Reimbursement for Business Use of Personal Vehicles

Study prepared for The Treasury Board of Canada Secretariat

By Corporate Fleet Services

1. Fuel Price Update Synopsis

Corporate Fleet Services (CFS) has been mandated by the Treasury Board of Canada Secretariat to perform the annual evaluation of per-kilometre Reimbursement Rates for government employees who are required to use their personal vehicles while performing government business. Furthermore, the periodic impact of varying fuel prices is to be evaluated quarterly by producing three additional Fuel Price Updates per year. The present document represents the Update for May 2025 (for publication on July 1st, 2025).

The latest annual study established Reimbursement Rates for each Canadian Province and Territory after performing a comprehensive analysis of all vehicle operating expenses. These rates were presented in the Reimbursement for Business Use of Personal Vehicles Report, dated November 2024 (for publication on January 1st, 2025). A subsequent Fuel Update was produced for February 2025 (for publication on April 1st, 2025).

The present Update reflects the impact of current fuel prices on the Travel and Commuting Rates’ recommendations made in the Annual Report with a focus on average pump prices of gasoline by Province and Territory. The prices were averaged for each Province or Territory for the three months prior to the release of the current Update (the months of March, April and May 2025). All prices are given in dollars per litre.

This Update also presents the latest recommended rates of reimbursement for consideration by the Treasury Board Secretariat in dollars per kilometre. The recommendations for Reimbursement Rates are given for:

- Travel Rates (travellers authorized and reimbursed to use their personal vehicles on government business travel), also referred to as “Kilometric Rates” in the National Joint Council Travel Directive (Appendix B), and

- Commuting Rates (employees reimbursed their variable expenses to use their personal vehicles to commute to their designated remote worksites), also referred to as “Lower Kilometric Rates” in the National Joint Council Commuting Assistance Directive (Appendix A).

Federal and Provincial sales taxes were also researched to determine if there were any recent changes that could have had an immediate impact on the total costs of vehicle ownership and operation.

For the period March - May 2025, fuel expenses represent 19.4% of the total cost of vehicle operation (reflected in the Travel Rates) or a Canadian weighted average of 11.6 cents per kilometre. The present Update identified moderate decreases in average gasoline prices across Canada, which had a slight downward effect on Reimbursement Rates everywhere except Manitoba, where they increased slightly. As a result, relative to the previous Fuel Update (February 2025, for publication on April 1st, 2025), the Reimbursement Rates for the ten Provinces varied between a decrease of 1.5 cents in Nova Scotia to an increase of 0.5 cents in Manitoba. In the Territories, the rates also followed a downward trend, with a maximum decrease of 1.5 cents for the Travel Rate in the Yukon. For a more detailed explanation of the main factors influencing these variations, see Section 2.2 - Gasoline prices across Canada.

2. Fuel Prices

2.1 Energy Market Context

With the continued trade tensions, the increased price volatility in global crude markets has persisted in the last three months. Oil prices began a moderate climb in March, a trend which was abruptly interrupted in April, when the new trade tariffs were announced and implemented between the United States (U.S.) and most of the world. This led to a rapid crude oil price drop. West Texas Intermediate (WTI) fell from nearly $72 USD per barrel to $62 USD per barrel in a span of two days, and Brent declined from $75 USD per barrel to $66 USD per barrel during the same time frame, a drop of nearly 14% and 12%, respectively. Crude prices continued sliding, reaching a three-month low in early May. On May 5th, WTI was at $57 USD per barrel and Brent was just above $60 USD per barrel. As of May 16th, WTI stood at $62.49 USD per barrel and Brent was at $65.41 USD per barrel.

Average gasoline prices in Canada followed crude oil trends, increasing in March before dipping in April. Notably, in addition to the crude price slide due to the tariffs, the Canadian Federal government dropped the consumer carbon pricing on April 1st, 2025, adding to the overall price decline. As a result, the average price for gasoline in Canada over the past three months was $1.504 per litre as compared to $1.572 per litre in the previous three-month period, a moderate 4.3% decline. From a yearly perspective, the average price was 9.2% lower than during the spring of 2024, when the average price at the pump was $1.657 per litre of gasoline.

The energy market, just like the global economy as a whole, has been affected by rapidly changing trade policies that have fuelled uncertainty and led to commodity price fluctuations in both directions. As a result, making any projections has become increasingly difficult. For example, the International Monetary Fund (IMF) projects that the current trade situation is likely to cause a significant slowdown in the global economic growth trajectory in the near term (described as a “reference forecast” in their World Economic Outlook (WEO) published in April 2025). It also notes that “many possible paths exist, reflecting the unpredictability surrounding future trade policy and the varied impact of tariffs across different countries through a diverse set of channels”. Similarly, the Bank of Canada considers two scenarios: one with the tariff negotiations continuing in the short term but largely negotiated away, and the other where the tariffs persist. The Bank notes, that “taken together, the scenarios frame many plausible paths for Canadian inflation and GDP growth (..)” In addition, the Bank of Canada points out that “the unpredictability of U.S. trade policy, and the speed and magnitude of the shifts, are making the economic outlook very uncertain.” As a result, any projections should be considered with caution and prudence.

Trade Tensions and Tariffs

Since February 2025, the U.S. has announced multiple waves of tariffs against trading partners. Some of those tariffs have been imposed, others were suspended or modified. As a result, some countries have imposed countermeasures. While markets first took the announcements mostly in stride, that changed when the U.S. announced near-universal application of tariffs on April 2nd, consisting of 10% tariffs on imports of all goods from nearly all countries, with additional “reciprocal” tariffs for many countries. This triggered historic drops in major equity indices and spikes in bond yields, which were followed by a partial recovery after the pause of “reciprocal” tariffs for 90 days and additional carve-outs announced on and after April 9th.

While Canada has been exempted from the 10% universal tariff, as of mid-May 2025, significant U.S. tariffs remain in place, particularly a 25% tariff on steel, aluminum as well as on motor vehicles. In addition, there still remains a 10% tariff on energy products, including oil. The Canadian government has implemented countermeasures targeting U.S. goods.

As significant trade tensions developed between the U.S. and China, tariffs at one point reached 145% on Chinese goods and 125% on U.S. goods. As of mid-May, an agreement has been reached to reduce the tariffs for 90 days. The current tariff amounts are 30% on Chinese goods and 10% on U.S. goods. This tariff conflict between the two largest economies has been weighing on market sentiment, reducing global trade volumes and demand for oil, and pushing crude prices down.

2.1.1 Global Crude Oil Demand

The global economic outlook has seen a significant shift. According to the International Monetary Fund’s (IMF) World Economic Outlook (WEO) published in April 2025, the global economic forecast has been “revised markedly down compared with the January 2025 World Economic Outlook (WEO) Update, reflecting effective tariff rates at levels not seen in a century and a highly unpredictable environment.” As a result, the world economy is expected to increase by 2.8% this year (down from the 3.3% projection in January 2025) and 3.0% in 2026 (as compared to the 3.3% rate in the January WEO Update report). The escalating trade tensions and the subsequent financial market adjustments result in downside risks dominating the outlook.

The IMF reference forecast projects 1.4% growth for Advanced Economies. Although the U.S. had a positive and improving outlook over the past several quarters, it has seen a significant downgrade of 0.9 percentage points. It is now projected that the U.S. economy will expand by 1.8% this year, a substantial decline from the 2.7% forecast in January 2025. The IMF cites the increased policy uncertainty, trade tensions, as well as a softer demand momentum for this change. Furthermore, the U.S. economy contracted by 0.3% in the first quarter of 2025, the first time since 2022. This was largely driven by the import increase before the tariff hikes and is largely seen as a temporary phenomenon. Similarly, the Euro Zone has also seen a downward adjustment of 0.2 percentage points, and the growth for 2025 is now projected at 0.8%.

As a result of the mounting trade tensions, the forecast for Emerging Markets and Developing Economies has been significantly downgraded by 0.5 percentage points and is now at 3.7% for 2025. China’s economy has faced prolonged weakness in the real estate sector. The rising trade tensions and the disproportionate tariffs between China and the U.S. are exacerbating the struggles faced by its economy. China’s growth projection has been marked down from 4.6% to 4.0% this year.

The Canadian economy ended last year strong, with the Bank of Canada estimating a 2.6% growth in the last quarter of 2024, thanks to strong residential investment and consumption promoted by the reduction of interest rates. However, the escalating trade conflict with the U.S. is diminishing Canada’s growth prospects as tariffs are adding to the upward price pressures. As a result, the IMF has reduced Canada’s growth projections by 0.6 and 0.4 percentage points, now standing at 1.4% and 1.6% for this year and the next, respectively. Similarly, the Bank of Canada, in its Monetary Policy Report (MPR) from April 2025, considers two possible scenarios of how the trade tensions could unfold, each with its own outcomes. The first scenario assumes that the current tariffs remain in place through 2026 but are negotiated away afterwards. Under this scenario, the economic growth stalls in the second quarter, but averages 1.6% this year and 1.4% in 2026. This is a 0.4 and 0.2 percentage point decline as compared to the projections made by the Bank in January 2025, when growth estimates for both years stood at 1.8%. The second scenario, however, is projecting a more permanent trade war with escalating and long-lasting tariffs. Under this scenario, Canada’s economy contracts by 0.2% next year and recovers to 1.6% in 2027.

Similar to the previous reports, the forecasts for global oil demand remain varied, with OPEC having the most optimistic outlook. According to the Monthly Oil Market Report (MOMR) from May 2025, OPEC estimates that global oil consumption was 103.7 million barrels per day (mb/d) last year. The OPEC projects an increase in demand of 1.3 mb/d in 2025, averaging 105.0 mb/d (a slight downward adjustment of 0.2 mb/d compared to three months ago) before rising further to 106.3 mb/d in 2026. The U.S. Energy Information Agency (EIA) estimates that global consumption averaged 102.7 mb/d in 2024 and is expected to average 103.7 mb/d this year (a significant downward adjustment of 0.4 mb/d as compared to three months ago) and increase to 104.6 mb/d in 2026 (a downward adjustment of 0.6 mb/d). The International Energy Agency’s (IEA) forecasts have also been reduced, and the demand is projected to increase by 0.7 mb/d in 2025 and 0.8 mb/d next year.

2.1.2 Global Crude Oil Supply

Both the demand as well as the supply are tending towards an oversupply, adding to the downward pressure on prices. Globally, the U.S. EIA projects the supply to increase from 102.8 mb/d last year to 104.1 mb/d this year and further to 105.4 mb/d in 2026. In comparison to their global consumption projections, this would result in about 0.4 mb/d of oversupply this year and 0.8 mb/d in 2026. The International Energy Agency (IEA) supply estimates are similar at 103.0 mb/d in 2024, expected to rise to 104.6 mb/d in 2025. Non-OPEC+ producers are set to add the majority of the increase, or about 1.3 mb/d this year, with the U.S., Canada, Brazil, and Guyana driving production growth over the forecast period. Next year, supply is projected to increase by an additional 1.0 mb/d in 2026, averaging at 105.6 mb/d.

Despite the overall deteriorating global economic situation, the OPEC+ coalition began unwinding production cuts with an approved increase of 137,000 barrels per day in April. The coalition accelerated the pace of the unwinding, agreeing to an additional 411,000 barrels per day increase for May and June 2025. At this pace, the voluntary cuts of 2.2 mb/d that had been in place since 2023 would be unwound by November 2025, much sooner than the initial target of September 2026. The escalating trade situation in early April pushed the oil prices down due to rising concerns that the tariffs could slow down economic activity and possibly lead to a recession, which could result in a significantly reduced demand for oil globally. In addition, around the same time, the OPEC+ coalition announced the acceleration of the production increase for May, intensifying the bearish sentiment. As a result, these factors pushed oil prices to their lowest levels in over two years, with Brent and WTI crude futures recording their largest weekly losses since 2021.

Currently, the U.S. oil production continues to rise, albeit at a slower pace than previously projected. According to the U.S. EIA’s Short-Term Energy Outlook (STEO) published in May 2025, production is expected to increase by 0.2 mb/d this year, only half of the pace projected three months ago. Nevertheless, there are some indications that the shale oil production growth is slowing. This is due to the depletion of the core drilling areas in the Permian Basin as well as the rising costs for steel, exacerbated by the tariffs. The increased costs are expected to lead to reduced rig counts and a decline in capital expenditures.

Despite the turmoil, the Canadian energy industry appears to be strong, well-positioned and benefiting from certain developments. Firstly, when the U.S. tariffs began targeting buyers of Venezuelan crude oil, the demand increased for Canadian oil to replace the missing barrels. In March, that led to a reduction of the price gap between Western Canadian Select (WCS) and WTI to the lowest level since 2020. Secondly, the Canadian oil production remains robust despite declining prices. Most Canadian oil comes from the oil sands, and each rig takes a significant investment upfront. However, the oil from these rigs is extracted for an extended period with low operational expenses. In contrast, the U.S. produces most of the oil through shale wells, which are cheaper to establish but run out of oil much quicker and thus have higher overall costs. As a result, it is expected that while the reduced crude oil prices are likely to put downward pressure on the oil production in the U.S., the Canadian energy sector production is set to remain strong.

The continued production of crude oil globally, as well as the accelerated unwinding of the production cuts by the OPEC+, has been applying a significant downward pressure on oil prices. With less oil being consumed this year, oil inventories have risen. The U.S. EIA estimates that about 0.3 mb/d of oil was put into inventory during the first four months of 2025. The increasing inventory levels are pointing towards oversupply and a potentially further downward push on oil prices in the future.

2.2 Gasoline Prices Across Canada

Average gasoline prices declined across Canada due to the declining oil prices as well as the lifting of the consumer carbon pricing by the Canadian Federal government on April 1st, 2025, which accounted for about 17.6 cents per litre of gas in the previous year. Two notable exceptions to the decline trend were Quebec and Manitoba.

In Quebec, the average gasoline price declined only by 1.3% as compared to 2.1% to 7.1% in other Provinces. This is because Quebec began its cap-and-trade system in 2013, before carbon taxation was federally implemented and thus was exempted from the Federal program. Now that the Federal carbon pricing was lifted, the Quebec system remains in place and is costing consumers an estimated 10 cents per litre. It must be noted that although British Columbia was the first province to impose a carbon tax in Canada, it sided with the Federal government and repealed its system at the same time as the Federal program was cancelled.

The second exception has been Manitoba, where the average cost of gasoline increased by about 2.1%. This was because of the reversal of Manitoba’s fuel tax “holiday” that was in place from January 1st through December 31st, 2024, mandated by the Provincial government in December 2023. Because of this “holiday”, the cost of gasoline at the pump in the Province was reduced by 14 cents per litre. This led to lower gas prices in Manitoba last year as compared to the rest of the country. As of January 1st, 2025, the Province imposed the tax again, albeit at a slightly reduced rate of 12.5 cents per litre. This resulted in a larger increase in gasoline prices at the pump in the first part of the year as compared to other Canadian Provinces.

Prices of gasoline, in Canada, include all applicable taxes. Prices vary significantly across Canada, mainly due to the difference in the types and amounts of taxes being charged on fuel in different Provinces and Territories. The present Update calculated the average prices of regular gasoline charged at the pump. The fuel price data was primarily obtained from Natural Resources Canada via Kalibrate (previously Kent Marketing), based on daily published fuel prices for 78 locations across Canada. This data was verified against additional databases that similarly track fuel prices all across Canada.

Consistent with the methodology of the Annual Report, when determining average gasoline prices per Province or Territory, we have used weighted averages according to population in order to better conform to reality. In this manner, metropolitan population centers account for a greater portion of the total average price compared to smaller towns.

The following is a table with average regular gasoline prices for all Canadian Provinces and Territories, in dollars per litre, for the period March - May 2025:

|

Province/Territory |

Current fuel price |

April 1st, 2025, Fuel Update Report fuel price |

Price difference |

|---|---|---|---|

|

Alberta |

$1.371 |

$1.437 |

-$0.066 |

|

British Columbia |

$1.716 |

$1.752 |

-$0.036 |

|

Manitoba |

$1.416 |

$1.387 |

$0.029 |

|

New Brunswick |

$1.483 |

$1.592 |

-$0.109 |

|

Newfoundland and Labrador |

$1.591 |

$1.681 |

-$0.090 |

|

Northwest Territories |

$1.533 |

$1.624 |

-$0.091 |

|

Nova Scotia |

$1.496 |

$1.594 |

-$0.098 |

|

Nunavut |

$1.664 |

$1.758 |

-$0.094 |

|

Ontario |

$1.425 |

$1.533 |

-$0.108 |

|

Prince Edward Island |

$1.556 |

$1.665 |

-$0.109 |

|

Quebec |

$1.566 |

$1.586 |

-$0.020 |

|

Saskatchewan |

$1.447 |

$1.487 |

-$0.040 |

|

Yukon |

$1.718 |

$1.823 |

-$0.105 |

Fuel price data was extracted for a period of three months (February 18th to May 16th, 2025) in order to reflect current gasoline price trends. Subsequent reports will focus on three-month periods following the period covered in the present study. Average gasoline prices per litre and per Province or Territory were found to vary between $1.371 in Alberta to $1.718 in the Yukon, with a Canadian average of $1.504, a decrease of 6.8 cents from the previous Fuel Update (February 2025, for publication on April 1st, 2025).

Generally, average fuel prices decreased across Canada, driven primarily by the removal of the Carbon Tax on April 1st, 2025, by the new Liberal Government, which applied everywhere except in Quebec (which has its own carbon pricing system, separate from the Federal system). Additional factors included a general downward trend of average gasoline prices, the 1% reduction in the HST in Nova Scotia, which took effect on April 1st, as well as an adjustment in the government-set gasoline prices in Nunavut, also effective April 1st, 2025. The exception to this was the average gasoline price in Manitoba, which actually increased slightly as compared to the previous Fuel Update (February 2025, for publication on April 1st, 2025). This was identified as being caused primarily by an upward readjustment after prices had remained substantially lower than the Canadian average during the 2024 calendar year. See above for details.

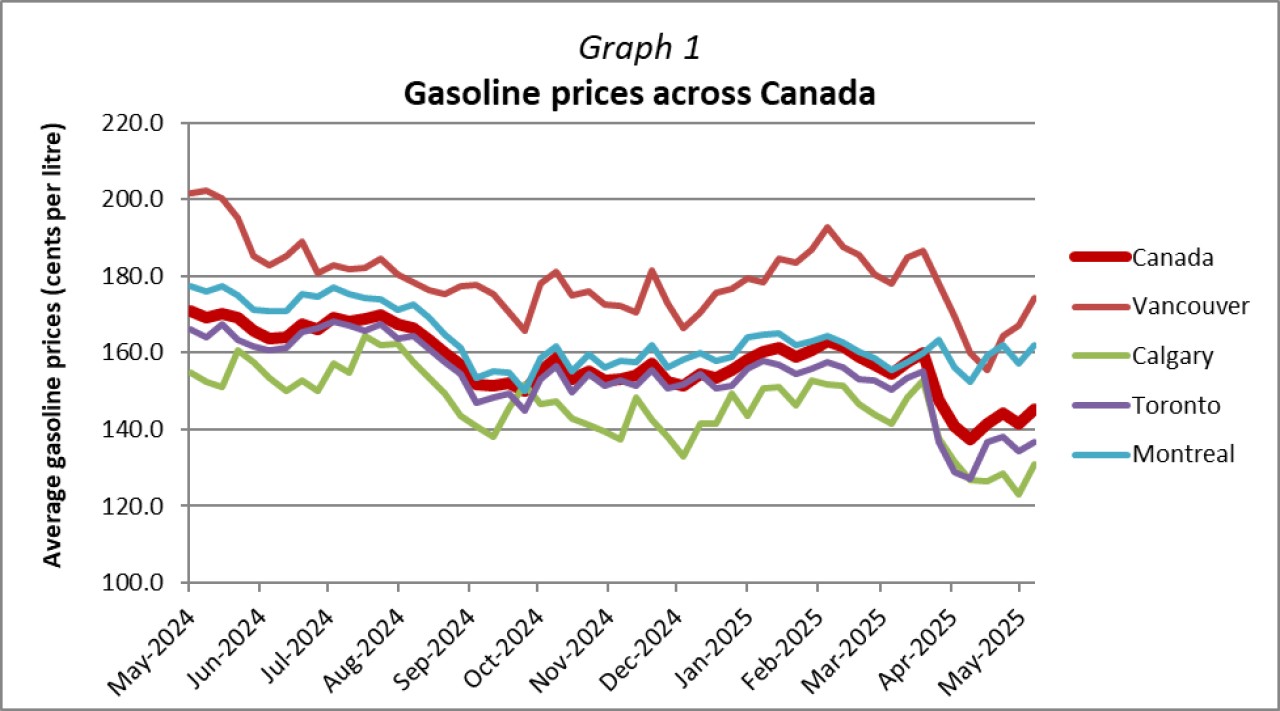

For illustration purposes, Graph 1 displays gasoline prices for the main metropolitan areas for a one-year period (May 2024 - May 2025).

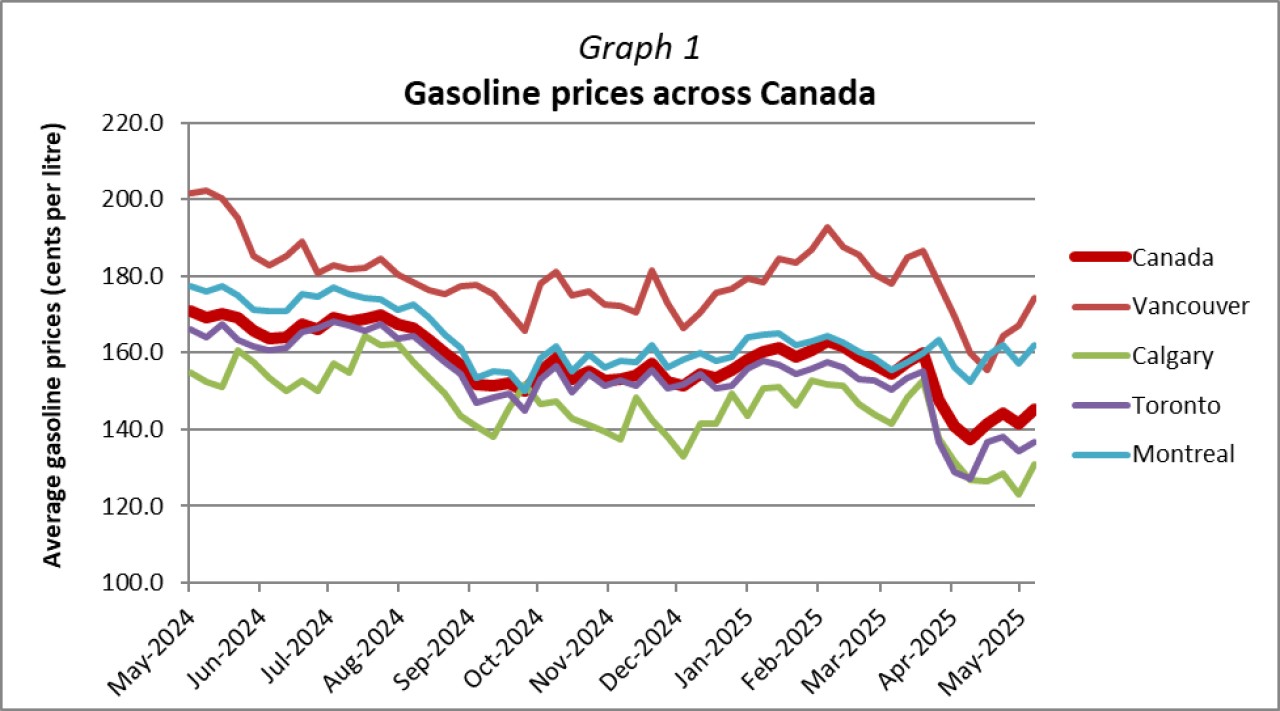

Also for illustration purposes, Graph 2 displays crude oil prices for three benchmarks – WTI (West Texas Intermediate), Brent and WCS (Western Canadian Select) for a one-year period (May 2024 - May 2025).

2.3 Sales Taxes

For the current Update, research was performed to see if there were any relevant changes to Federal and Provincial sales taxes that could have an immediate impact on the Reimbursement Rates. As noted in the previous Fuel Update (February 2025, for publication on April 1st, 2025), the government of Nova Scotia proceeded with the reduction of the provincial portion of the sales tax by 1%, effective April 1st, 2025, effectively lowering the HST in Nova Scotia to 14%, from the previous 15%. This reduction was factored into the calculations of the Reimbursement Rates for the current Fuel Update report. As of the date of this Update, no other changes were observed in sales taxes anywhere in Canada as compared to the previous Fuel Update (February 2025, for publication on April 1st, 2025). Moreover, no changes are foreseen at this time for the immediate future.

3. Impact of Fuel Prices on Reimbursement Rates

3.1 Fuel Consumption

In calculating the fuel costs contribution to the total vehicle operating costs, the methodology employed in the Annual Report was strictly adhered to. Fuel consumption for every vehicle model in the study was thus combined with average prices per Province or Territory to determine the fuel portion of operating costs, based on an average of 20,000 kilometres per year.

3.2 Updated Reimbursement Rates

For comparison, the following table provides updated Travel (Kilometric) and Commuting (Lower Kilometric) Rates, as well as rates previously calculated for the Annual Report (November 2024, for publication on January 1st, 2025) and the February 2025 Fuel Update (for publication on April 1st, 2025):

Current Reimbursement Schedule (in dollars per kilometre)

|

Travel Rate |

Commuting Rate |

|||||

|

Province/Territory |

Current Fuel Update |

April 1st, 2025, Fuel Update |

January 1st, 2025, Annual Report |

Current Fuel Update |

April 1st, 2025, Fuel Update |

January 1st, 2025, Annual Report |

|

Alberta |

$0.570 |

$0.575 |

$0.575 |

$0.220 |

$0.225 |

$0.225 |

|

British Columbia |

$0.600 |

$0.605 |

$0.600 |

$0.260 |

$0.265 |

$0.260 |

|

Manitoba |

$0.565 |

$0.560 |

$0.560 |

$0.230 |

$0.225 |

$0.220 |

|

New Brunswick |

$0.600 |

$0.610 |

$0.605 |

$0.235 |

$0.245 |

$0.245 |

|

Newfoundland and Labrador |

$0.620 |

$0.630 |

$0.630 |

$0.245 |

$0.250 |

$0.250 |

|

Northwest Territories |

$0.710 |

$0.720 |

$0.720 |

$0.315 |

$0.325 |

$0.325 |

|

Nova Scotia |

$0.600 |

$0.615 |

$0.615 |

$0.235 |

$0.245 |

$0.245 |

|

Nunavut |

$0.715 |

$0.725 |

$0.725 |

$0.330 |

$0.340 |

$0.335 |

|

Ontario |

$0.625 |

$0.635 |

$0.630 |

$0.230 |

$0.240 |

$0.240 |

|

Prince Edward Island |

$0.590 |

$0.600 |

$0.600 |

$0.245 |

$0.250 |

$0.250 |

|

Quebec |

$0.605 |

$0.610 |

$0.605 |

$0.250 |

$0.255 |

$0.255 |

|

Saskatchewan |

$0.560 |

$0.565 |

$0.565 |

$0.230 |

$0.235 |

$0.235 |

|

Yukon |

$0.715 |

$0.730 |

$0.730 |

$0.335 |

$0.345 |

$0.350 |

Note: All figures were rounded up to the nearest half-cent.

The impact of gasoline prices on the Reimbursement Rates was moderate for the present Fuel Update. In comparison to the last Fuel Update (February 2025, for publication on April 1st, 2025), the Reimbursement Rates have varied between a decrease of 1.5 cents per kilometre to an increase of 0.5 cents for the Provinces. For the Territories, the Reimbursement Rates have varied between a decrease of 1.5 cents and 1.0 cent per kilometre.

Overall, Canadian weighted averages decreased by 0.5 cents per kilometre for both the Travel Rate and the Commuting Rate, compared to the last Fuel Update (February 2025, for publication on April 1st, 2025). They are now at 60.5 cents per kilometre and 24.0 cents per kilometre, respectively.

Fuel contributes on average 11.6 cents per kilometre to total operating costs, ranging from 10.7 cents in Alberta to 19.4 cents in the Yukon. Given the complexity of socio-economic factors affecting the global energy market, it is difficult to make any prediction regarding gasoline prices for the next three-month period. However, any future changes will be reflected in the next Fuel Update.