

$0.585 |

$0.565 |

$0.580 |

$0.275 |

$0.255 |

$0.275 |

|

Manitoba |

$0.540 |

$0.540 |

$0.560 |

$0.225 |

$0.220 |

$0.240 |

|

New Brunswick |

$0.585 |

$0.575 |

$0.590 |

$0.255 |

$0.240 |

$0.260 |

|

Newfoundland and Labrador |

$0.605 |

$0.595 |

$0.605 |

$0.260 |

$0.250 |

$0.265 |

|

Northwest Territories |

$0.700 |

$0.700 |

$0.705 |

$0.320 |

$0.320 |

$0.330 |

|

Nova Scotia |

$0.590 |

$0.580 |

$0.595 |

$0.255 |

$0.245 |

$0.255 |

|

Nunavut |

$0.705 |

$0.690 |

$0.680 |

$0.335 |

$0.325 |

$0.310 |

|

Ontario |

$0.605 |

$0.590 |

$0.605 |

$0.245 |

$0.230 |

$0.245 |

|

Prince Edward Island |

$0.575 |

$0.565 |

$0.575 |

$0.255 |

$0.245 |

$0.255 |

|

Quebec |

$0.580 |

$0.570 |

$0.580 |

$0.265 |

$0.255 |

$0.265 |

|

Saskatchewan |

$0.545 |

$0.535 |

$0.550 |

$0.235 |

$0.225 |

$0.240 |

|

Yukon |

$0.705 |

$0.700 |

$0.720 |

$0.345 |

$0.340 |

$0.355 |

Note: All figures were rounded up to the nearest half-cent.

The impact of gasoline prices on the Reimbursement Rates was moderate for the present Fuel Update. In comparison to the last Fuel Update (February 2024, for publication on April 1st, 2024), the Travel (Kilometric) and Commuting (Lower Kilometric) Rates have increased by a maximum of 2.0 cents per kilometre for the Provinces. For the Territories, the Reimbursement Rates varied between no increase in the Northwest Territories, to a maximum increase of 1.5 cents for the Travel Rate in Nunavut.

Overall, Canadian weighted averages increased by 1.0 cent per kilometre for the Travel Rate and by 1.5 cents for the Commuting Rate, compared to the last Fuel Update (February 2024, for publication on April 1st, 2024). They are now at 58.0 cents per kilometre and 25.0 cents per kilometre, respectively.

Fuel contributes on average 13.0 cents per kilometre to total operating costs, ranging from 10.8 cents in Manitoba to 20.9 cents in the Yukon. Given the complexity of socio-economic factors affecting the global energy market, it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the next Fuel Update.