Reimbursement for Business Use of Personal Vehicles

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1. Fuel Price Update Synopsis

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the annual evaluation of per-kilometre Reimbursement Rates for government employees who are required to use their personal vehicles while performing government business. Furthermore, the periodic impact of varying fuel prices is to be evaluated quarterly by producing three additional Fuel Price Updates per year. The present document represents the Update for February 2025.

The latest annual study established Reimbursement Rates for each Canadian Province and Territory after performing a comprehensive analysis of all vehicle operating expenses. These rates were presented in the Reimbursement for Business Use of Personal Vehicles Report, dated November 2024 (for publication on January 1st, 2025).

The present Update reflects the impact of current fuel prices on the Travel and Commuting Rates’ recommendations made in the Annual Report with a focus on average pump prices of gasoline by Province and Territory. The prices were averaged for each Province or Territory for the three months prior to the release of the current Update (the months of December 2024, January 2025 and February 2025). All prices are given in dollars per litre.

This Update also presents the latest recommended rates of reimbursement for consideration by the Treasury Board Secretariat in dollars per kilometre. The recommendations for Reimbursement Rates are given for:

- Travel Rates (travellers authorized and reimbursed to use their personal vehicles on government business travel), also referred to as “Kilometric Rates” in the National Joint Council Travel Directive (Appendix B), and

- Commuting Rates (employees reimbursed their variable expenses to use their personal vehicles to commute to their designated remote worksites), also referred to as “Lower Kilometric Rates” in the National Joint Council Commuting Assistance Directive (Appendix A).

Federal and Provincial sales taxes were also researched to determine if there were any recent changes that could have had an immediate impact on the total costs of vehicle ownership and operation.

For the period December 2024 - February 2025, fuel expenses represent 20.0% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 12.1 cents per kilometre. The present Update identified slight variations in average gasoline prices across Canada, which had a minimal impact on both Reimbursement Rates. As a result, the Reimbursement Rates for the ten Provinces either stayed constant or increased by a maximum of 0.5 cents relative to the previous Annual Report (November 2024, for publication on January 1st, 2025). For the Territories, while the Travel Rates remained constant, the Commuting Rates varied from a decrease of 0.5 cents in the Yukon to an increase of 0.5 cents in Nunavut (see Section 2.2 - Gasoline prices across Canada for details).

2. Fuel Prices

2.1 Energy Market Context

Over the last three months, the global energy markets have seen a further increase in price volatility due to escalating geopolitical conflicts, persistent uncertainty over the global economic outlook, as well as the rising potential of oversupply of crude. Oil prices climbed in December and early January, rising from a three-month low of $67.20 USD per barrel for West Texas Intermediate (WTI) and $71.12 USD per barrel for Brent on December 5th, 2024, to $80.12 USD and $82.03 USD respectively by January 14th, 2025. As of February 14th, WTI stood at $70.57 USD per barrel and Brent was at $74.57 USD per barrel.

On average, gasoline prices followed crude oil price trends, rising in December and early January and fluctuating thereafter. As a result, the Canadian average price for gasoline in the three-month period was $1.572 per litre as compared to $1.554 per litre during the fall months, an increase of 1.2%. From a yearly perspective, the average price was 5.6% higher than a year ago when the cost was $1.488 per litre.

2.1.1 Global Crude Oil Demand

According to the International Monetary Fund’s (IMF) World Economic Outlook (WEO) update published in January 2025, the global economic growth projections have only seen minor adjustments. The world economy is expected to increase by 3.3% in 2025, as well as in 2026. As noted by the IMF, this is significantly lower than the historic average of 3.7% growth rate for the 20-year period between 2000 and 2019. Most of the gains in 2025 are coming from an upward adjustment in the United States (U.S.), offset by downward revisions in other major economies.

Changes in the outlook for the Advanced Economies have been quite significant and in different directions. The projection for the U.S. has seen a substantial upward adjustment of 0.5 percentage points as compared to three months ago and is now at 2.7% for this year. This has been largely driven by strong consumer consumption. At the same time, the Euro Zone has seen a downward adjustment of 0.2 percentage points. This is reflecting a continued weakness in manufacturing and the export of goods despite the recovery of consumption and real incomes. The outlook for the German economy has seen a disproportionate downward adjustment of 0.5 percentage points and is now projected to expand by a marginal 0.3% this year. Similarly, France and Italy have also seen downward adjustments with only moderate gains of 0.7%-0.8% projected this year.

A major source of increased risk and uncertainty over the economic outlook has come from the U.S. trade policy. The new U.S. administration is planning on implementing significant tariffs on its importing partners, including Canada. This has led to discussions about retaliatory actions. The U.S. proposed a 25% tariff on a wide range of Canadian export products, which is intended to take effect on March 4th, 2025. Furthermore, a 10% tariff is to be imposed on energy exports to the U.S., which would have a significant impact on the Canadian energy sector. Canada has responded by proposing a 25% tariff on a number of consumer products coming from the U.S., while also considering additional tariffs on passenger vehicles, trucks, steel and aluminum products, as well as agricultural products. Canada is the U.S.'s second-largest trading partner after Mexico, accounting for 13.9% of total U.S. trade in late 2024. As a consequence, the introduction of any tariffs, which effectively act as a tax, is likely to be felt on both sides of the border and will hurt consumers in both countries. The U.S. is also imposing a 25% tariff on global imports of steel and aluminum products targeted to begin March 12th, which will impact Canada’s industry even if the Canada-specific tariffs end up not being enacted.

The growth rate for the Canadian economy has been adjusted downward. The IMF projects the Canadian economy to expand by 2.0% this year, as well as in 2026. By comparison, the Bank of Canada projections stand at 1.8% for both years. While lower than the IMF projections, this would be a significantly higher rate than the 1.3% growth rate in 2024. Because of the past interest rate cuts, household spending has been strengthening, although business investments remain weak, and the unemployment rate is still elevated at 6.7% as of December 2024. The Bank notes that the inflation has been around 2% since August 2024 with the Consumer Price Index (CPI) being below the historic averages for most components except housing. Because of the high level of uncertainty surrounding the U.S. trade policy at this time, the Bank’s forecasts are “in the absence of new tariffs”. Thus, the Bank also notes: “(..) if broad-based and significant tariffs were imposed, the resilience of Canada’s economy would be tested.” Notably, the potential of these tariffs has started weighing in on consumer and business confidence as well as investments. Furthermore, it has already led to a material depreciation of the Canadian dollar value against the U.S. currency.

The forecast for Emerging Markets and Developing Economies has not seen much change and is projected to expand by 4.2% in 2025. China’s growth is projected at 4.6%, while India’s economy is set to expand by 6.5% this year. The only notable change in the outlook has been observed for Saudi Arabia, whose growth projection has been adjusted downwards by 1.3% this year to 3.3% due to the extension of the OPEC+ production cuts.

Forecasts for the global oil demand remain varied. Although adjusted downward, the Organization of Petroleum Exporting Countries (OPEC) projections remain quite optimistic. According to the Monthly Oil Market Report (MOMR) from February 2025, OPEC estimates that global oil consumption was 103.7 million barrels per day (mb/d) last year. The OPEC projects an increase in demand of 1.5 mb/d in 2025, averaging 105.2 mb/d before rising further to 106.6 mb/d in 2026. The U.S. Energy Information Administration’s (EIA) estimates are more conservative. The U.S. EIA estimates that global consumption averaged 102.8 mb/d in 2024 and is expected to rise by 1.3 mb/d in 2025, averaging 104.1 mb/d before increasing to 105.2 mb/d in 2026. The International Energy Agency’s (IEA) forecasts are even more conservative. While the estimate for the consumption last year is in line with the U.S. EIA at 102.8 mb/d last year, their growth projections are more constrained, forecasting an increase of 1.1 mb/d, resulting in a total demand of 103.9 mb/d this year.

2.1.2 Global Crude Oil Supply

While the demand projections are seeing moderate downward adjustments, the global crude oil supply remains strong, and it is likely that an oversupply will be recorded this year. If this happens, it will apply further downward pressure on global oil prices.

In early December 2024, the OPEC+ coalition announced another three-month delay to its plan to gradually begin increasing the output. This has been the third deferral of the plan to gradually phase out the 2.2 million barrels per day (mb/d) of voluntary production cuts. As of the latest plan, OPEC+ is set to start unwinding production in April 2025. While the OPEC+ decision to delay the production increase has somewhat reduced oversupply concerns, the strong supply from non-OPEC+ countries will probably still lead to global overproduction.

The projections by the U.S. Energy Information Administration (EIA) for the global crude oil supply stand at 104.6 mb/d in 2025, which means an estimated oversupply of 0.5 mb/d. Similarly, the International Energy Agency (IEA) projects the oversupply to be around 0.6 mb/d this year, with production averaging 104.5 mb/d. As noted by the IEA, non-OPEC+ producers, primarily in the Americas, are anticipated to contribute over 70% of the production growth, which is set to total 1.6 mb/d over last year’s 102.9 mb/d. This forecast assumes that OPEC+ maintains all the present production cuts, voluntary and compulsory, totaling about 5.9 mb/d. Should OPEC+ start unwinding cuts this year as per the current plan, an additional 0.5 mb/d could be added to the market average in 2025.

Overall, U.S. oil production keeps rising steadily. According to the U.S. EIA, it averaged 13.2 mb/d in 2024 and is projected to increase by 0.4 mb/d this year and 0.1 mb/d in 2026. The U.S. has been able to increase its production mostly thanks to improved efficiency and productivity enhancements in shale oil extraction. As an example, a rig operating in the Permian basin right now is about 4-5 times more productive than its counterpart from a decade ago. As of 2024, the U.S. has been the world’s top producer of crude oil for the seventh consecutive year, exceeding Saudi Arabia’s production rate by about 25%.

Similarly, Canada continues to increase its production. Given that Canada has limited refining capacity, oil exports are a crucial part of the Canadian economy. As of 2023, Canadian crude oil production averaged 4.6 mb/d while the refining capacity was at 1.7 mb/d. With the increased production, Canadian oil has been making its way to refineries in the U.S., many of which are configured to process the heavier oil. In 2023, 60% of U.S. crude oil imports originated in Canada, a significant increase from 33% in 2013. Moreover, 97% of Canadian oil exports were destined for the U.S. With the final numbers still being processed, U.S. imports of crude oil from Canada are estimated to have hit a record high of 4.3 mb/d in 2024, driven by the expansion of Canada's Trans Mountain Pipeline. The potential of 10% tariffs on oil products is weighing heavily on the outlook for the market.

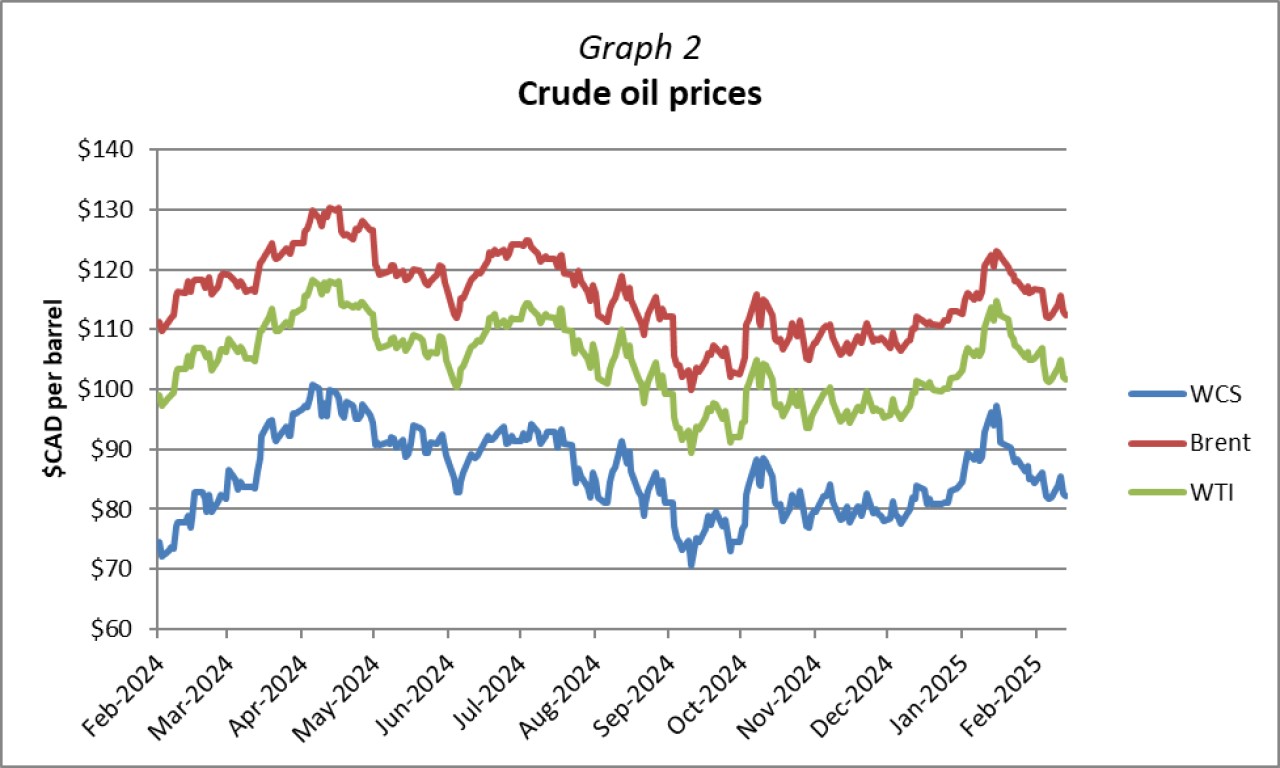

Canadian oil is a heavy, sour blend, that is good for making diesel but is more difficult to refine when compared to light, sweet oil, which is easier to refine and better for making gasoline. As a result, Canadian oil sells at a discount to U.S. oil, as represented by the price gap between the Western Canadian Select (WCS) and the West Texas Intermediate (WTI). Thanks to the opening of the Trans Mountain Pipeline, the price differential had been declining, but the potential of new tariffs has threatened to widen the gap once again.

2.2 Gasoline Prices Across Canada

While crude oil price fluctuations have been quite pronounced, gasoline prices across Canada have seen only moderate changes over the past three months. The average price increased in most provinces, ranging from 0.6% (or 1.0 cent per litre) in Newfoundland and Labrador to 3.7% (or 4.9 cents per litre) in Manitoba. On the other hand, Alberta, Saskatchewan, the Northwest Territories and the Yukon saw decreases between 0.1% (or 0.2 cents per litre) and 2.1% (or 3.9 cents per litre). No significant underlying price trends seemed to drive those changes except for local market fluctuations.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across Canada, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. The present Update calculated the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate (previously Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the Annual Report, when determining average gasoline prices per Province or Territory, we have used weighted averages according to population in order to better conform to reality. In this manner, metropolitan population centers account for a greater portion of the total average price compared to smaller towns.

The following is a table with average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, for the period December 2024 - February 2025:

|

Province/Territory |

Current average fuel price ($/litre) |

January 1st, 2025, Annual Report fuel price ($/litre) |

Price difference ($/litre) |

|

Alberta |

$1.437 |

$1.450 |

-$0.013 |

|

British Columbia |

$1.752 |

$1.723 |

$0.029 |

|

Manitoba |

$1.387 |

$1.338 |

$0.049 |

|

New Brunswick |

$1.592 |

$1.569 |

$0.023 |

|

Newfoundland and Labrador |

$1.681 |

$1.671 |

$0.010 |

|

Northwest Territories |

$1.624 |

$1.626 |

-$0.002 |

|

Nova Scotia |

$1.594 |

$1.576 |

$0.018 |

|

Nunavut |

$1.758 |

$1.751 |

$0.007 |

|

Ontario |

$1.533 |

$1.521 |

$0.012 |

|

Prince Edward Island |

$1.665 |

$1.633 |

$0.032 |

|

Quebec |

$1.586 |

$1.573 |

$0.013 |

|

Saskatchewan |

$1.487 |

$1.515 |

-$0.028 |

|

Yukon |

$1.823 |

$1.862 |

-$0.039 |

Fuel price data was extracted for a period of three months (November 11th, 2024, to February 14th, 2025) in order to reflect current gasoline price trends. Subsequent reports will focus on three-month periods following the period covered in the present study. Average gasoline prices per litre and per Province or Territory were found to vary between $1.387 in Manitoba to $1.823 in the Yukon, with a Canadian average of $1.572, an increase of 1.8 cents from the previous Annual Report (November 2024, for publication on January 1st, 2025).

Gas prices in Nunavut are typically set for a full calendar year and rarely exhibit any changes. However, the Territory has been gradually bringing its gasoline prices more in line with the rest of Canada and the latest price update occurred on April 1st, 2024. The territorial average was thus determined to be $1.758 for the current Update.

For illustration purposes, Graph 1 displays gasoline prices for the main metropolitan areas for a one-year period (February 2024 - February 2025).

Also for illustration purposes, Graph 2 displays crude oil prices for three benchmarks – WTI (West Texas Intermediate), Brent and WCS (Western Canadian Select) for a one-year period (February 2024 - February 2025).

2.3 Sales Taxes

For the current Update, research was performed to see if there were any relevant changes to Federal and Provincial sales taxes that could have an immediate impact on the Reimbursement Rates. As of the date of this Update, no changes were observed in sales taxes anywhere in Canada as compared to the previous Annual Report. However, it is worth noting that the government of Nova Scotia recently announced that they are planning to reduce the provincial portion of the sales tax by 1%, effective April 1st, 2025. If this reduction applies as planned, it will be factored into the May 2025 Fuel Update report.

3. Impact of Fuel Prices on Reimbursement Rates

3.1 Fuel Consumption

In calculating the fuel costs contribution to the total vehicle operating costs, the methodology employed in the Annual Report was strictly adhered to. Fuel consumption for every vehicle model in the study was thus combined with average prices per Province or Territory to determine the fuel portion of operating costs, based on an average of 20,000 kilometres per year.

3.2 Updated Reimbursement Rates

For comparison, the following table provides updated Travel (Kilometric) and Commuting (Lower Kilometric) Rates, as well as rates previously calculated for the Annual Report (November 2024, for publication on January 1st, 2025):

Current Reimbursement Schedule (in dollars per kilometre)

|

Travel Rate (Kilometric Rate) |

Commuting Rate (Lower Kilometric Rate) |

|||

|

Province/Territory |

Current Fuel Update |

January 1st, 2025, Annual Report |

Current Fuel Update |

January 1st, 2025, Annual Report |

|

Alberta |

$0.575 |

$0.575 |

$0.225 |

$0.225 |

|

British Columbia |

$0.605 |

$0.600 |

$0.265 |

$0.260 |

|

Manitoba |

$0.560 |

$0.560 |

$0.225 |

$0.220 |

|

New Brunswick |

$0.610 |

$0.605 |

$0.245 |

$0.245 |

|

Newfoundland and Labrador |

$0.630 |

$0.630 |

$0.250 |

$0.250 |

|

Northwest Territories |

$0.720 |

$0.720 |

$0.325 |

$0.325 |

|

Nova Scotia |

$0.615 |

$0.615 |

$0.245 |

$0.245 |

|

Nunavut |

$0.725 |

$0.725 |

$0.340 |

$0.335 |

|

Ontario |

$0.635 |

$0.630 |

$0.240 |

$0.240 |

|

Prince Edward Island |

$0.600 |

$0.600 |

$0.250 |

$0.250 |

|

Quebec |

$0.610 |

$0.605 |

$0.255 |

$0.255 |

|

Saskatchewan |

$0.565 |

$0.565 |

$0.235 |

$0.235 |

|

Yukon |

$0.730 |

$0.730 |

$0.345 |

$0.350 |

Note: All figures were rounded up to the nearest half-cent.

The impact of gasoline prices on the Reimbursement Rates was minimal for the present Fuel Update. In comparison with the Annual Report (November 2024, for publication on January 1st, 2025), the Travel (Kilometric) and Commuting (Lower Kilometric) Rates have either stayed constant or increased by a maximum of 0.5 cents per kilometre for the Provinces. For the Territories, the Reimbursement Rates varied between a decrease of 0.5 cents per kilometre for the Commuting Rate in the Yukon, to an increase of 0.5 cents for the Commuting Rate in Nunavut.

Overall, Canadian weighted averages remained constant for the Travel Rate and increased slightly by 0.5 cents for the Commuting Rate, compared to the last Annual Report (November 2024, for publication on January 1st, 2025). They are now at 61.0 cents per kilometre and 24.5 cents per kilometre, respectively.

Fuel contributes on average 12.1 cents per kilometre to total operating costs, ranging from 10.8 cents in Manitoba, to 20.6 cents in the Yukon. Given the complexity of socio-economic factors affecting the global energy market, it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the next Fuel Update.